- Ripple's XRP is under pressure, losing ground even as other coins are recovering.

- The price is hovering at a critical level created by the daily EMA200.

Ripple's XRP is a whipping boy of the cryptocurrency industry. The digital asset lost nearly half of its value in less than a week amid panic caused by SEC's lawsuit against the San-Francisco-based fintech startup.

At the time of writing, XR is changing hands at $0.29, down over 6% on a day-to-day basis. The asset slipped to fourth place in the global cryptocurrency market rating with the current market capitalization of $13.2 billion and an average daily trading volume of $9.5 billion.

Cryptocurrency exchanges continue delisting XRP

As FXStreet previously reported, several cryptocurrency exchanges delisted or suspended XRP trading, citing concerns about Ripple's legal issues. If the court decides that XRP is a security, the trading platforms may be accused of making it available for retail investors.

Bistamp is the latest exchange that introduced limitations on XRP trading. The US-based customers will not be allowed to trade or deposit XRP as of January 2021, the company announced on Twitter.

In light of the SEC's recent filing alleging XRP is a security, we are going to halt XRP trading and deposits for all US customers on January 8, 2021. Other countries are not affected. Read more: https://t.co/RUGtkAjr08

— Bitstamp (@Bitstamp) December 25, 2020

The Bistamp's decision halted XRP's upside correction and threw the price back below $0.30.

XRP is bearish as on as it stays below $0.45

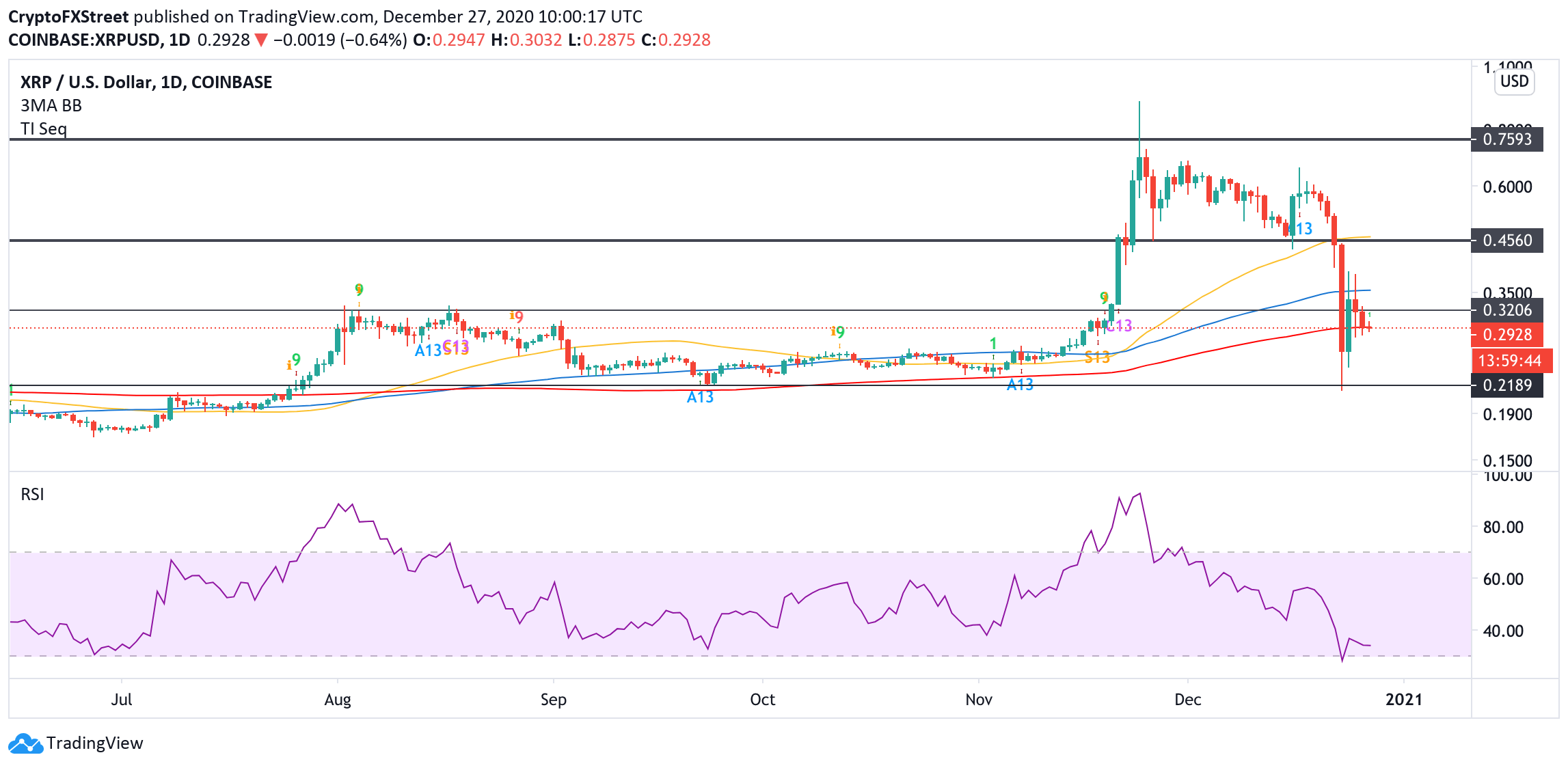

From the technical point of view, XRP has settled at the daily EMA200. This critical barrier has been limiting XRP's sell-off since June 2020. If it is broken, the sell-off may gain traction with the next focus on the former channel support at $0.21. The price touched this area on December 23 but managed to recover amid strong profit-taking activity.

XRP, daily chart

Meanwhile, on the upside, the local recovery is created by a psychological $0.30. However, a sustainable move above $0.32 is needed to mitigate the initial bearish pressure and allow for a rally towards $0.035 (daily EMA100) and $0.45. The latter is created by the broken channel support and the daily EMA50. A move above this barrier will invalidate the bearish scenario and bring XRP in line with the cryptocurrency market recovery.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.