Ripple price crushes bulls’ dreams as European energy crisis heats up

- Ripple price leaves investors with a hangover after a 7.5% intraday price change.

- XRP price had to close down over 3% as markets slipped in the last trading hours of the US session.

- This shows initial warnings that a bull market in cryptocurrencies is still far from over.

Ripple (XRP) price action slipped overnight in the last trading hours after sentiment shifted 180 degrees as geopolitical issues flared up again and energy issues reached boiling point in Europe. Headlines that speak of a Lehman collapse amongst energy suppliers in Finland, along with Turkey’s president Erdogan speaking harsh words about the possibility of a military intervention against Greece, and Putin committing to fully cutting off gas and oil supplies to Europe, piled on the pressure. It is not surprising, therefore, normal that markets should roll over on the back of all this negativeness and take a nosedive as investors start to hoard cash.

XRP price is no match for dire geopolitics

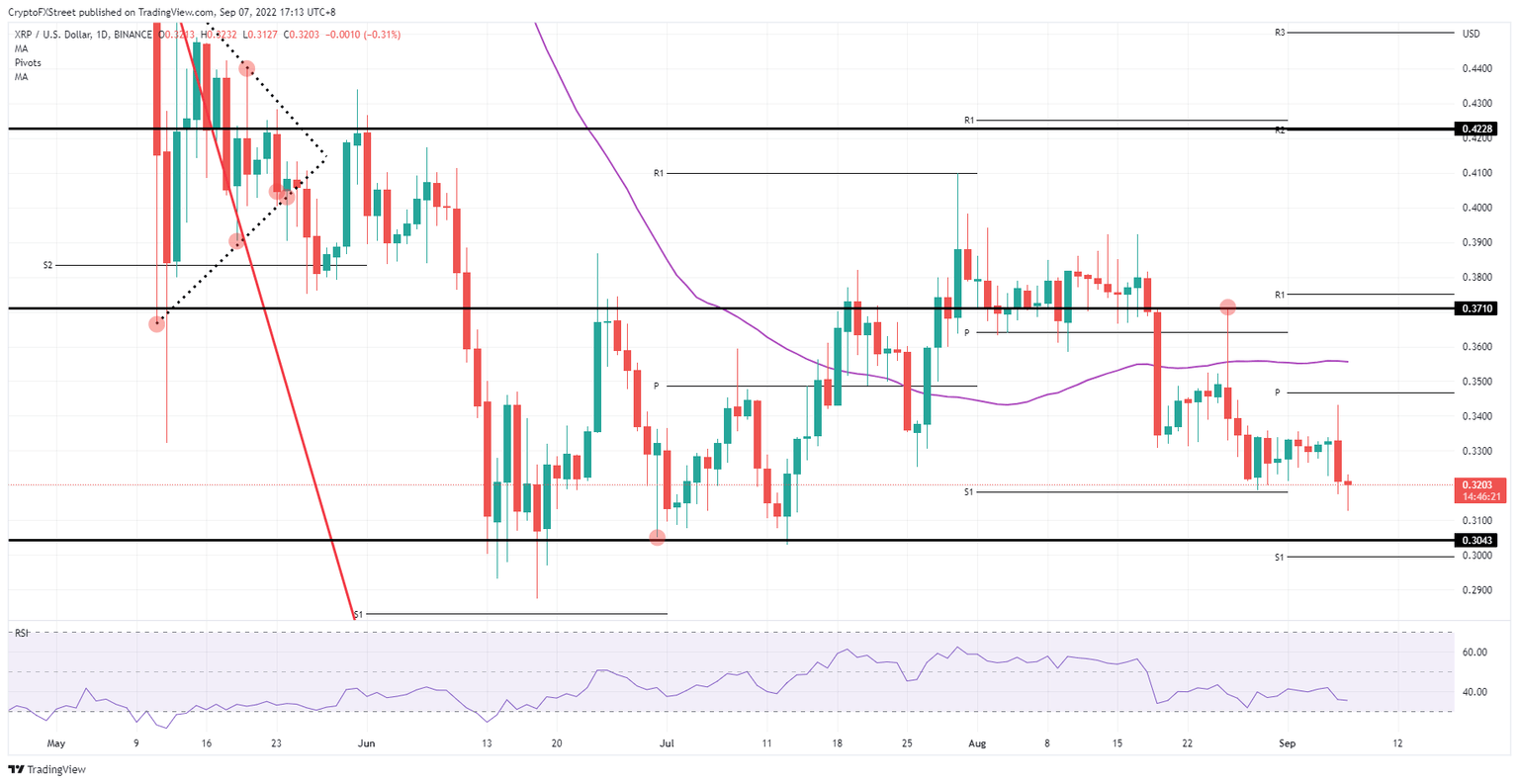

Ripple price dropped another 2.5% already during the ASIA PAC session, whereas the European session is bringing some relief for now. Support for bulls has been broken and once the US session gets underway, expect to see a continuation of the downturn. XRP price is thus at risk of printing bigger losses as support for bulls at $0.3182 that held overnight has broken this morning.

XRP price will now look for the nearest level of support where bulls will want to buy. That level looks to be near $0.3043, which is still 5% away and could be tested later this afternoon, if the US equity session gets on the back foot. To make matters worse, the ECB is set to issue a rate hike again on Thursday, and with a history of not-so-good communication, that could even be a catalyst that could trigger XRP to trade below that $0.3043 pivotal level and test $0.2900 to the downside.

XRP/USD Daily chart

Alternatively, markets could start to look beyond these negative headlines and focus on the upside as Europe is trying to address the energy issues while diplomatic talks get underway between Greece and Turkey. XRP price could easily see bulls buying the dip and making it a false break, with price action trading back up above $0.3300 near-term. Friday could then see a restoration of the upside price action, with XRP price trading near $0.35 around the monthly pivot as the benchmark.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.