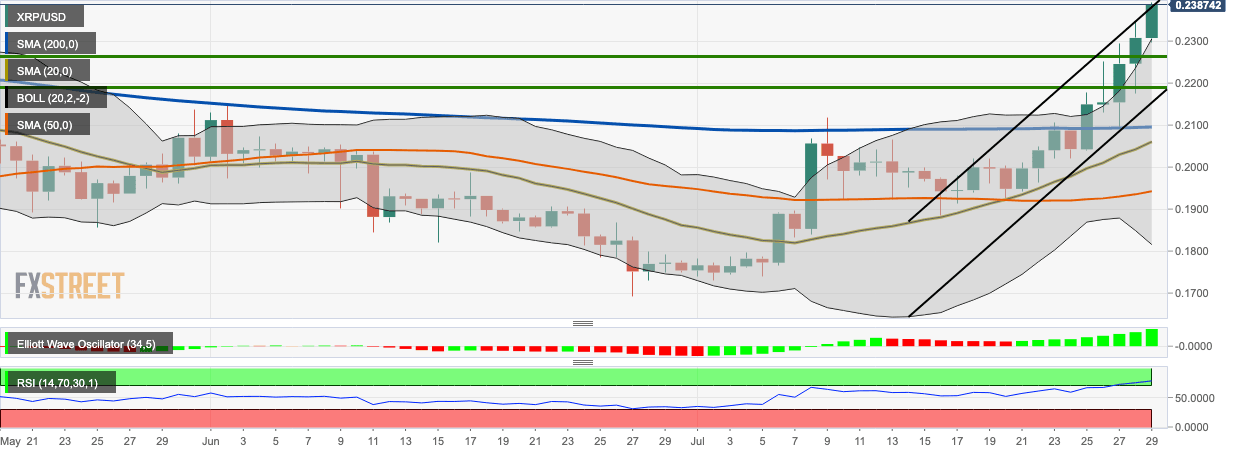

Ripple Price Outlook: XRP/USD bulls in complete control, aim for $0.25 psychological level

- XRP/USD bulls retained control for the fifth straight day.

- The Elliott Oscillator has had nine consecutive green sessions.

XRP/USD daily chart

XRP/USD bulls retained control for the fifth straight day as the price went up from $0.2246 to $0.2378. Over the last four days, XRP/USD has been sitting on top of the 20-day Bollinger Band, showing that it’s currently overvalued. The RSI has also crept into the overpriced zone, indicating that a slight bearish correction is nigh. The Elliott Oscillator has had nine consecutive green sessions, showing that the present market sentiment is overwhelmingly bullish.

XRP/USD has the following healthy support levels – $0.226, $0.2187, $0.2098 (SMA 200), $0.2061 (SMA 20) and $0.1945 (SMA 50).

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.