- The Ripple price had a colossal 100% rally in the past three days, hitting $1.19.

- The digital asset encountered intense selling pressure as holders took profits.

- One key on-chain indicator shows that XRP is poised for a more substantial correction.

The Ripple price had one of the craziest rallies in the past three days, jumping by 100% to a three-year high of $1.19. Despite the ongoing SEC lawsuit against Ripple, XRP holders have grown confident in the digital asset and managed to push it above several important resistance levels.

Ripple price poised to fall deeper

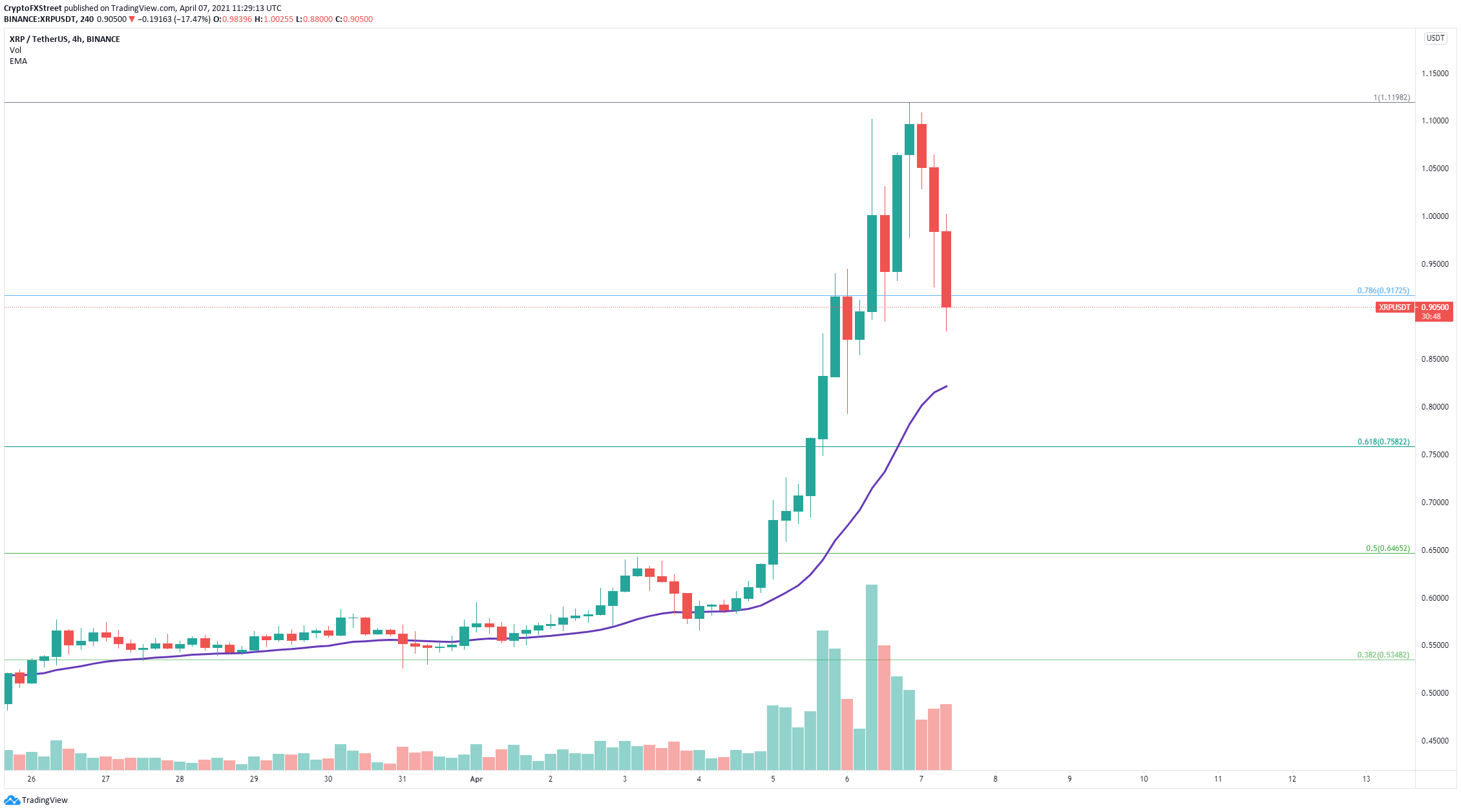

On the 4-hour chart, XRP bulls fight to hold the 78.6% Fibonacci retracement level at $0.917. The digital asset faces massive profit-taking as several on-chain metrics indicate XRP is poised for a deeper correction.

XRP MVRV (30d) and Active Addresses charts

The MVRV ratio (30D), a metric that shows the average profit or loss of XRP tokens moving in the past 30 days, has entered the danger zone above 40%, which is usually indicative of a significant upcoming correction.

XRP/USD 4-hour chart

Additionally, the digital asset experienced a massive spike in the number of active addresses, which also happened on February 1 when XRP hit a peak of $0.72 before collapsing within the next 24 hours.

The next support level is the 26 EMA on the four-hour chart located at $0.824, followed by the 61.8% Fibonacci retracement point at $0.758.

Nonetheless, a rebound from the 78.6% Fibonacci level at $0.917 should drive the Ripple price toward the psychological level of $1 and as high as the previous peak of $1.19.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[13.31.17,%2007%20Apr,%202021]-637533935180297768.png)