- Ripple price is ready to break above $0.63, taking out past highs.

- XRP bulls come in on a wave of positive global market sentiment.

- Expect a break above $0.63 to carry 25% gains.

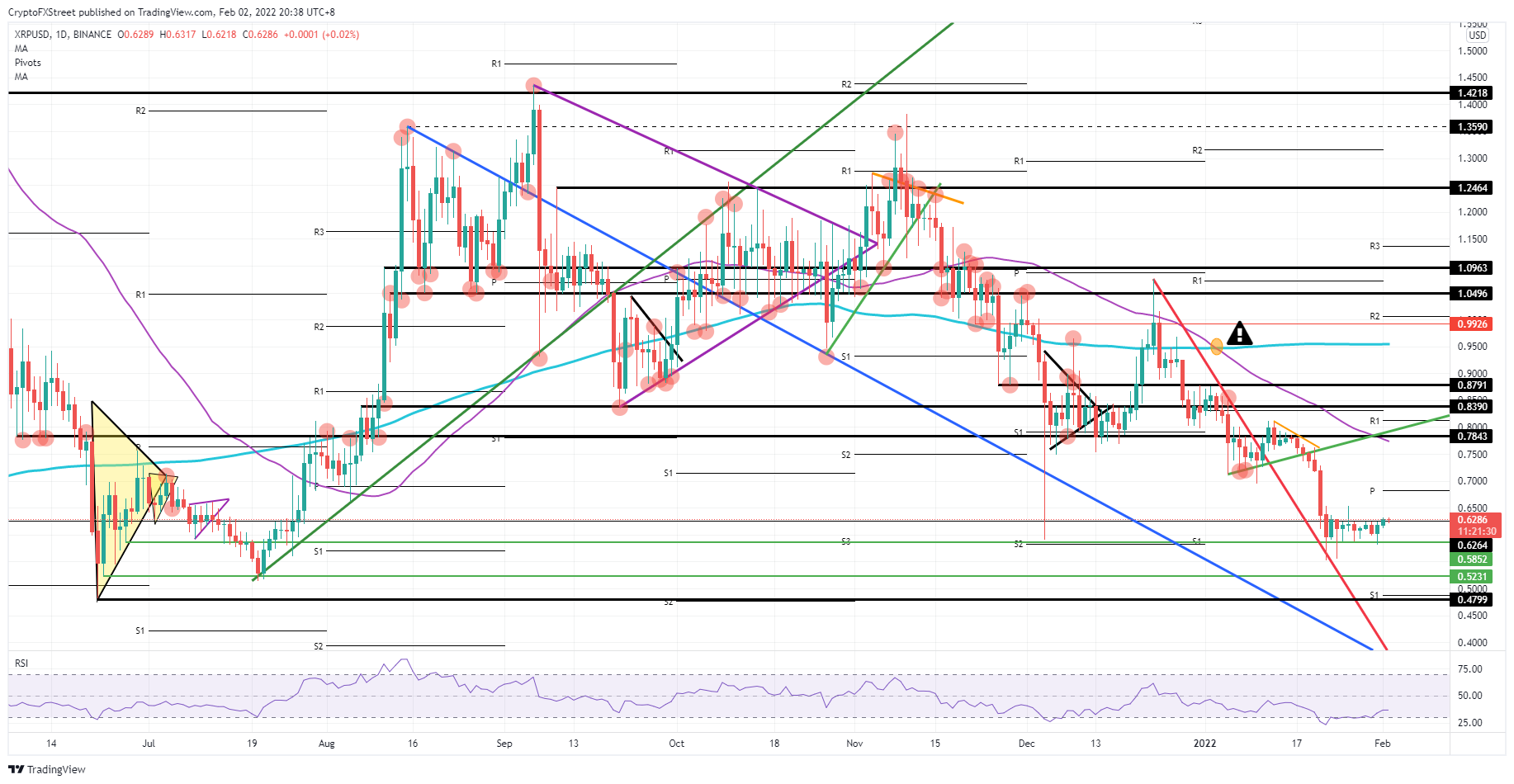

Ripple (XRP) price is experiencing a bullish lift after price opened above a vital barrier that could draw more investors into the nascent rally in Ripple coins. The buy-demand force is so tremendous that it is being reflected by the Relative Strength Index (RSI) which is experiencing a substantial up move. Expect a further continuation higher as long as global markets stay in risk-on mode, carrying 25% of gains before hitting $0.78 to the upside.

XRP bulls set the target at $0.78, carrying 25% of gains

XRP price has been trading a bit sideways these past few days as investors and market participants awaited confirmation that markets were ready to shrug off January’s negativeness. Going into the second trading day of February, bulls look set to come storming out of the gates in full force, as all equity indices are in the green and, in the process, are pulling cryptocurrencies out of their ditch. This perfect tailwind will see a lift in XRP price action, carrying 25% of gains as bulls set a new target at $0.78, in the near term.

XRP bulls have some other elements in their corner for building a case to start an uptrend, apart from the tailwind spillover from equity markets. Bulls have very well respected $0.58, leading to a massive inflow of investors at this level. With that, the RSI has been drifting further away from the oversold area and still has a lot of ground to cover before becoming overbought, thus holding more upside potential for any long positions.

XRP/USD daily chart

Sentiment could still be set to shift to the downside as inflation seems to be sticky, stirring more hawkish central banks into action, and hitting global market sentiment. For XRP, that would translate in a sharp downturn towards $0.58 with a possible dip towards $0.52, where investors will want to engage again. Bears will not be in it for the long haul, however, given the RSI is likely to y hit back from oversold levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

Meta shareholders turn down Bitcoin treasury reserve proposal as its stock soar on AI plans

Meta (META) shareholders opposed a proposal to adopt Bitcoin as a treasury asset, with more than 95% voting against the idea, according to a filing with the Securities & Exchange Commission (SEC).

Ripple price forecast: XRP price could hit $1.76 this week amid potential 20% correction

Ripple (XRP) faces legal uncertainty in its battle with the United States Securities and Exchange Commission, and the XRP price continues to slide. At the time of writing, XRP is trading at $2.1540, down 1.20% in the day.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.