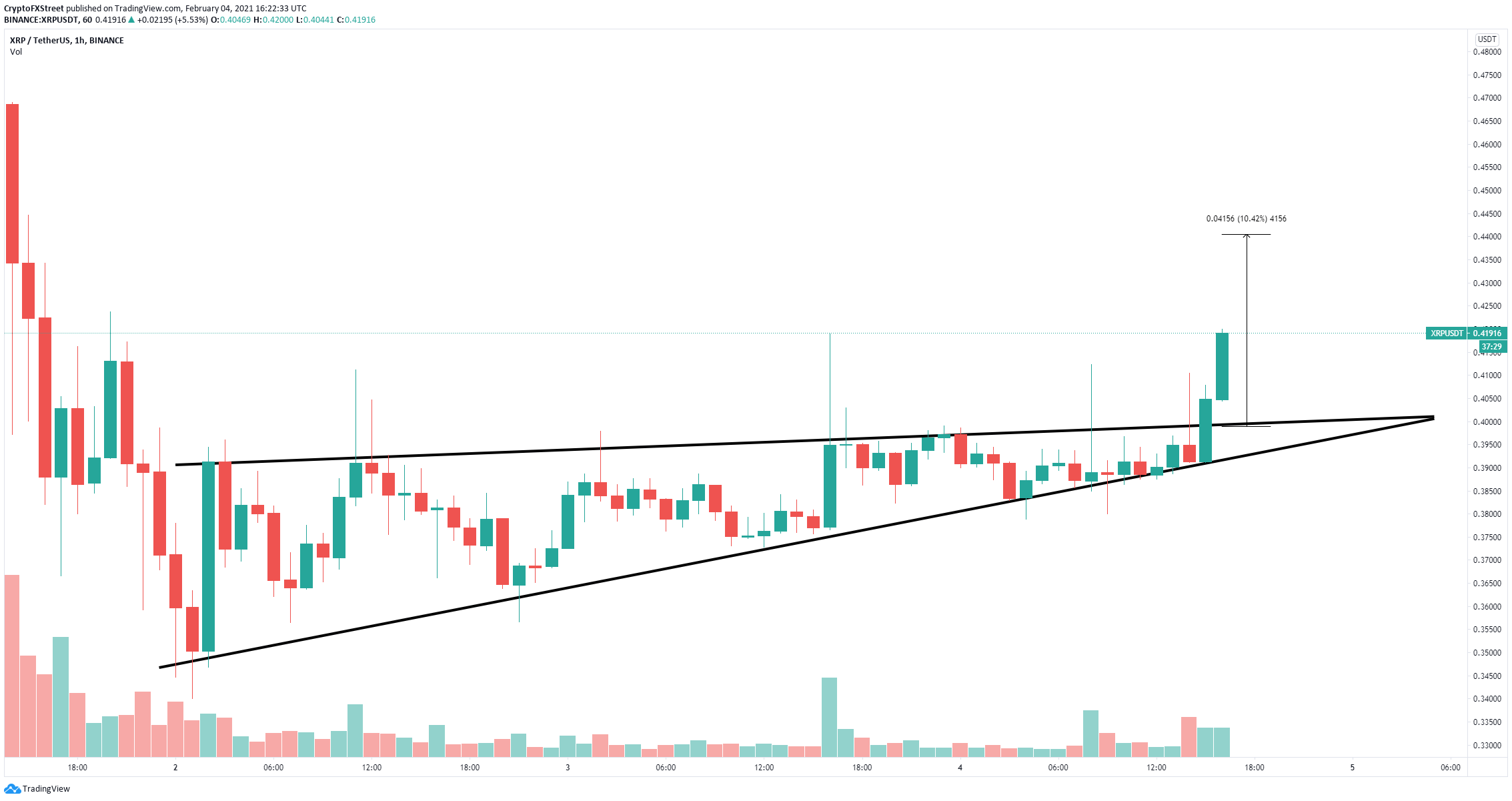

- Ripple price was contained inside a wedge pattern on the 1-hour chart.

- The breakout of the pattern is significant because XRP faces very weak resistance above until $0.75.

- XRP price action is extremely volatile and hard to predict, investors must dread carefully.

On January 30, XRP had a massive pump pushing the digital asset by 85% thanks to the WallStreetBets group and other Pump and Dump groups over Telegram which coordinated a push for the digital asset.

From a low of $0.278 on January 30 to a high of $0.755 on February 1, the pump lasted less than three days as XRP price quickly plummeted down to $0.35.

Ripple price sees the light at the end of the tunnel

On the 1-hour chart, XRP formed an ascending wedge pattern and traded inside a tightening range. Ripple price finally had a clear breakout with a price target of $0.44. However, the most important bullish factor is the lack of resistance above this point.

XRP/USD 1-hour chart

It also seems that the number of whales holding at least 10,000,000 XRP coins has exploded by 16 in the past five days despite XRP price exploding. This metric shows that large holders have become interested in the digital asset again despite the SEC suing Ripple.

XRP Holders Distribution chart

However, it’s important to note that XRP price is extremely volatile right now after the initial pump and dump and it could steeply drop at any point.

XRP Social Volume

The social volume of XRP has spiked again in comparison to the past 48 hours which indicates more volatility is underway and potentially another steep drop like it happened the last four times after spikes in volume. XRP price can easily fall towards the psychological level at $0.30 again.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[17.30.06,%2004%20Feb,%202021]-637480623993049383.png)

%20[17.39.14,%2004%20Feb,%202021]-637480624015250187.png)