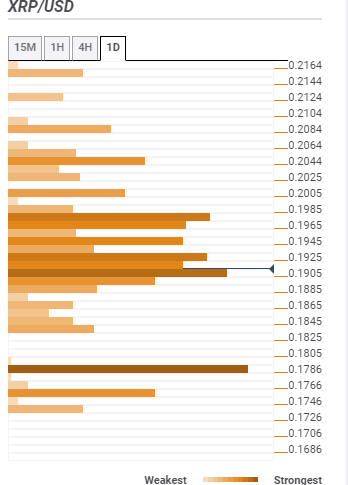

Ripple Price Prediction: XRP/USD recovery faces stacks of resistance levels under $0.20 – Confluence Detector

- Ripple bulls are considering consolidation after attempts to clear resistance at $0.1950 proved futile a few times.

- XRP/USD is facing acute confluence resistance levels towards $0.20.

Ripple price is trading above $0.19 after a recent rejection at $0.1950. The buyer congestion at $0.19 has prevented another slide to the support at $0.1850. On the upside, an intraday high has been reached at $0.1925, marking the end of the bullish action on Wednesday during the Asian session. XRP is trading at $0.1913 after a minor retreat from the day’s opening value at $0.1923. The prevailing trend is strongly bullish and coupled with the high volatility, could jeopardize the support at $0.19. At the same time, it makes it increasingly difficult for bulls to focus on higher levels.

Looking at the 4-hour chart, Ripple is embracing support provided by the 23.6% Fibonacci level. The immediate upside is limited by the 50 SMA in the 4-hour range. A wider glance upwards highlights more hurdles at the 38.2% Fibo (former support) and $0.20.

With the RSI moving horizontally at 50, it means that XRP is falling into a consolidation period. The bulls seem to have the upper hand, especially with the MACD almost crossing into the positive side of the midline. Buyers are keen on pulling the price above $0.20 but will the sellers let them?

XRP/USD 240' chart

%20(35)-637279634284795668.png&w=1536&q=95)

Ripple daily confluence levels

Ripple is looking into stacks of resistance zones according to the daily confluence tool. Initial resistance is observed at $0.1925 as highlighted by the Fibonacci 38.2% one-day, the Bollinger Band 15-mins middle, the SMA 100 15-minutes, and the Fibo 61.8% one-day. Marginally above this is the second hurdle at $0.1945. This zone is home to the SMA 200 1-hour, SMA 50 4-hour, the previous high one-day, and the pivot point one-day resistance one. The journey to $0.20 must also brace for the congestion of sellers at $0.1985 as highlighted by the pivot point one-day resistance three.

On the flip side, support is anticipated initially at $0.1905; a region where the SMA 50 one-hour, SMA 200 15-minutes, the previous low one-day, the pivot point one-day support one and he Bollinger Band 1-hour curve converge. Below $0.1900, other support areas of interest include $0.1885, $0.1845 (frequent support), $0.1786 (strongest support zone) and $0.1766.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren