Ripple price slides as XRP traders get a harsh lesson on economics

- Ripple price slipped over 7% overnight and erased the incurred gains from last week.

- XRP price sees bulls trying to claw back as markets quickly price in the shock inflation numbers out of the US.

- Expect to see more downturn as votes rise for a 100bps hike from the Fed next week.

Ripple (XRP) price was a textbook example on Tuesday of what can happen with a rally when traders try to pre-position and are convinced that a specific economic number will hold a surprise that only bring more profit to their trade. Of course, every economic data point that comes out holds a certain risk, especially if that data point is US inflation, which has been the keyword for most of 2022. The rise in inflation has poured cold water on long-positions and washed them out, with XRP price back below $0.3500, and more pain to come.

XRP got its ass kicked by US inflation data

Ripple price rallied these past few days, fueled by high hopes that the inflation numbers would fade for a third time in a row and meet the Fed's brief that three consecutive declines would be enough for them to start to loosen their tight monetary policy stance. Instead, the US inflation print surprised to the upside and rattled the markets as those hopes and aspirations were quickly smashed. Instead, the dollar roared back, and everything got sold as if no one wanted to hold assets anymore.

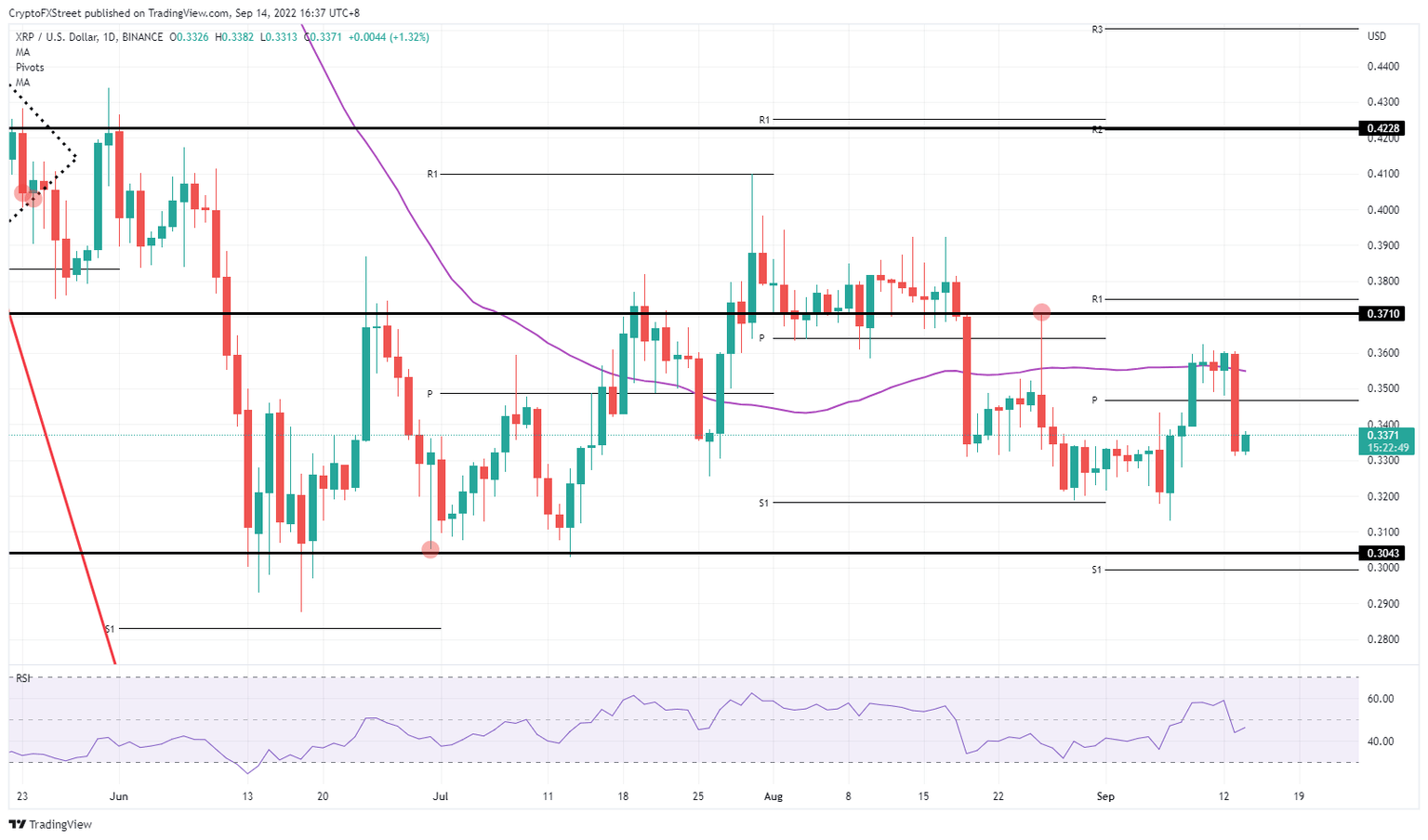

XRP price thus has had a massive blow from sentiment, and it looks like any hopes for another rally will stay away for some time. To make matters worse, bulls were just set to fully move away from the 55-day Simple Moving Average (SMA) towards $0.3710, they are now caught in a bull trap and could see themselves being squeezed out even more. The risk comes that price action would drop towards $0.3043 as the Fed meeting is within a week, and rate hike bets are starting to point to an even bigger 100 bps hike.

XRP/USD Daily chart

As this economic data point gets priced in, plenty more data points will emerge between now and the next Fed meeting. These could paint a whole other picture of the inflation data from Tuesday and ease the impact of the number. A turnaround could even be on the cards, with traders slowly but surely trading back above $0.3600.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.