Ripple Price Prediction: XRP poised to recover if critical resistance is breached

- XRP price sits at a 'make-or-break' point with a 25% upswing on the horizon.

- Despite the heavy manipulation that this cryptocurrency has gone through, it looks promising as it contends with a critical resistance barrier.

- On-chain data adds credence to the bullish outlook as whales are back in accumulation mode.

XRP price continues to suffer from the impact that the U.S. Securities and Exchange Commission's lawsuit had on Ripple. Telegram groups have coordinated “pumps and dumps” to help prices recover, but investors have taken advantage of every upswing to get rid of their tokens due to the legal uncertainty around it.

Now, this cryptocurrency could be about to make a comeback if it slices through a crucial resistance level.

XRP looks promising as whales go into a buying frenzy

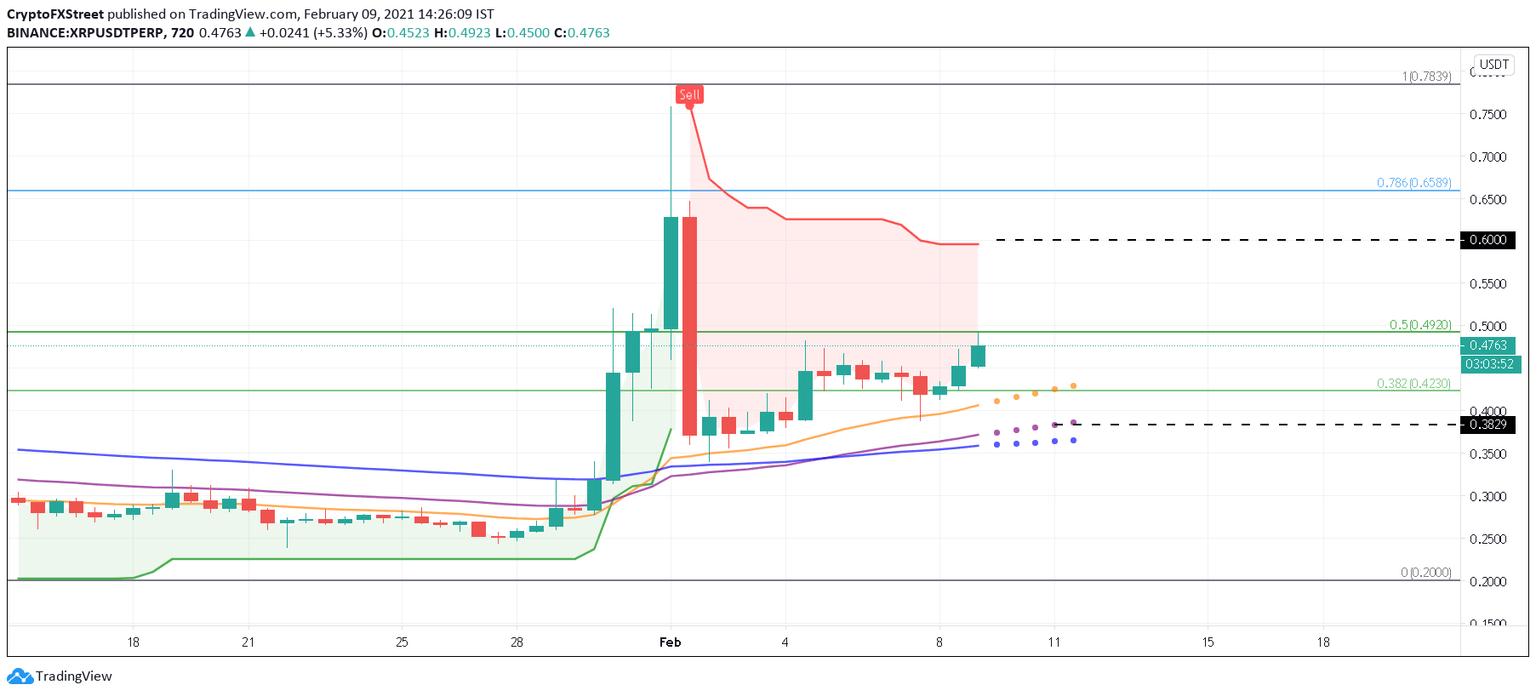

After going through one of the most vicious pumps and dumps ever, XRP managed to bounce off the 200 twelve-hour EMA on its 12-hour chart on February 2. Since then, this cryptocurrency has risen by nearly 45% to recently test the 50% Fibonacci retracement level at $0.50.

If the bullish momentum seen recently remains intact, XRP price might be able to close above the $0.50 resistance level on the 12-hour chart. Breaking above this price hurdle could catapult Ripple’s native token by 25% towards $0.60.

XRP/USDT 12-hour chart

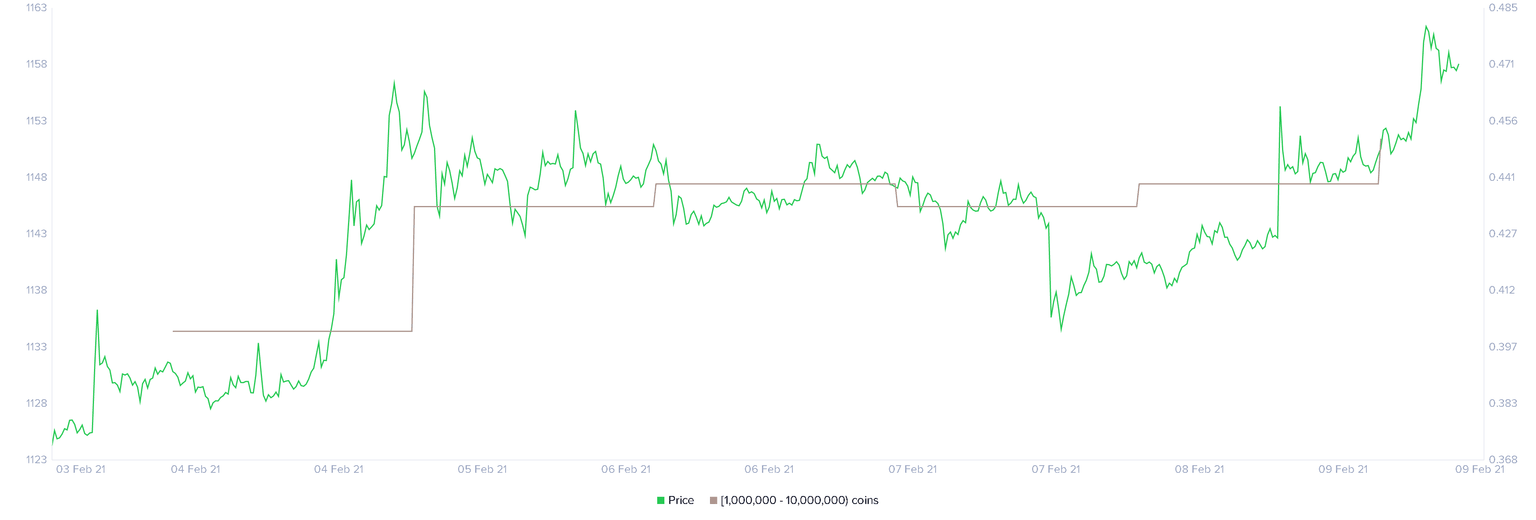

The bullish thesis holds when looking at Santiment’s holders distribution chart. Based on this on-chain metric, the number of addresses holding between 1 million to 10 million XRP has risen more than 1.70% since February 3.

Roughly 21 new whales have joined the network within such a short period. Consequently, increasing the upward pressure behind XRP price, which increases the odds for another leg up as long as the $0.50 resistance level breaks.

XRP Holders Distribution chart

However, a failure to slice through the $0.50 resistance level may invalidate the optimistic outlook. Rejection from this barrier may result in a downswing towards the 38.2% Fibonacci retracement level at $0.43 or the 50 twelve-hour EMA at $0.38.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.