- Ripple ends 2021 on a strong note by establishing itself in the East despite the ongoing lawsuit in the US against the SEC.

- XRP price burned brightly in the first half of 2021 but its momentum appears to have vanished in the second half.

- Regardless of the lackluster performance, Ripple and its native token XRP have a bright future ahead of them in 2022.

The cryptocurrency industry flourished in 2021 after going through a grueling year in 2020. The recovery has been nothing short of a miracle, as Bitcoin and many other cryptos hit a new all-time high. The adoption of digital assets, be it in the DeFi, NFT or Metaverse market, has gone through the roof.

Unlike previous years, where the institutional involvement was meager, 2021 has seen major companies align with the burgeoning ecosystem of cryptocurrencies.

Ripple, in particular, carried its burdens from the last year but has surprisingly risen through it and made amazing headway. While XRP price managed to surge spectacularly in the first half of 2021, the second half saw its momentum dwindle and volatility dry up. Still, 2022 is likely to see Ripple and XRP burn brightly and flourish.

Ripple and its arduous journey in 2021

SEC v. Ripple

The US Securities & Exchange Commission (SEC) sued Ripple on December 22, 2020, for allegedly selling unregistered securities within the nation. The $1.3 billion lawsuit came as a shock to XRP holders and the community, considering the closed-door meetings the blockchain startup had with multiple regulators over the years.

More importantly, it set a precedent in the ecosystem given the lack of regulatory clarity.

After almost a year of back-and-forths, there does not appear to be any type of conclusion. The case is stuck at a point where Ripple asked the SEC to submit documents that detail the regulatory body's discussion or reasoning that went into classifying Bitcoin and Ethereum as commodities.

The defendants argue that these documents reveal the contradictory nature of the SEC’s decision-making, which could help prove that authorities did not provide Ripple with a fair notice about XRP being considered a security. However, the plaintiff argues that such crucial documents are protected by the Deliberative Process Privilege (DPP).

Judge Sarah Netburn performed an in-camera review of these documents to confirm the authorities’ claims, but the process has not reached a conclusion and both the SEC and Ripple were asked to re-brief.

There is a high probability that the lawsuit spills over to next year, so here is what investors and traders can expect going forward.

SEC wins

- If the SEC wins the lawsuit against Ripple, it will set the precedent for years to come and give the regulatory agency power to control and regulate cryptocurrency projects with a short leash.

- While it might stifle innovation, there could also be a sense of clarity and a set of guidelines that upcoming projects can follow to prevent falling under the watchful eye of regulators.

- Ripple would then have to pay a hefty fine and focus its business anywhere but the West. This scenario might also cause other European countries to follow the same path, which will leave the firm with slightly less ground to cover.

- XRP price could take a massive hit, but it would likely be short-lived.

- The SEC might not sit back after the win and might focus on Ethereum as many speculators believe.

Expanding his thoughts on the possibility of ETH being the next target, John Deaton, the court-appointed Amicus Curiae, stated,

There’s a reason Gensler won’t comment on whether he believes #Ether is a security. It’s because he wants the option of going after them. What’s crazy ironic, is that, with Gensler at the helm, the lawsuit could ultimately give Ripple and XRP an advantage moving forward.

Ripple wins

- If Ripple wins the lawsuit against the SEC, it would likely put the federal agency on a backfoot, which could also denote a paradigm shift in securities laws for cryptocurrencies.

- Although the potential win could put Ripple in a safe place, existing and upcoming projects might still lack clarity.

- Regulators would have to think twice before taking on other huge projects like Ripple.

- XRP price could see a massive boost and set a new record price higher.

Raol Paul, the former Head of European Hedge Fund Sales, said that his investment in XRP after the lawsuit in December has “no-brainer” risk-to-reward statistics.

Paul added,

It got heavily discounted in the price, and then I looked at it and thought, ‘Well, what’s it going to do? Fall 100% from here to zero? But if it gets solved, it’s 10 times.’ And I’m like, ‘Well that’s a no-brainer.’ Why would you not take a 10-1 risk/reward that has a catalyst around it?

Noteworthy progress despite headwinds

Although 2021 might feel like lawsuits and bureaucracy for Ripple, the distributed ledger company has made some notable achievements not just in its sales but also in partnerships.

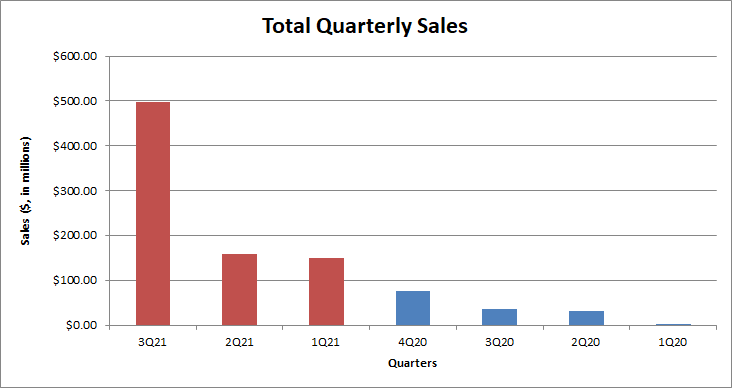

The net sales for the three quarters of 2021 increased by roughly 450% from $146.41 million to $806 million. The third quarter of 2021 saw the highest sales ever at $497 million, all of which was a result of On-Demand Liquidity (ODL).

ODL is a service that leverages XRP for cross-border transactions. Unlike the traditional method which includes locking-up capital and pre-funding the destination accounts, ODL will allow instant transfers and reduce operational costs.

Interestingly, the ODL sales for Ripple have spiked by 231% between Q1 and Q3 of 2021, indicating a rising demand for blockchain-powered remittances.

Quarterly Sales 2020, 2021

The most significant development in Q1 2021 included Ripple’s 40% acquisition of Asia’s leading cross-border payments specialist, Tranglo. The strategic investment was designed to expand the reach of ODL to the APAC region.

In Q2 2021, the European ODL transactions grew by 250%, providing an idea of the regulatory landscape in this region. To further improve remittances in European countries, Ripple appointed Sendi Young as managing director of Europe. The company also announced its foray into the NFT space via its investment in Mintable.

Lastly, Q3 2021 witnessed a major boost in the use of XRP for cross-border payments as a result of legacy customers like SBI Remit switching from RippleNet to ODL solutions. ODL volumes increased 130% quarter-over-quarter.

On the NFT front, the US-based company announced the development of a $250 million Creator Fund to support creators, brands, and marketplaces to explore new use cases for non-fungible tokens on the XRP Ledger.

One of the major partnerships throughout the quarter included the Royal Monetary Authority of Bhutan. Ripple is helping them pilot a Central Bank Digital Currency (CBDC) using its technology.

Fundamentally, Ripple has been growing strong despite the SEC’s $1.3 billion lawsuit. The fate of XRP price, on the other hand, rests largely on how the case ends and could either catapult it to record highs or suppress its potential.

XRP price interests both long and short-term investors

XRP price seems to be forming a cup-and-handle on its weekly chart. The continuation pattern forms after an upward advance that looks like a bowl or a rounding bottom accompanied by a trading range, which results in the handle.

The target for this bullish setup is obtained by adding the distance between the cup’s lowest point upwards from the breakout point. In this case, the cup-and-handle projects that XRP price could enter a 1,625% bull run toward $34. When the distance is measured from the breakout point to the bottom of the cup, it forecasts a 94% breakout to $3.82.

Even though the bullish outlook might appear hard to achieve, investors must have an open mind. If Ripple wins the lawsuit against the SEC, there is a high probability that XRP price will shatter its previous record high at $3.31 and make its way higher.

XRP/USD 1-week chart

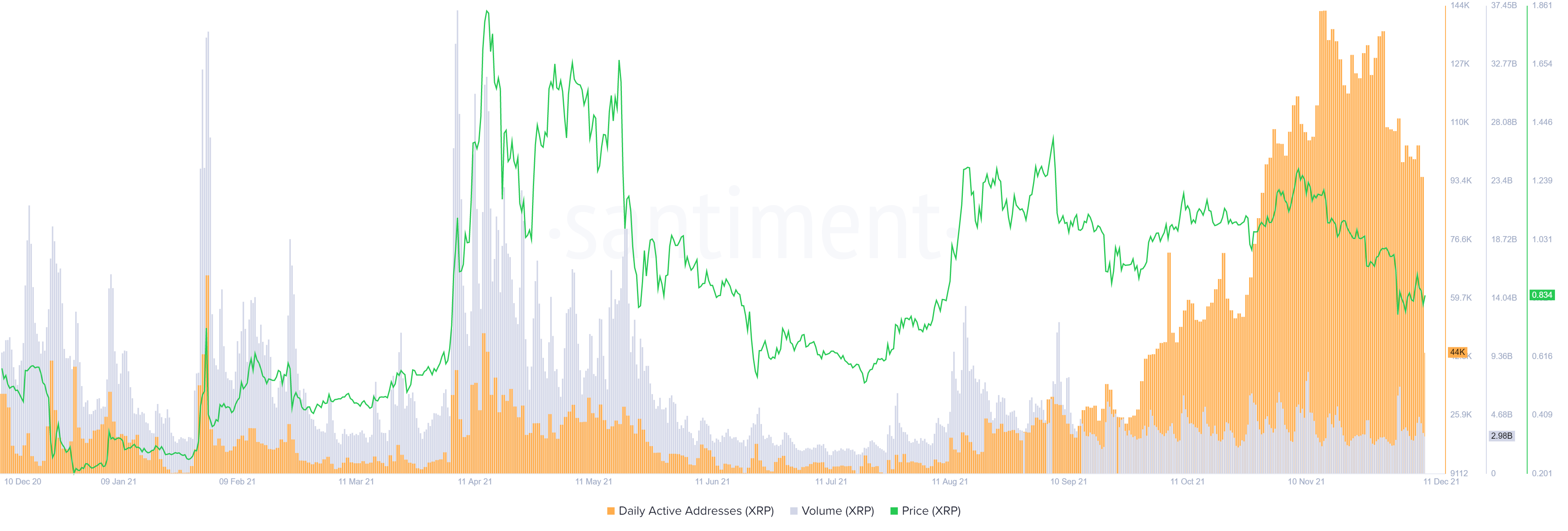

The daily active addresses (DAA) on the XRP ledger are a major supporting factor for the optimistic outlook despite the low levels of volatility seen recently. This metric is currently in triple-digit territory, suggesting that the network continues to grow.

On-chain volume is the only missing factor that has yet to lean bullish. It currently sits at $2.98 billion, just below its 30-day average at $3.21 billion. A spike in this index could indicate the reentry of capital.

XRP DAA, Volume

Over the past year, addresses holding 1 million to 10 million XRP have increased their holdings from 2.76 billion to 3.32 billion tokens. The 18.1% increase suggests that institutions continue accumulating XRP, expecting its market value to increase in the coming months or years.

XRP whale distribution

Assuming the handle’s bottom is around $0.50, the bullish thesis connected with the cup-and-handle setup will fail if XRP price produces a swing low below it. A similar scenario could take place if Ripple loses the lawsuit against the SEC. Under such circumstances, XRP price might shatter the $0.50 support level and slide lower toward $0.23.

Perfect concoction for 2022

With the growing bullish momentum across the cryptocurrency industry, XRP price could breach its previous all-time high in 2022. Still, everything would depend on the outcome of the SEC v. Ripple lawsuit.

Coming on top could serve as a tailwind for the bullish argument and propel XRP beyond the $3.31 all-time high toward the double-digit territory. Ripple has the fundamentals to achieve its upside potential as it makes significant strides in the eastern hemisphere and establishes itself in the European and the Middle-Eastern countries.

But if Ripple loses the lawsuit, it will, at best, lose its ground in the US. The news could temporarily setback XRP price before the market realizes its strong fundamentals.

Gregor Horvat projects a a bounce for XRP/USD price next year on his Elliott Wave analysis:

XRP/USD Elliott Wave Analysis

by Gregor Horvat

by Gregor Horvat

On XRP/USD we are seeing sideways price action for the last three years which can be a fourth wave, ideally a triangle so weakness can be limited at 0.30 cents, or at 10, if wave four will be a flat. But in either case we think that bounce can be seen next year.

Forecast Poll 2022

| Forecast | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Bullish | 0% | 16.66% | 33.33% |

| Bearish | 33.33% | 0% | 0% |

| Sideways | 66.66% | 83.33% | 66.66% |

| Average Forecast Price | 0.8262 | 1.0477 | 1.3630 |

| EXPERTS | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Alberto Muñoz | 0.7000 Sideways | 0.8650 Sideways | 1.0200 Sideways |

| Andrew Lockwood | 1.0100 Sideways | 1.2000 Sideways | 1.3100 Sideways |

| Brad Alexander | 1.0000 Sideways | 0.8000 Sideways | 1.2000 Sideways |

| Navin Prithyani | 0.6000 |