Ripple Price Prediction: XRP offers breakout signals to $3.00 backed by heightened institutional interest

- XRP resumes uptrend above $2.30 as US CPI data for May comes in below forecast.

- Ondo Finance debuts tokenized real-world assets on the XRP Ledger, featuring short-term US Treasuries.

- Qualified investors can seamlessly subscribe and redeem OUSG on XRPL around the clock with RLUSD.

Ripple (XRP) is rising marginally to trade at $2.31 at the time of writing on Wednesday, as interest in XRP-related financial products rapidly grows, with Ondo Finance, a tokenization platform, launching its flagship tokenized US treasury fund on the blockchain.

Meanwhile, the Bureau of Labor Statistics (BLS) report shows that the United States (US) Consumer Price Index (CPI) data rose slightly to 2.4% in May from 2.3% in April, falling below the market forecast of 2.5%.

Market overview: Sentiment improves as US CPI softly rises

Major digital assets, including Bitcoin (BTC), Ethereum (ETH) and XRP, edged higher during the American session on Wednesday, buoyed by the US CPI data coming in below the market forecast.

As reported by FXStreet, the Core CPI, which excludes the volatile prices of food and energy, rose 2.8% in May, matching the figures in April. Monthly, the CPI and the Core CPI each rose 0.1%, sitting below market expectations of 0.2% and 0.3%, respectively.

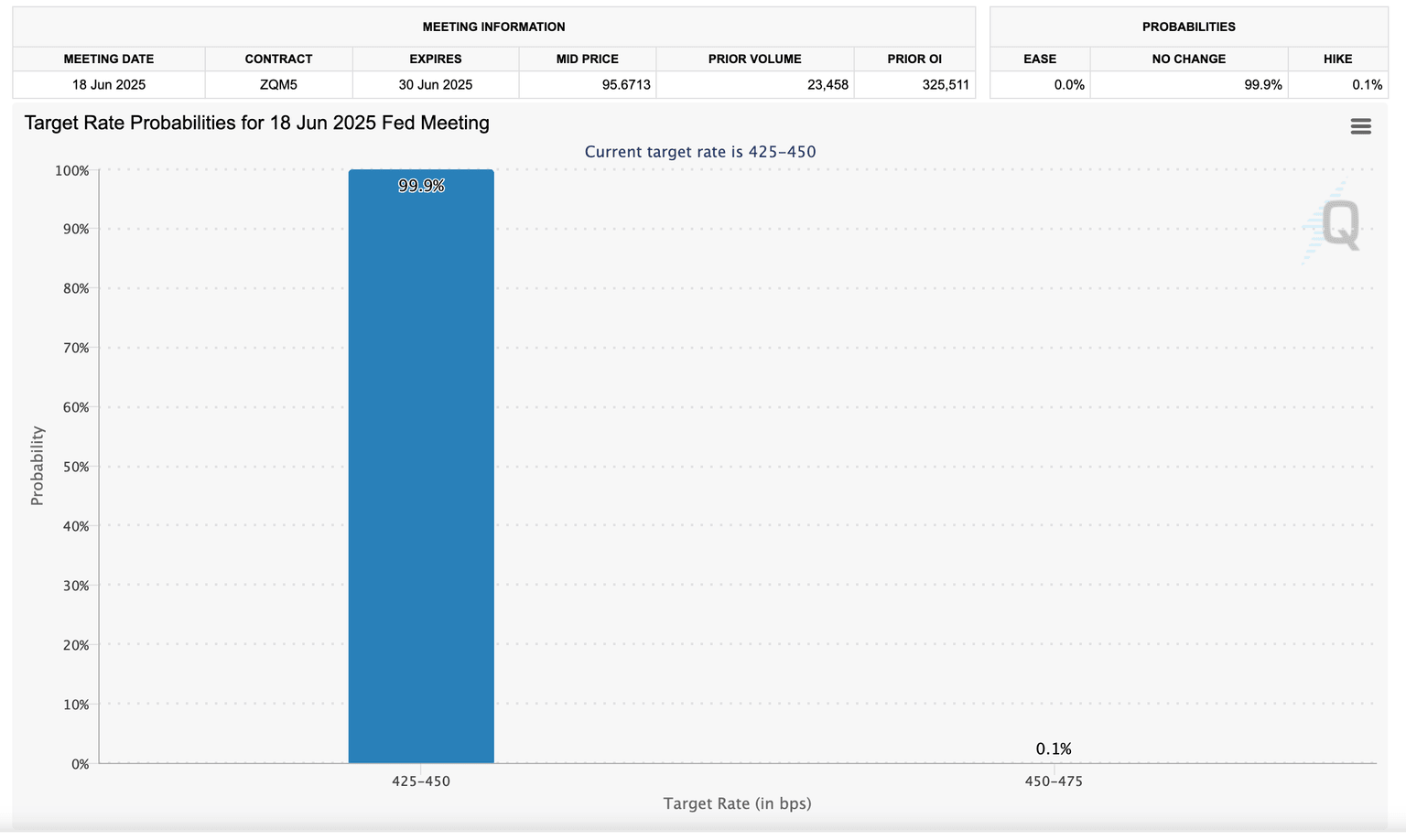

The inflation data, which comes ahead of the Federal Reserve (Fed) meeting on June 18, is unlikely to influence the Fed's decision on interest rates. According to the CME Group's FedWatch tool, analysts expect the central bank to leave the rates unchanged in the range of 4.25% - 4.50%.

FedWatch tool | Source: CME Group

Ondo Finance debuts flagship tokenized US Treasuries on the XRP Ledger

Ondo Finance has announced the launch of its flagship Ondo Short-Term US Government Treasuries (OUSG) on the XRP Ledger (XRPL), as per communication on social media platform X.

The launch is a major milestone, bridging the gap between Decentralized Finance (DeFi) and the traditional finance sector. Institutional investors on XRPL can now tap OUSG for exposure to short-term US Treasuries, generating yields through a diversified portfolio of industry money market funds.

The new product enables investors to mint and redeem using Ripple's stablecoin, RLUSD, made possible by round-the-clock capital access and deployment. At the same time, the platform offers high-quality, low-risk liquidity options, supported by accessible intraday settlement and liquidity, which enables efficient portfolio management and expanded exposure to tokenized US Treasury-backed assets.

"By bringing OUSG to the XRPL, Ondo Finance is bringing institutional-grade assets directly to the institutions, providing access to high-quality tokenized assets as flexible treasury management tools," Ondo Finance said in a blog post. "As global demand for tokenized financial products accelerates, this expansion furthers our mission to bridge traditional finance and onchain markets," the blog post continued.

The platform boasts seamless multi-chain support across Ethereum, Solana and the XRP Ledger. Investments span leading funds, including BlackRock's USD Institutional Digital Liquidity Fund (BUIDL), WisdomTree's Government Money Market Digital Fund (WTGXX) and Franklin Templeton's Franklin On-Chain US Government Money Fund (FOBXX).

Ondo Finance's groundbreaking launch follows VivoEnergy, a NASDAQ-listed firm, which announced plans to deploy $100 million worth of XRP tokens on the Flare blockchain to generate yield. Additionally, the company is reportedly planning to adopt a payment system powered by the RLUSD stablecoin to serve as its cash equivalent platform.

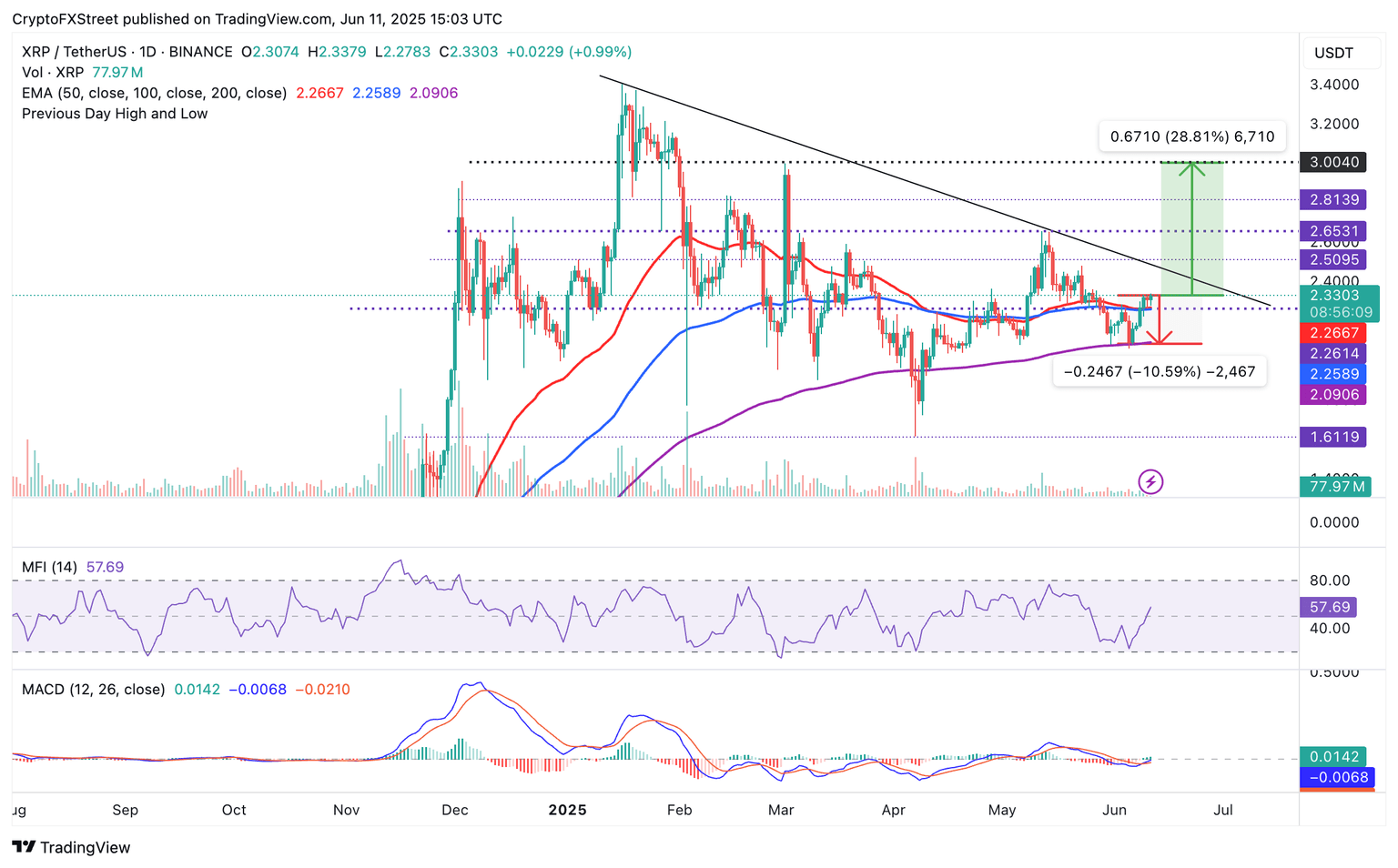

Technical outlook: XRP extends gains amid institutional adoption

The XRP price edges higher above the confluence support at $2.26, established by the 50-day Exponential Moving Average (EMA) and the 100-day EMA, to trade at around $2.32 at the time of writing.

Technical indicators, including the Moving Average Convergence Divergence (MACD), reinforce the bullish outlook by sending a buy signal, as observed on the daily chart below.

Such a signal, which often encourages traders to buy XRP, occurs when the blue MACD line crosses above the red signal line. With the green histogram bars expanding above the mean line (0.00), the path of least resistance could stay firmly upward.

The Money Flow Index (MFI) indicator has recently crossed above the 50 midline, signaling that bulls have the upper hand, as more money is flowing into XRP. If the uptrend persists, traders may begin to adjust to the likelihood of the XRP price moving 28% above its current level to the hurdle at $3.00.

XRP/USD daily chart

Still, downside vulnerability cannot be ignored, especially with XRP likely to encounter resistance at $2.40 and $2.65, both of which were tested in mid-May. If the confluence support at $2.26 breaks, traders might want to prepare for support at the 200-day EMA, positioned 10.5% below the current level at $2.09.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren