Ripple price could break key support level as regulatory jitters linger

- Ripple price sees bulls throwing in the towel as SEC lawsuits escalate.

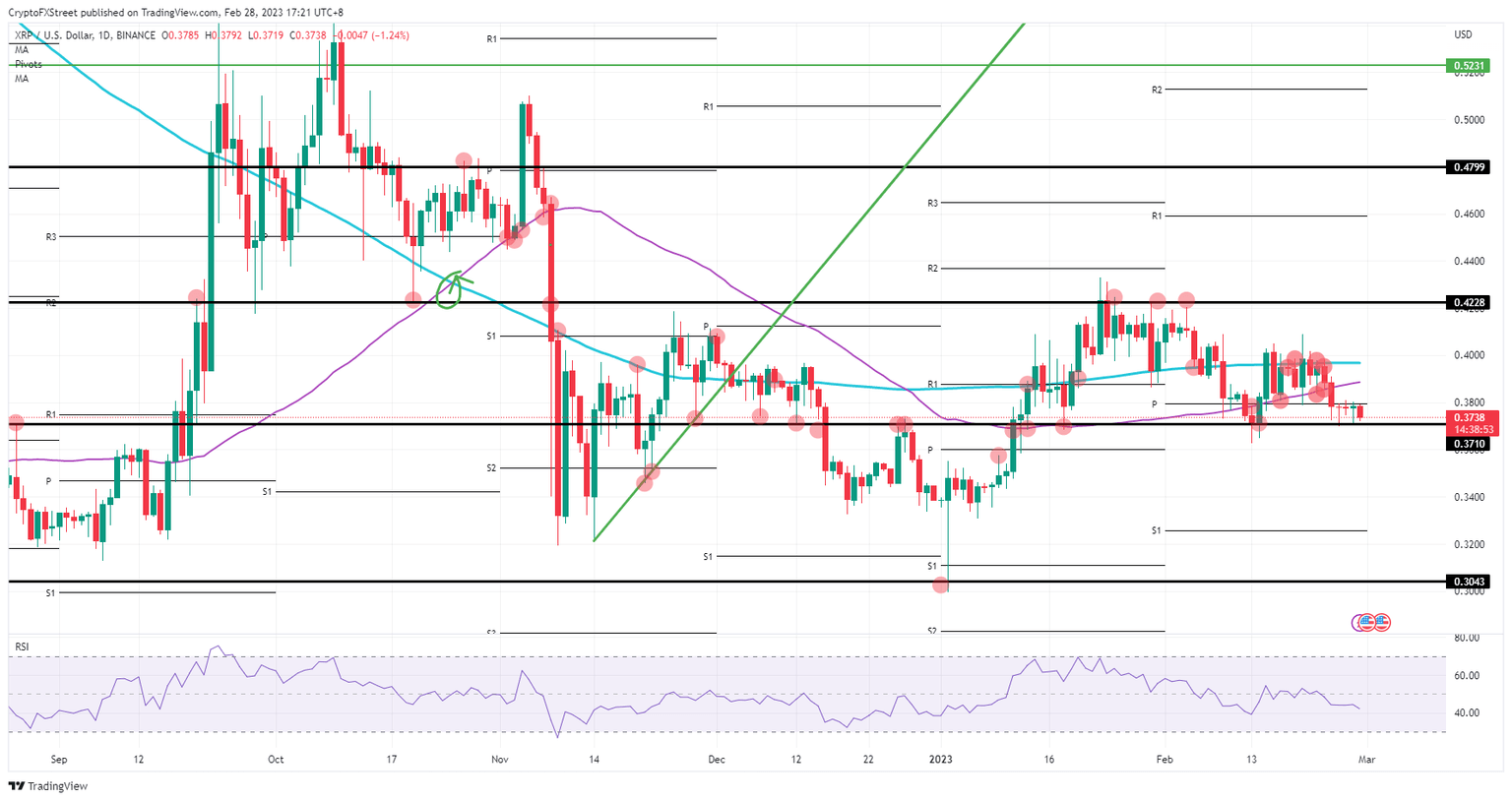

- XRP could break below $0.37, taking out vital support.

- The longer this uncertainty takes, XRP could drop toward $0.32.

Ripple (XRP) price is set to tank another 13% as the lawsuit between Ripple and the US Securities & Exchange Commission (SEC) escalates again. Ripple’s lawyer suggested that the US SEC Chair recuse himself over a past claim concerning Bitcoin. Meanwhile, rumors are simmering that XRP could be backed with gold, which eats into the credibility of the top three cryptocurrencies.

Ripple price does not react well to uncertainty

Ripple price is sliding again by 1% during the ASIA PAC session this Tuesday. The negative price action occurs as regulatory pressure emerges again with Ripple’s lawyer in the SEC court case demanding that SEC Chair Gary Gensler recuse himself over a past statement where he said all altcoins were unregistered securities. This adds additional bearish pressure on the price action, possibly seeing XRP drop below $0.37.

XRP could tank further if this negative news surrounding the cryptocurrency continues. With an already fragile trading environment, from a purely technical point of view, a full unwind of the profits for 2023 could be underway. That means roughly 20% is at risk of being erased from XRP’s performance.

XRP/USD daily chart

Should there be a breakthrough in the court case or ruling in favor of XRP, expect a massive relief rally to unfold. Quite quickly, Ripple price would take out both moving averages at $0.38 and $0.39 to trade near $0.40. A short breather there would open up the window for more bulls to join and create a breakout above $0.42 with a 28% profit nearby.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.