Ripple Price Prediction: Is XRP/USD at danger of falling towards $0.10 again?

- XRP has progressively lost strength compared to other top coins.

- XRP/USD is struggling to stay above $0.18 after another bear break.

It’s quite apparent that XRP has been weaker than Bitcoin or Ethereum. XRP, like most of the other altcoins, is following Bitcoin, however, with every crash, XRP crashes harder and with every bounce, recovers less. The XRP/BTC pair has been in a huge downtrend basically since January 2018.

Not many positive indicators in favor of XRP

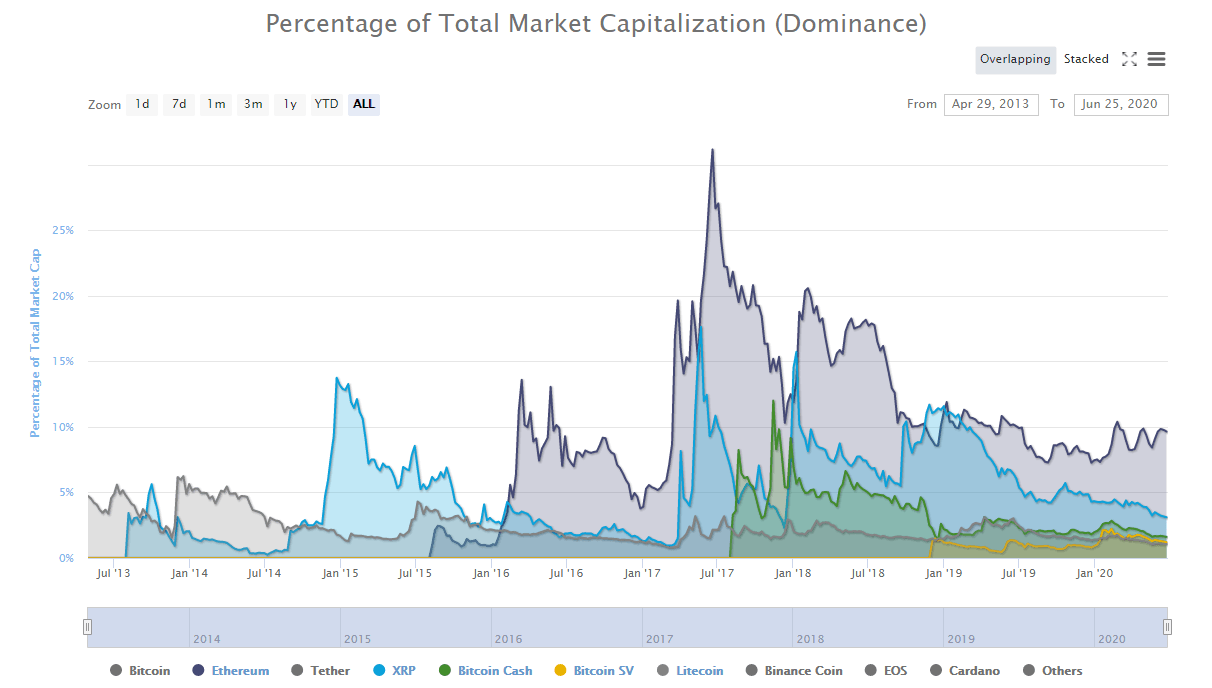

The decline in dominance is significant. The chart clearly shows that XRP’s dominance (blue) has been going down since 2019. Ethereum, for instance, only lost a little of its dominance. Similarly, BCH is practically at the same level as it was at the start of 2019, BSV’s dominance has actually increased a little. Of course, this metric alone doesn’t necessarily indicate that XRP will go to $0 but it does show a clear weak trend.

Looking at the weekly chart of XRP, the downtrend is also quite notable, far weaker than most of the other coins. XRP is down 95% since its peak in January 2018. Ethereum is also down around 83% since its peak, which might seem like a similar situation but it’s not. For Ethereum to be down 95%, the price would need to be at $67 approximately.

Even on the monthly chart, XRP is showing no signs of recovery, bears have been forming lower lows since January 2018. There is no reason to think XRP will not break the low of March at $0.11 in the coming months.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.