- Ripple price has defended a key support level at $0.41.

- The TD Sequential indicator has presented a significant buy signal.

- XRP doesn't face a lot of resistance to the upside but needs more bullish momentum.

XRP had a major sell-off like the rest of the market, but bulls have managed to hold and defend a major support level at $0.41. Ripple price aims for a significant rebound as a key indicator also presented a buy signal.

Ripple price prepares for a potential rebound to $0.66

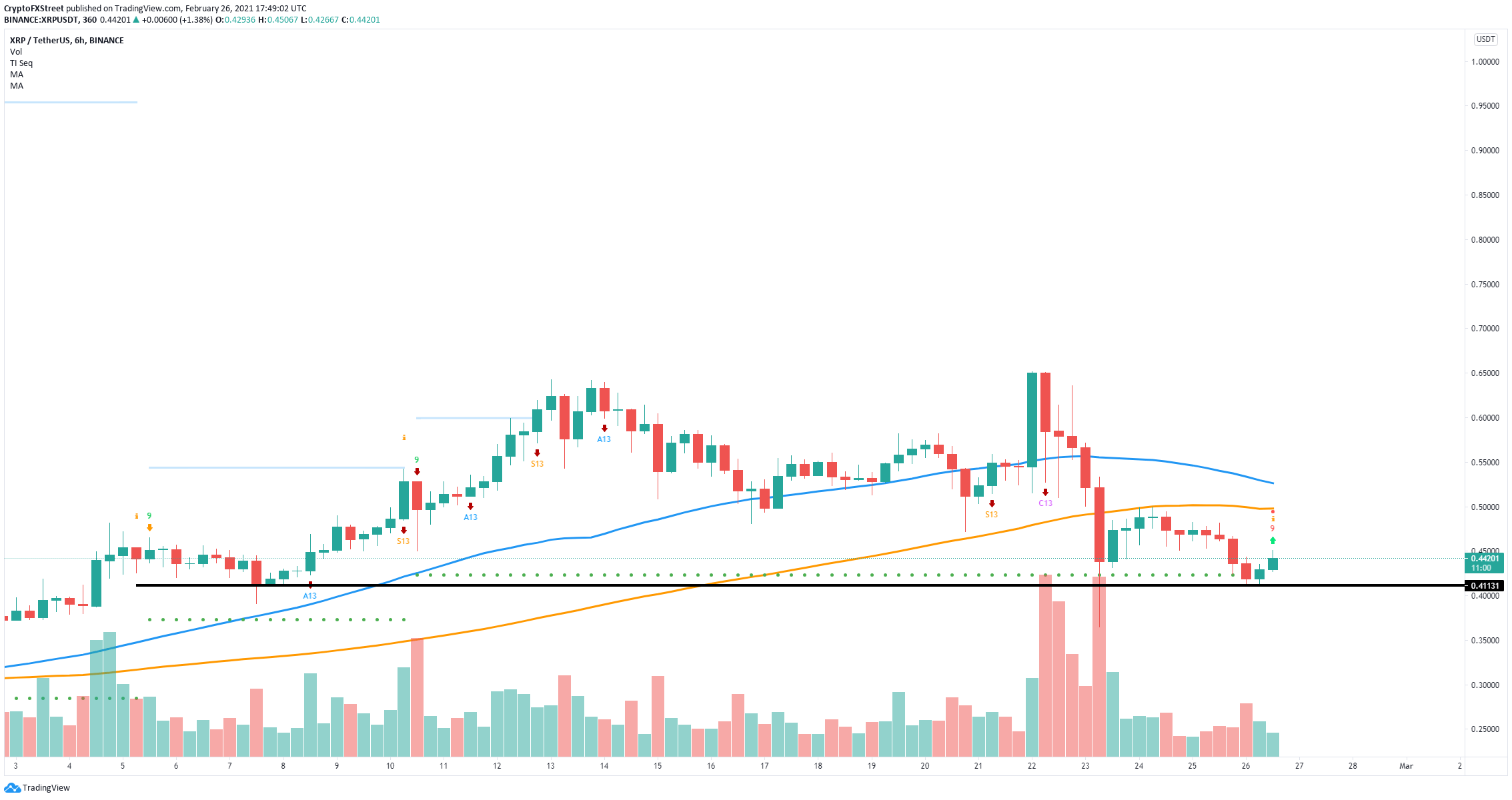

On the 6-hour chart, Ripple price has defended a key support level located at $0.41 and formed at the beginning of February. On top of that, the TD Sequential indicator has just presented a buy signal for the first time in months adding even more credence to the bullish outlook.

XRP/USD 6-hour chart

There seems to be almost no strong barriers on the way up besides the 50-SMA at $0.5 and the 100-SMA at $0.52. Climbing above both levels will easily drive Ripple price towards $0.66.

On the flip side, bears try to push XRP below the critical support level at $0.41. Losing this key point has the ability to drive Ripple price towards a new low at $0.34.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.