Ripple Price Forecast: XRP moves sluggishly above $0.24 – Confluence Detector

- XRP is currently consolidating itself and prepping for a breakout.

- Daily confluence detector shows that price is stifled under strong resistance stack.

XRP bounced up from the $0.222 support line and managed to jump above the downward trending line coming from mid-August highs. Following that, the price has been trending horizontally around the $0.242-mark, below the SMA 20 curve as shown by the chart below.

XRP/USD daily chart

The horizontal price movement shows that the forces of supply and demand are nearly equal. This usually happens when an asset goes through a period of consolidation before breaking out into a previous trend or reversing it into a new direction. Also, note how the RSI indicator is trending around the neutral zone, showing that the buyers and sellers are canceling each other out.

XRP/USD 4-hour chart

The sellers have taken the price down from $0.246 to $0.24 over two sessions, breaking below the upward trending line plotted in the 4-hour chart from September 24 low, in the process. As of now, the price has bounced up from the $0.24 support level and is consolidating below the SMA 20 curve.

So, can we expect any price movement at all? Or is XRP going to keep moving along sluggishly in the near future? For that, let’s check the daily confluence detector.

XRP daily confluence detector

XRP is presently stifled below a heavy stack of resistance between $0.243-$0.245. If the bulls somehow gain enough momentum to break above this robust stack, the price has space to grow till $0.2735. On the downside, there are two moderate-to-strong support levels at $0.2415 and $0.24. If XRP/USD breaks below these levels, it will be pretty catastrophic for the bulls since the price may plummet to $0.21.

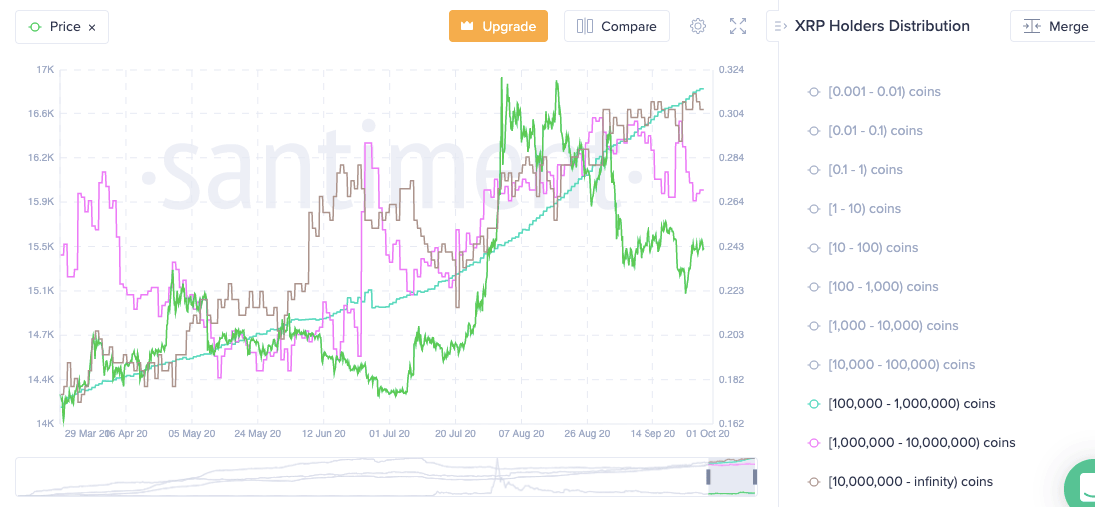

XRP holders chart

Santiment’s holder distribution chart helps check how much of the XRP tokens are held by holders in different token brackets. On September 23, the number of holders with >10 million XRP dipped from 310 to 307, which caused a slight correction in the price. Following that, there was another slight dip (313 to 311) in this token bracket over the last two days, while the number of holders in the 1M to 10M and 100,000 to 1M ranges have gone up. As such, the price has managed to move horizontally, instead of facing a massive bearish or bullish breakout.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637369538229286189.png&w=1536&q=95)