Ripple Price Prediction: XRP is on the edge of a massive fall below $0.20

- XRP price has been trading sideways for the past two weeks after the SEC sued Ripple.

- The digital asset seems to be on the verge of a massive sell-off as bulls lose power.

- There is still a small chance for XRP bulls to defend a critical support level.

Over the past two months, XRP’s total market capitalization has fallen from a high of $32 billion on November 24, 2020, to only $12 billion currently. The biggest reason for this drop was the SEC suing Ripple for the sales of unregistered securities. XRP is close to losing its fifth position in market capitalization ranking to Cardano.

XRP price will drop below $0.20 if this level fails to hold

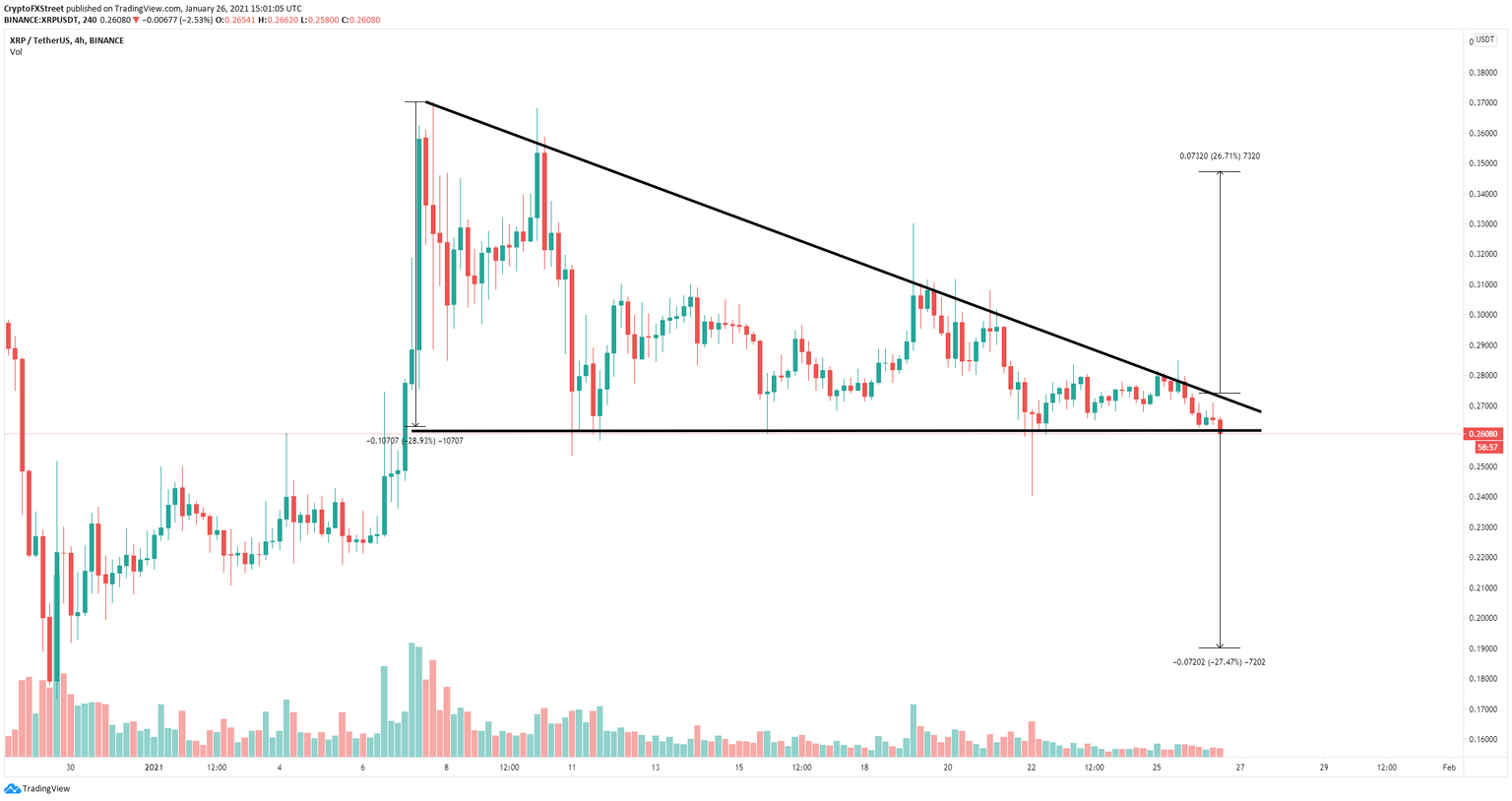

XRP has formed a descending triangle pattern with the support level located at $0.26 on the 4-hour chart. XRP price is currently trading at $0.261, just above this point. A breakdown below $0.26 could quickly push the cross-border payments giant towards $0.19.

XRP/USD 4-hour chart

As for on-chain metrics, the number of whales holding at least 10,000,000 XRP ($2,600,000 or more) has significantly dropped from a high of 356 on December 25, to 300 currently. This metric indicates that large investors have sold XRP and are not interested in accumulating right now, which adds credence to the bearish outlook above.

XRP Holders Distribution chart

However, there is a small chance that bulls can defend the $0.26 support level. A rebound from this point would push XRP towards the resistance trendline at $0.27. A breakout above this level can drive XRP to a high of $0.35.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.06.50%2C%252026%2520Jan%2C%25202021%5D-637472704996941479.png&w=1536&q=95)