Ripple price eyes 5% gains as $1.9 billion in market capitalization comes in

- Ripple price has defied the bearish market trend, recording a 101% increase in trading volume compared to previous stats.

- The capital gain comes after an 8% weekly increase, injecting a staggering $1.9 billion into XRP’s current market capitalization.

- Accordingly, the remittance token has asserted its dominance in the Korean market, outperforming Bitcoin and Ethereum.

Ripple (XRP) has earned itself a place among the top crypto forces to reckon with, with the recent value surge captivating investors and crypto enthusiasts who marveled at the network’s ability to defy an overall bearish trend that has progressively plagued the wider crypto scene.

Also Read: Ripple Chief Legal Officer cites case from the 70s, argues SEC knows XRP is not a security

Ripple price records a $1.9 billion influx in market cap

Ripple (XRP) price has recorded an 8% increase over the past week, with the surge injecting a staggering $1.9 billion into the token’s current market cap at around $23.9 billion at the time of writing. Along with these stats, cryptocurrency traders transacted over $850 million worth of XRP over the last 24 hours.

The above figures point to an increase in investor confidence in XRP. It also hints at the token’s potential to yield significant returns and an astonishing trading volume representing a 101% increase relative to past figures.

Meanwhile, another interpretation of the increase in investor confidence in Ripple price can be drawn from the recent movement of XRP tokens by whales. According to the renowned whale transaction tracker Whale Alert, many XRP tokens were transferred to various exchanges.

87,305,753 #XRP (41,197,105 USD) transferred from unknown wallet to #Binancehttps://t.co/slOigEUMX5

— Whale Alert (@whale_alert) May 21, 2023

According to the tracker, a colossal 87.3 million XRP tokens worth around $41 million were transferred from an unknown wallet to a giant crypto exchange Binance over the weekend. Further, the platform revealed 25.7 million XRP tokens worth around $11.8 million, moving from another unidentified wallet called Bitstamp.

25,700,000 #XRP (11,874,505 USD) transferred from unknown wallet to #Bitstamphttps://t.co/emJ55ktnhj

— Whale Alert (@whale_alert) May 22, 2023

As expected, these activities have sparked curiosity among token holders, fueling concerns about investors’ motivation(s) for such significant transfers.

XRP tops Korean crypto markets

In the spirit of market dominance, Ripple price is keen on asserting its dominance, with recent developments showing that XRP is arguably the most actively traded asset in South Korea, outperforming both Bitcoin (BTC) and Ethereum (ETH) price.

The token’s trading volume on major Korean exchanges such as Bithumb, Upbit, and Coinone exceeded $100,000 million within the last 24 hours. As a top 10 crypto asset, XRP diverging from the current bearish market trend has sparked intriguing debates about its unique position and potential. Moreover, the significant movements by XRP whales and continued dominance in the South Korean crypto market underscore the currency’s influence and impact within the broader crypto community.

Ripple price eyes 5% gains

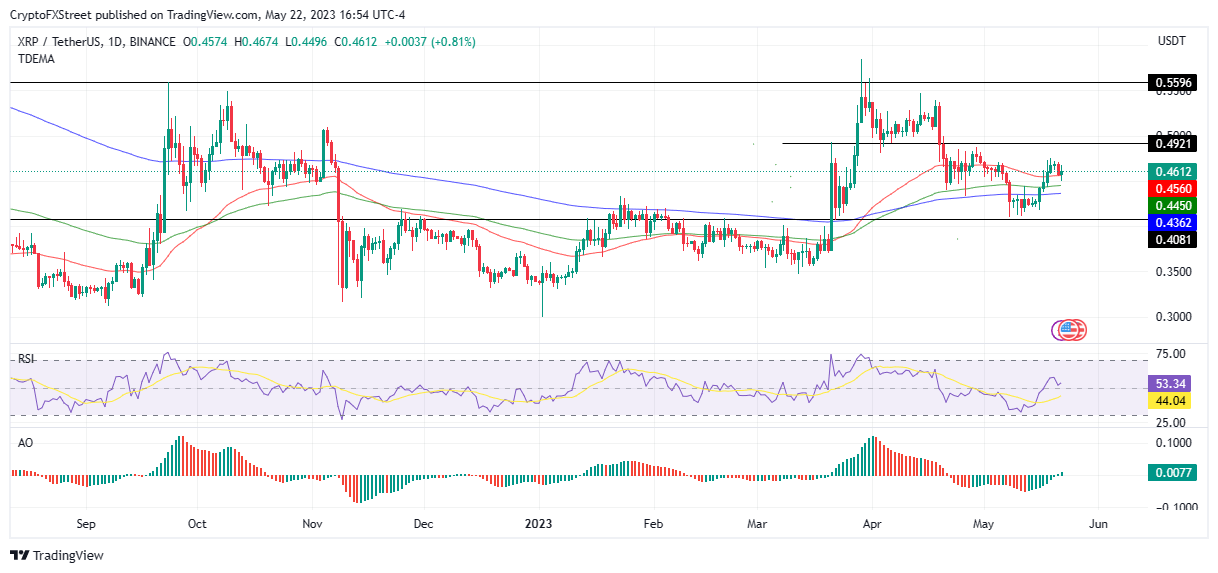

Amid this bullish outlook, Ripple price could rally 5% to tag the $0.49 resistance level or, in a highly bullish case, tag the $0.55 resistance level. This bullish thesis draws support from the fact that the remittance token had strong downward support due to buying pressure from the 50-, 100-, and 200-day Exponential Moving Averages (EMA) at $0.45, $0.44, and $0.43 respectively.

Further, the Relative Strength Index (RSI) was in the positive zone at 53 and headed north, suggesting that even as more buyers flocked to the scene, there was more room for the upside. In addition, the Awesome Oscillators (AO) were flashing green and pulling towards the positive region as bullish control intensified.

XRP/USDT 1-Day Chart

Conversely, early profit-taking inspired by greed among traders could interfere with the bull trend, causing a fall in Ripple price below the three EMA to find support around the $0.40 support level before a possible trend reversal.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.