Ripple Price Forecast: XRP in dire need of nearby support in order to avoid imploding

- Ripple price sees traders taking profit and leaving cryptocurrencies in the first big volatile week of 2023.

- XRP could be seen dropping 10% in the current fade.

- Should central banks succeed in dampening the bullish mood, a nosedive move toward $0.30 could tremble the markets.

Ripple (XRP) price is facing a big test this week as traders brace for a series of punches that could see bulls hanging on the ropes or even knocking them out. A salvo of central banks is set to hit the wires by Wednesday, with each posting their rate hike decision, forecasts and monetary stance against the current economic situation. With the jump in Spanish inflation this Monday morning, traders will hang on the lips of US Federal Reserve Chair Jerome Powell to look for clues if inflation in the US is set to swing back higher as well. That would mean the end of the current recovery rally in equities and cryptocurrencies.

XRP price focused on swing-back inflation message from central bankers

Ripple price action on Monday has traders getting hit by a surprise curveball from European economic data as the trading plan was for nervousness and stress not to kick in until Wednesday. Instead, traders had to brace for some wild and massive waves of profit-taking as inflation in Spain jumped, which triggered a repricing in the markets for the European Central Bank (ECB) to do more. With the Fed set to appear on Wednesday and the US job data expected on Friday, traders will be on edge to see if Jerome Powell will issue alerts and go against the market consensus of a 25-basis-point hike.

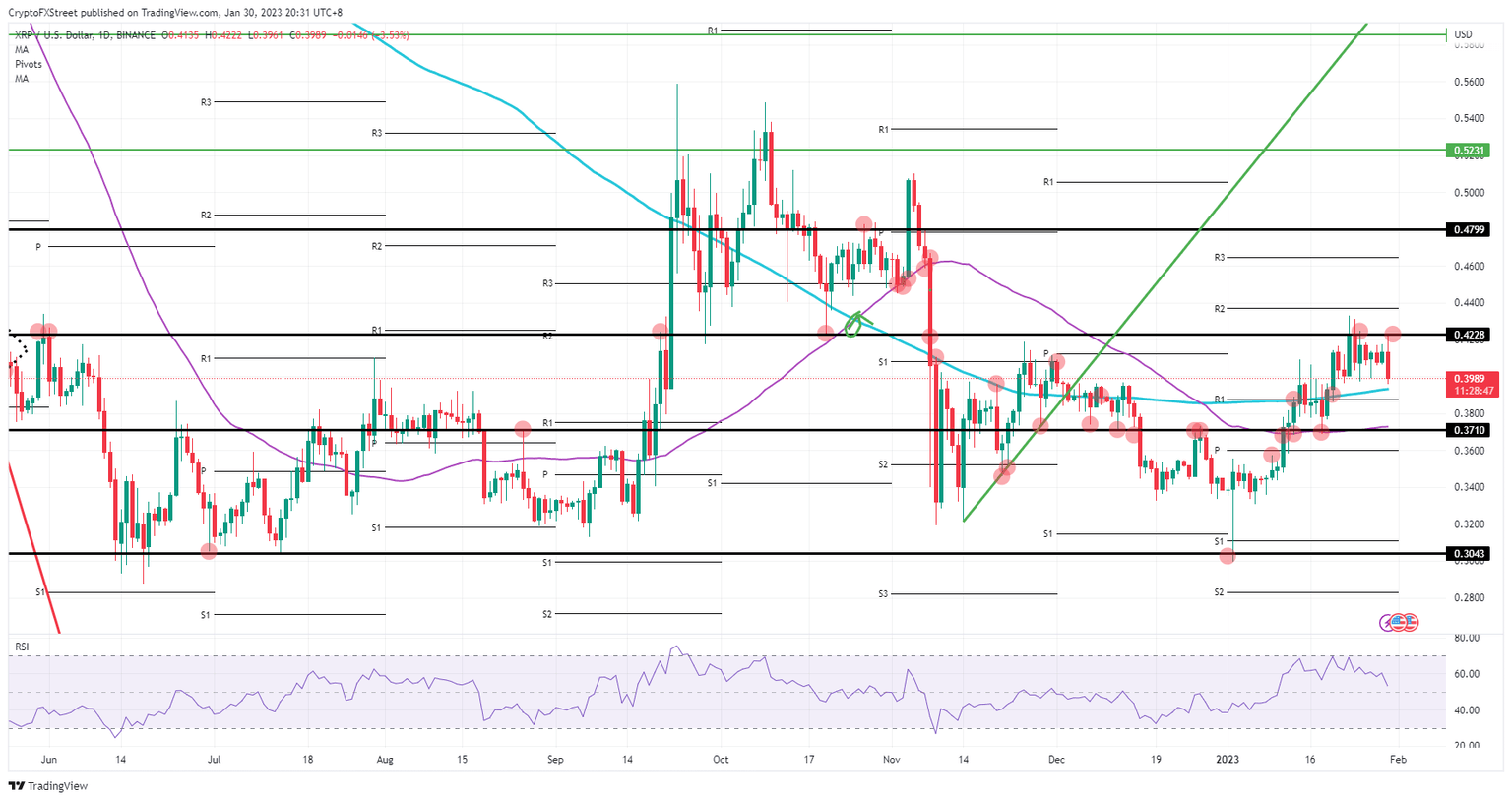

XRP is thus tanking on that waive of profit-taking and looking for support near $0.3925. That level comes in line with the 200-day Simple Moving Average. A bit less focus will be on $0.3710 between now and Thursday once the ECB and the Bank of England come out the day after the Fed decision. Should all central banks keep hiking at the same pace and forecast more hikes to keep inflation under pressure, expect the market to be repriced with XRP at risk of nosediving toward $0.30.

XRP/USD daily chart

The Spanish inflation number could be an outlier due to pensioners from northern Europe moving south to avoid the heating bill at home. This spike in inflation thus could have been a one-off and would mean that inflation further declined in the colder parts of Europe. If that is the case, and central banks are also already writing off that number in their comments, expect XRP to quickly head back to $0.4228 and advance above there with $0.4800 as the price target for next week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.