Ripple price set for a bullish breakout over the weekend as tailwinds persist

- Ripple price tests $0.8390 again, break to the upside possible.

- XRP sees bulls entering at current levels as RSI ticks higher.

- Expect a bullish breakout today or over the weekend when some headwinds start to fade.

Ripple (XRP) price still sees bullish momentum building as $0.8390 is tested. Some minor headwinds in global markets are keeping a lid on the bullish breakout. Expect investors to keep entering at current levels, preparing for a pop towards $1.0 over the weekend.

XRP price could hit $1.0 over the weekend

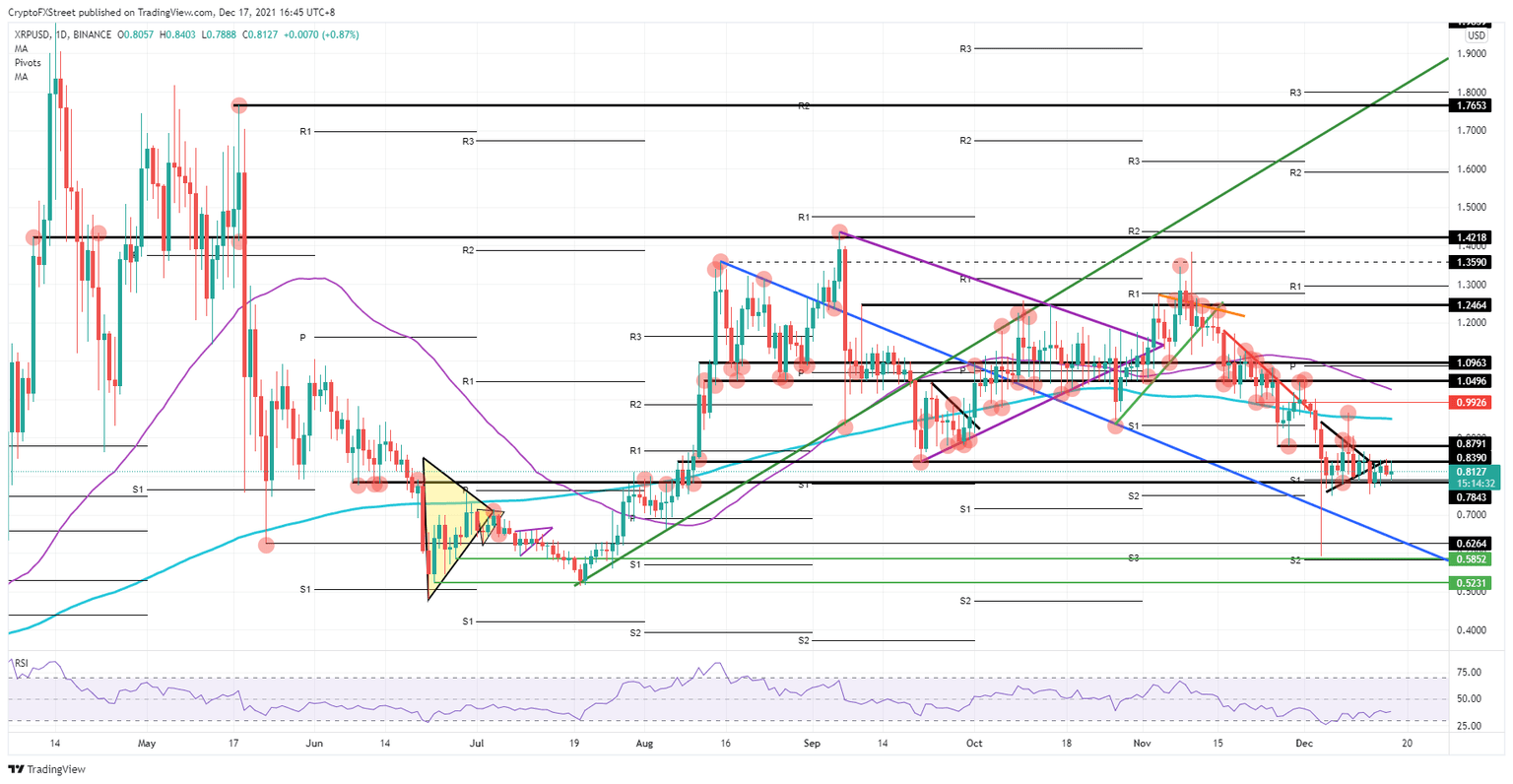

Ripple price is still range trading between $0.78 and $0.84. Investors are using the zone for a fade-in trade opportunity as the Relative Strength Index (RSI) is ticking up with buying volume outperforming selling. Currently, a few headwinds in global markets are keeping further price action to the upside muted. When those fade, expect investors to pull the trigger, and XRP to push higher.

XRP price looks set to break above $0.88 and face its first genuine hurdle with the 200-day Simple Moving Average (SMA) at $0.95. The 200-day SMA will be a crucial element to crack, as a break above will be seen as an uptrend signal, attracting even more buyers into the rally. With the MA overcome, the rally should steam on towards $1.05, with the 55-day SMA just below. Expect those levels to get hit around the end of the weekend or the beginning of next week.

XRP/USD daily chart

That may be as far as the rally gets as XRP bulls will face a tough resistance at $1.09 where both the monthly pivot and a historical support level are situated. Expect profit taking at that level as well asat $1.05 and the 55-day SMA. Should global markets start to weigh with headwinds, there is a risk of no bullish breakout at all. To the downside we have $0.78 and $0.63 where there may be a rebound off the blue descending trend line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.