Ripple Price Analysis: XRP/USD locked in a range after wild price movements

- XRP/USD failed to settle above $0.1500 on Tuesday.

- The critical support is created by the level of $0.1300.

Ripple's XRP attempted a recovery above $0.1500. The third-largest coin hit the intraday high at $0.1528, but the upside proved to be unsustainable as the price swiftly slipped back inside the previous range. At the time of writing, XRP/USD is changing hands at $0.1472, having gained about 5% both on a day-to-day basis and since the beginning of the day.

XRP/USD has been moving in sync with the market recently. Despite the recovery from Monday's lows, the third-largest digital asset with the market value of $6.2 billion is still down over 30% on a weekly basis, and 22% since the beginning of the year. XRP/USD got a powerful boost earlier this year as Binance added XRP futures support. However, the gains proved to be short-lived as the market got hit by a combination of negative factors including global pandemic and recession fears.

XRP/USD: Technical picture

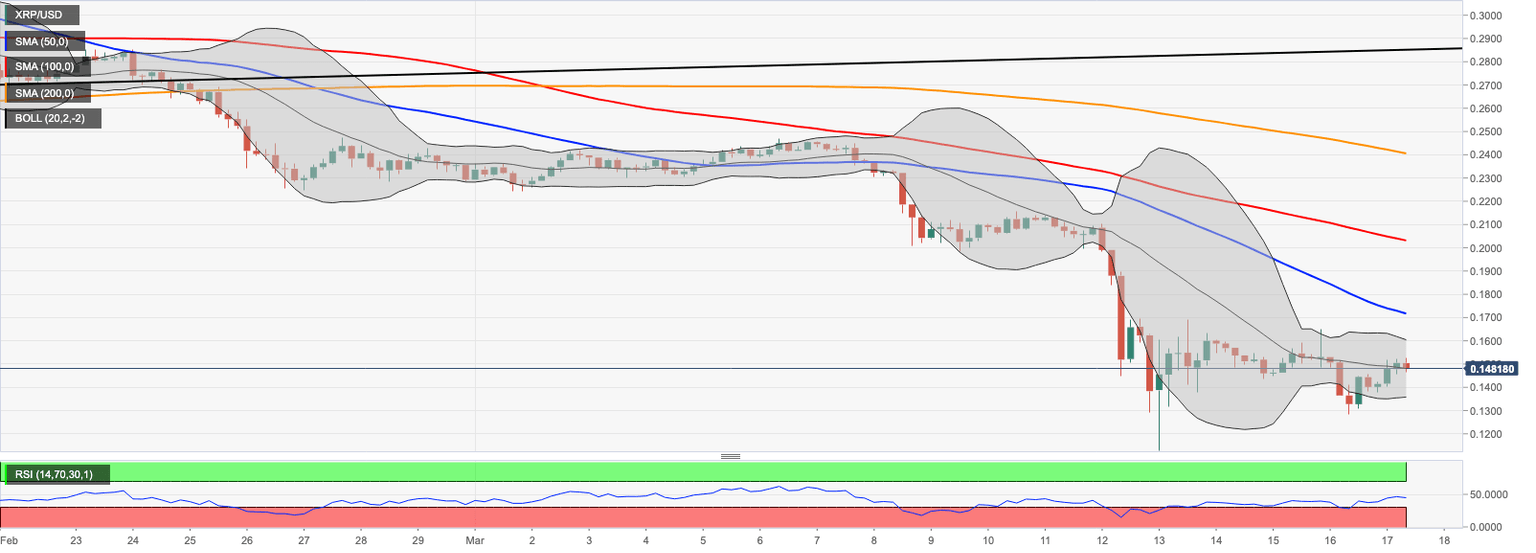

From the technical point of view, XRP/USD has been moving in a range limited by $0.1300 on the downside and $0.1600 on the upside. The price dipped below $0.1300 twice in a recent week, however, the sell-off proved to be short-lived. A crypto Twitter analyst Robert Art noted that $0.1300 support is even more important than $0.10 and added that there was little that could stop XRP for falling to $0.05

Unless Bitcoin is manipulated by whales to new all-time highs or Ripple releases some mind-blowing news that result in FOMO nothing will stop XRP from hitting $0.05. Utility will take years, just as Garlinghouse said it would. I’m patient. I’ve got nothing but time and ambition.

Meanwhile, an optimistic scenario implies that XRP/USD can break above $0.1600 and proceed with the recovery towards $17.20 (SMA50 4-hour) and psychological $0.2000 reinforced by SMA100 4-hour. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.2200 (the lower boundary of the previous consolidation channel) and $0.2400 (SMA200 4-hour)

XRP/USD 4-hour chart

Author

Tanya Abrosimova

Independent Analyst