Ripple price is set for a fall as on-chain data shows a negative bias

- Ripple price retests and fails to overcome the daily resistance level at $0.626, leaning towards a price decline ahead.

- On-chain data paints a bearish picture for XRP, with negative OI-Weighted Funding Rate and long-to-short ratio below one.

- A daily candlestick close above $0.626 would invalidate the bearish thesis.

Ripple's (XRP) price declined 8.2% after being rejected from its daily resistance level on August 24. As of Friday, trades slightly higher by 0.1% at $0.562. Additionally, the suggestion from on-chain data supports the bearish trend ahead, as evidenced by the negative OI-Weighted Funding Rate and a long-to-short ratio below one.

Ripple price set for a decline after retesting its daily resistance barrier

Ripple price found support around the 200-day Exponential Moving Average (EMA) at $0.552 after being rejected by its daily resistance level of $0.626 on August 24. As of Friday, it trades slightly up by 0.1% to $0.562.

If XRP breaks below the 200-day EMA and closes below $0.544, its daily support level, it could decline by 10% to retest its August 7 low of $0.492.

The RSI and AO are trading below the neutral levels of 50 and zero on the daily chart. These momentum indicators strongly indicate bearish dominance and impending decline on the horizon.

XRP/USDT daily chart

Coinglass's OI-Weighted Funding Rate data is a crucial metric for traders and analysts to assess market sentiment and predict future price movements. This metric relies on funding rates from futures contracts, weighted by their open interest. A positive rate (Longs pay shorts) typically signals bullish sentiment, as long positions compensate shorts. Conversely, a negative rate (Shorts pay Longs) indicates bearish sentiment, with shorts compensating longs.

In the case of XRP, this metric stands at -0.0084%, reflecting a negative rate, indicating that shorts are paying longs. This scenario often signifies bearish sentiment in the market, suggesting potential downward pressure on Ripple's price.

XRP OI-Weighted Funding Rate chart

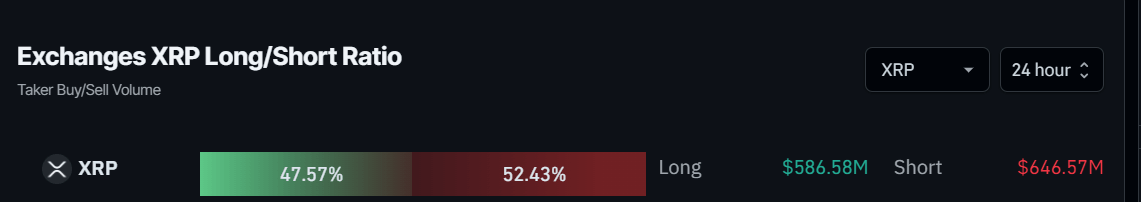

Additionally, Coinglass's data shows that XRP's long-to-short ratio is 52.43%. This ratio reflects bearish sentiment in the market, as the number has a higher percentage of shorts compared to longs, suggesting that more trades anticipate the price of the asset to decline, bolstering Ripple's bearish outlook.

XRP long-to-short ratio

However, if the Ripple price closes above the $0.626 daily resistance level, it would shift the market structure by creating a higher high on the daily chart, potentially leading to a 5.3% rise to revisit the July 31 high of $0.658.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.