Ripple Price Prediction: Eyes $0.1960 amid symmetrical triangle breakout

- Ripple picking up bids amid quiet Easter trading.

- Technical set up points to a bullish bias in the near-term.

- Hourly RSI has climbed back above the midline.

The rebound in Ripple (XRP/USD) from daily troughs of 0.1864 has gained momentum over the last hours, as the bulls look to regain the 0.1900 level. The price finally broke the recent consolidative mode to the upside, resuming the recovery momentum from Friday’s low of 0.1817. The third-most favorite cryptocurrency trades at 0.1890, having reversed the early losses while up nearly 5% over the week. Its market capitalization stands at $8.31 billion.

Short-term technical outlook

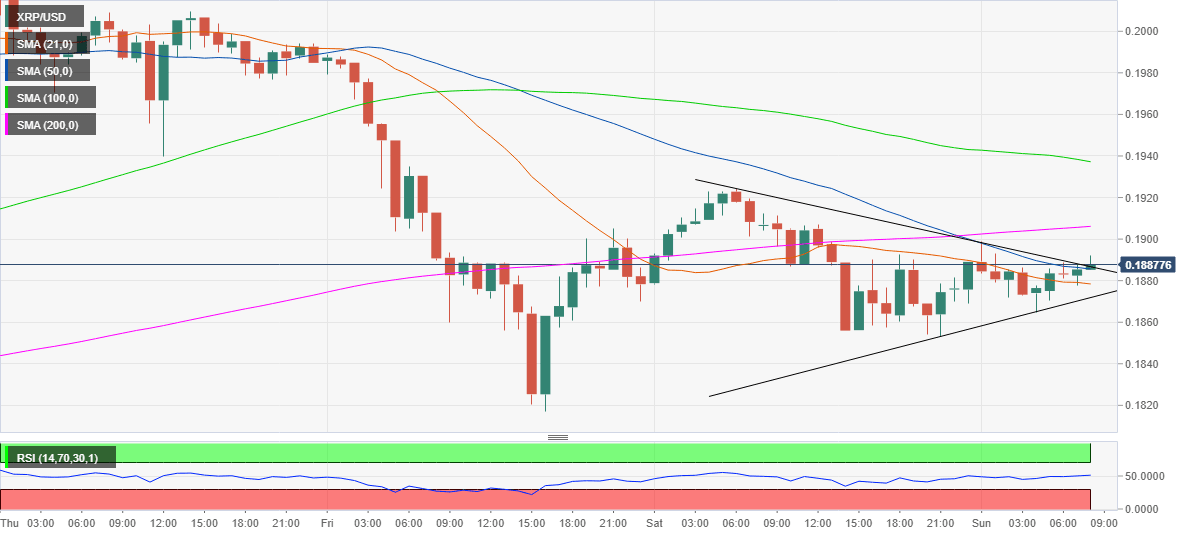

Looking at the hourly sticks, the price has charted a symmetrical triangle breakout after it broke through the pattern falling trendline resistance at 0.1888. The move higher picked up pace once the coin regained the 21 and 50-hourly Simple Moving Averages (HMA) at 0.1878 and 0.1885 respectively.

On its way north to reach the pattern target at 0.1958, XRP/USD could likely face the initial hurdle at 0.1906, the horizontal 200-HMA, beyond which the next resistance at the 100-HMA of 0.1937 will be tested. The hourly Relative Strength Index (RSI) has steadily crawled back above the midline, 50.0, suggesting that the bulls could take back charge.

To the downside, any pullback is likely to find the initial cushioning at the 21-HMA resistance-turned-support. A failure to resist the latter, the coin will reverse further to test the 0.1865 area, the confluence of the pattern rising trendline support and daily low.

XRP/USD 1-hour chart

XRP/USD key levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.