Ripple price eyes 30% upswing as Uphold announces XRP debit cards

- XRP price is slowing down after the recent rally to gather steam for the next run-up.

- Uphold launches XRP debit cards as it partners with GlobaliD.

- A decisive 9-hour candlestick close above $0.785 will confirm the start of an uptrend.

XRP price is trading above two critical support levels. A retest of either of these barriers will likely trigger an upswing that shatters the range high and scales to tag new swing highs.

Uphold to launch XRP debit cards with cashback in XRP tokens

Uphold, a digital money platform, recently partnered with GlobaliD, a digital identity platform, to launch XRP debit cards. Interestingly, these cards are from Mastercard and provide 5% cashback paid out in XRP tokens.

The announcement reads,

The XRP debit card tries to combine the power and flexibility of the Uphold platform with the compliance and oversight that GlobaliD provides. Using the debit card, the users would be able to pay in fiat or digital currencies, but the cashback would always be in XRP.

This development is fundamentally positive for XRP and promotes the adoption of digital currencies while users can accumulate Ripple passively. This news comes as the SEC v. Ripple lawsuit is still ongoing.

During the Aspen Security Forum on Wednesday, Brad Garlinghouse, the CEO of Ripple, commented on the case,

You know, to say that we have certainty, we have clarity, is like the alcoholic saying, 'I don't have a problem.’

A win for Ripple, in this case, would be a massive morale booster for the community and might trigger an explosive bull run.

XRP price eyes a higher high

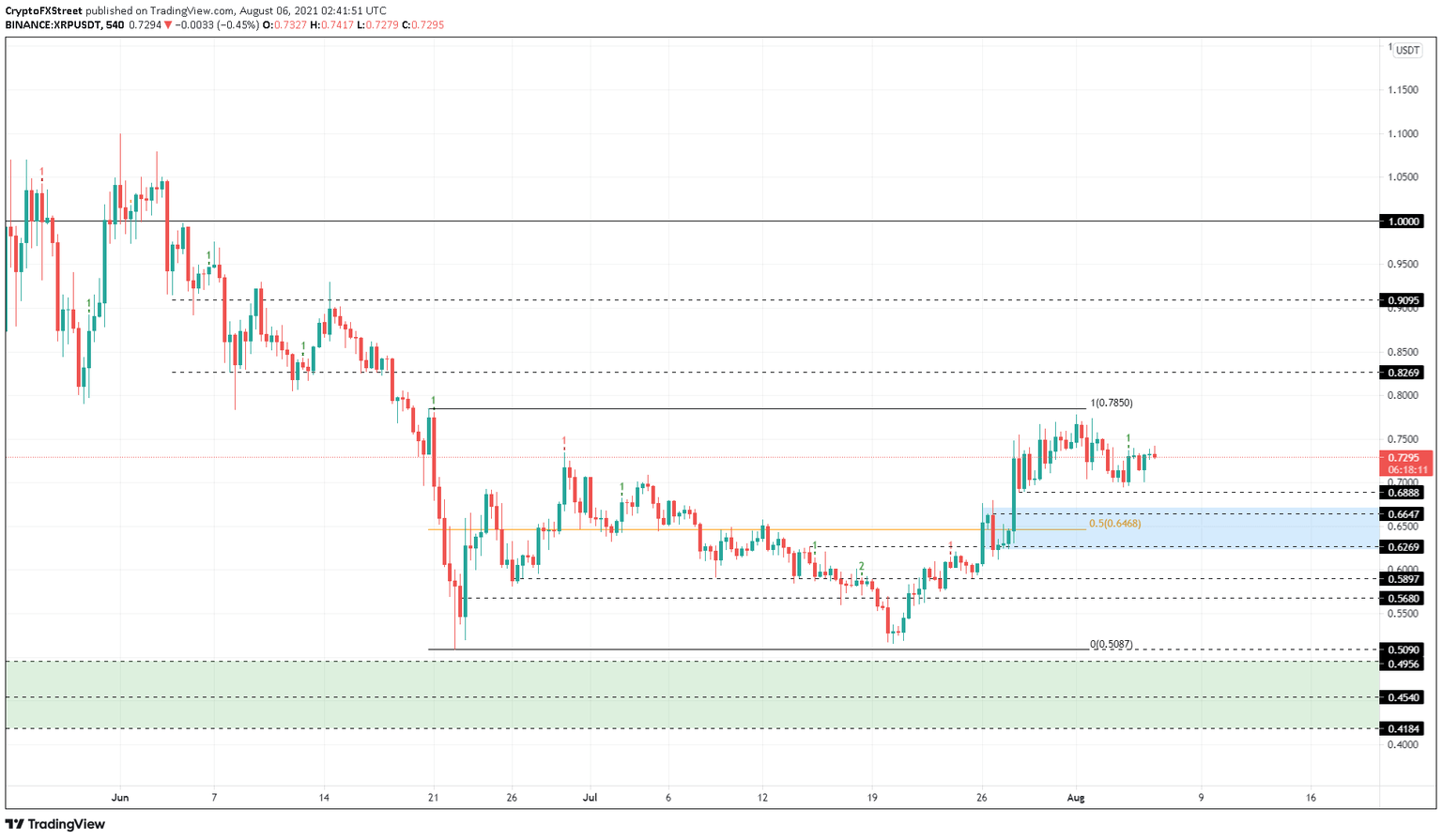

XRP price came very close to retesting the range high at $0.785 but failed during the recent upswing. Since this point, Ripple has been on a slow and steady consolidation that is sloping downwards.

Although XRP price seemed like it would retest the immediate support level at $0.689, it has not. Going forward, investors can expect the bulls to gather steam after a retest of either $0.689 or the demand zone below it that extends from $0.623 to $0.671.

This move would create a higher high and allow the sidelined investors to step in and trigger a new uptrend. The resulting bull rally must slice through $0.785 and flip it into a support level to confirm further ascent.

Doing so might open the path to $0.90, roughly 30% from $0.689. In a highly bullish case, the $1 level might be tagged.

XRP/USDT 12-hour chart

Regardless of the optimistic outlook, things could turn awry if XRP price shows no strength during the retest of the demand zone extending from $0.623 to $0.671. A breakdown of this barrier will push Ripple down to $0.590.

If this support level is breached, it will invalidate the bullish thesis and potentially trigger a sell-off to subsequent footholds.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.