Ripple Price Forecast: XRP recovery to $0.75 gradual but steady as on-chain metrics improve

- Ripple is on the road to recovery after rebounding from the support at $0.35.

- The return of whales is a bullish signal for the cross-border cryptocurrency.

- Closing the day above $0.45 is vital; otherwise, a correction may ensue toward $0.3.

Ripple is nurturing an uptrend with anticipation that it rises to levels seen earlier in the week. Support at $0.35 has been instrumental for the ongoing recovery. However, the Resistance at $0.45 must come down for XRP to continue with the uptrend toward $0.75.

Japan’s financial giant SBI supports XRP lending

A subsidiary of Japan’s financial behemoth SBI has announced that XRP will be available for customers to lend and earn interest in return. SBI VC Trade said that XRP has a lending period starting from 84 days.

The cryptocurrency exchange has set 1,000 XRP as the minimum loan limit, while 100,000 XRP is the maximum. The loan will attract an interest referred to as a “usage fee” of 0.1% per year.

Ripple rebuilds the momentum brick by brick

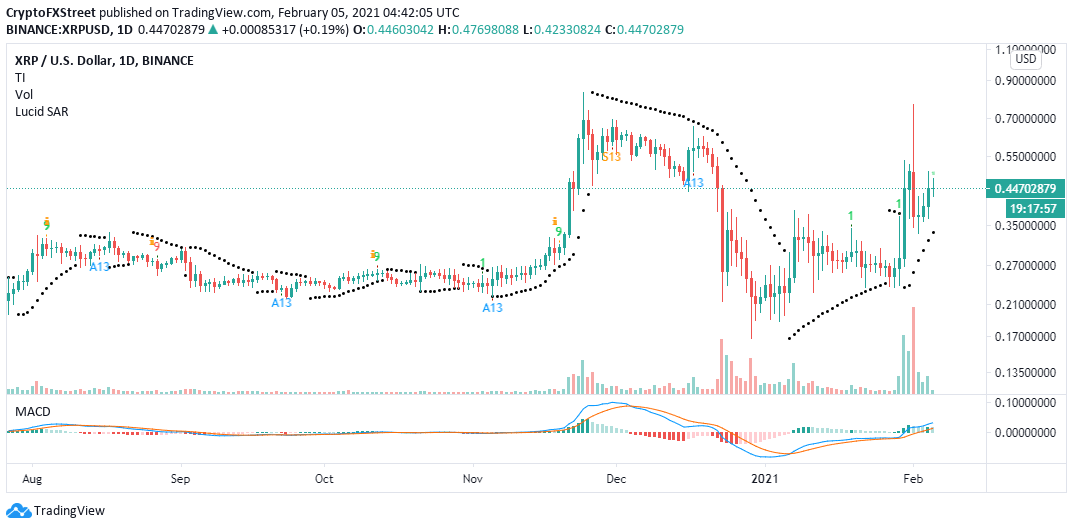

XRP is trading at $0.448 after ascending from the support established at $0.35. The Resistance at $0.45 continues to derail the recovery. However, the Moving Average Convergence Divergence (AMCD) hints at a bullish impulse.

The MACD follows the trend of an asset and helps to measure its momentum. For now, the MACD line (blue) has widened the divergence above the signal line, adding credibility to the uptrend.

At the same time, the cross border cryptocurrency is trading above the Parabolic SAR points. The technical indicator is usually used to identify specific trends and assist in forecasting trend continuations and reversals. In this case, Ripple is likely to sustain the uptrend, but a significant move will come into the picture if the price closes the day above $0.45.

XRP/USD daily chart

Ripple’s uptrend supported by improving on-chain picture

After the pump to $0.75, XRP whales sold plenty of their holdings, perhaps to take out the profit. It is essential to remember that XRP suffered a blow when the Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs Inc. in December. The cross-border token was stuck in consolidation until the end of January.

However, as the price starts to increase, large volume addresses seem to be making their way back. For instance, holders of between 1 million and 10 million XRP have risen from 1,117 recorded on February 2 to 1,137. This significant increase can explain the rising buying pressure, and if it continues, XRP will lift off toward $0.75.

Ripple holder distribution

Looking at the other side of the fence

Ripple may resume the downtrend if the Resistance at $0.45 remains unshaken. A correction from this level may trigger massive sell orders as investors panic-sell. Support at $0.35 will help reduce the fall's impact, but XRP may retreat to $0.3 before a substantial recovery comes into the picture.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B08.16.12%2C%252005%2520Feb%2C%25202021%5D-637480999345737835.png&w=1536&q=95)