Ripple Price Prediction: XRP bounces as exchanges prepare to re-list it

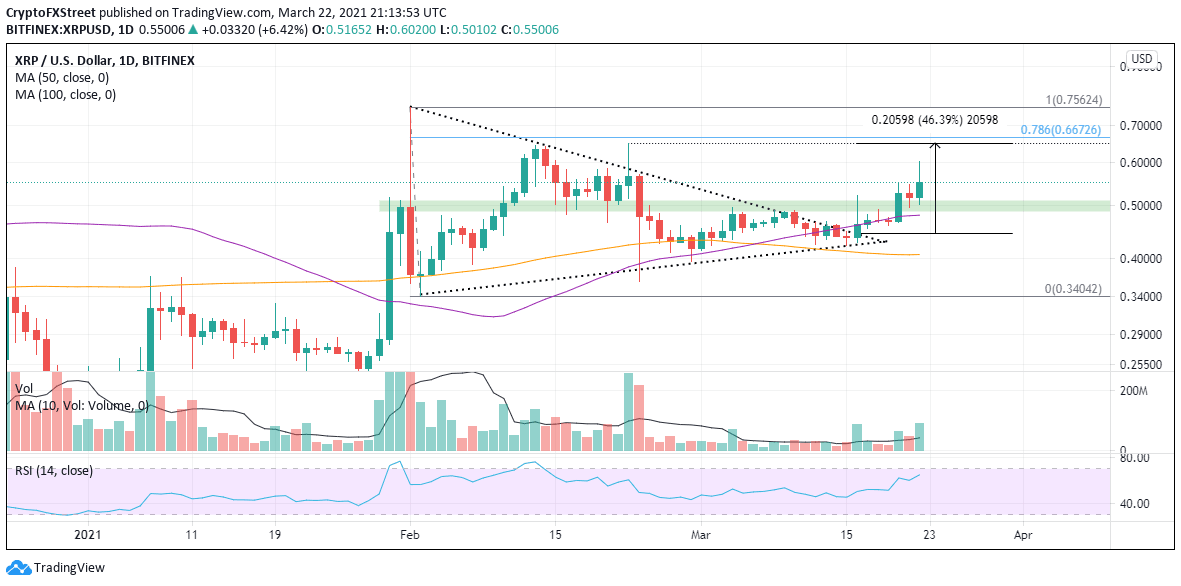

- XRP price clearing the critical $0.55 price level.

- Today’s volume is double the 50-day simple moving average (SMA).

- Still on target to rise 45% from the symmetrical triangle breakout on March 16.

XRP price has frustrated bearish narratives, despite the legal standoff between Ripple executives and the SEC as well as the delisting or suspension by several crypto exchanges. The lack of sellers, highlighted by the below-average volume, put bulls on alert that a bullish outcome from the multi-week trading range is becoming a higher probability.

XRP price to catch up with the rest of the market

The Ripple breakout on March 16 has been underpinned by robust volume on the up days. For example, on the breakout day of March 16, in which it closed up almost 6%, volume closed 3x the daily average. On March 20, it closed up roughly 13% on double the average daily volume. As for today, it is up 6% on double the average volume.

The Relative Strength Index (RSI) still has not reached an overbought condition, offering traders more upside in the short-term. If $0.55 holds today on a closing basis, the February 22 high at $0.650 and the 0.786 Fibonacci retracement level at $0.667 are the next pertinent resistance levels for Ripple.

If selling remains limited on down days, XRP price can challenge higher values, including the February 1 high at $0.757 and even the 1.618 Fibonacci extension of the February decline at $1.013.

XRP/USD daily chart

On the downside, the $0.500 price level is HUGE support. A breach below $0.500 will push Ripple to the 50-day SMA at $0.479 and then the 100-day SMA at $0.406.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.