- XRP price tussles with the $0.50 resistance level, which coincides with a confluence of multiple technical hurdles.

- Rejection at this level increases the odds for a 45% drop in Ripple’s market value.

- The potential correction could be cut short by the 50 four-hour MA around $0.42.

It is an understatement to say that XRP price has been affected by the SEC’s charges on Ripple. Indeed, the remittance token has suffered a liquidity shortage as many cryptocurrency exchanges suspended it for trading. While some market participants have done everything in their power to push it upwards, this altcoin seems primed for another downswing.

Update: Ripple's XRP is defying gravity as of Wednesday – trading above $0.53, an increase of over 11%. The token has been experiencing elevated volatility as it remains in the spotlight for right and wrong reasons alike. Regulatory issues loom over its price and so do some technical aspects of its price. On the other hand, XRP benefits from the growing interest in cryptocurrencies stemming from Elon Musk's venture in Bitcoin. Tesla, founded by Musk announced it is investing $1.5 billion in the granddaddy of cryptocurrencies and may also accept BTC payments under some conditions. Ripple's offering is also promising for transactions, and some investors may be trying to jump on XRP – seeing it as the next digital coin to gain more substantial adoption in the real economy. More: Elrond may provide a buying opportunity.

XRP could be overrun by bears soon

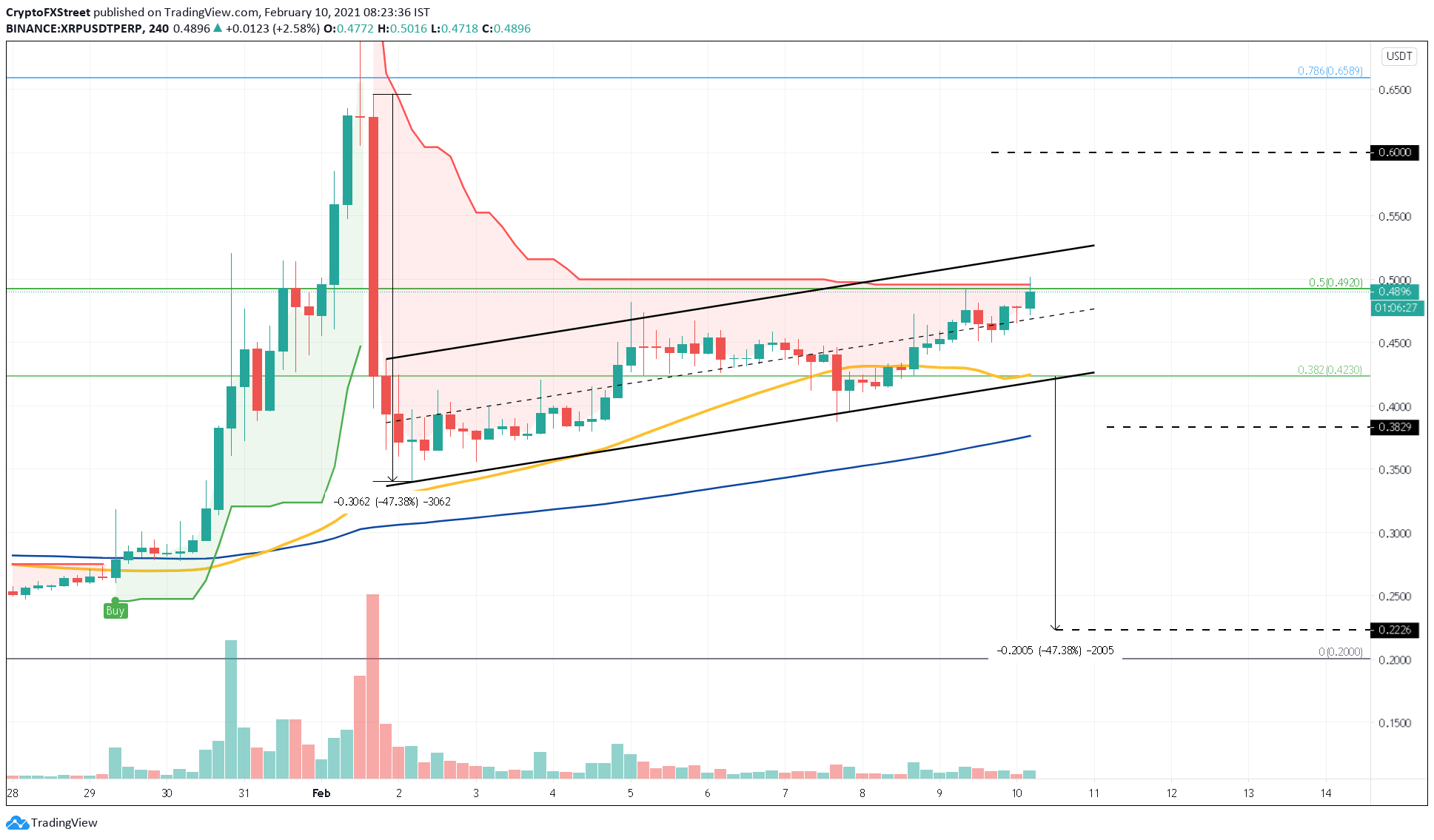

XRP price has developed a bear flag on its 4-hour chart. Since this is considered a continuation pattern, the flag pole’s height suggests this altcoin could drop by 45%.

Nonetheless, this bearish scenario isn’t set in stone.

The $0.50 resistance level is crucial in determining where XRP price is headed next. This hurdle is made up by the 50% Fibonacci retracement level and the SuperTrend’s sell signal. Thus, moving past it will not be an easy task.

A spike in selling pressure around this level might be significant enough to push the XRP price to $0.42. Here, the 50 four-hour MA coincides with the 38.2% Fibonacci level, adding an extra layer of support.

But If this level is breached for any reasons, then XRP price may drop to $0.22.

XRP/USDT 4-hour chart

Regardless of the pessimistic outlook, an increase in buying pressure that leads to a 4-hour candlestick close above the channel’s upper trendline at $0.53 might see XRP price head to greener pastures. Slicing through resistance will open the possibility for a 20% surge to $0.60.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC Crypto Task Force plans to establish digital asset regulatory sandbox

The Securities & Exchange Commission's (SEC) Crypto Task Force met with El Salvador's National Commission on Digital Assets (CNAD) representatives to discuss cross-border regulation and a proposed cross-border sandbox project.

DeFi Dev Corp buys additional 65,305 SOL amid broader institutional interest: Solana price slides below $150

Solana (SOL) price faces growing overhead pressure and slides below $150 to trade at $148 at the time of writing on Thursday. The sudden pullback follows the crypto market's edging higher on improving investor sentiment, which saw SOL climb to $154 on Wednesday.

Uniswap Price Forecast: UNI whale moves 9 million tokens to Coinbase Prime

Uniswap (UNI) price hovers around $5.92 at the time of writing on Thursday, having rallied 12.8% so far this week. According to Wu Blockchain, data shows that the address potentially related to the Uniswap team, investor, or advisor transferred 9 million UNI to the Coinbase Prime Deposit on Thursday.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.