Ripple Price Forecast: XRP pacing towards $1 ignores the uncertain regulatory future

- Ripple's response to the SEC lawsuits dares the regulator to prove how Ethereum and Bitcoin are not securities.

- XRP bulls yearn for gains at $0.1, but they must overcome the hurdle at $0.75 first.

- A correction will come into the picture if XRP fails to close the day above $0.6.

Ripple is trending higher during the weekend session. This week's trading has yielded immensely for the cross-border token, keeping in mind that it had tumbled to $0.35 in the previous week. The least resistance seems upward as Ripple exchanges hands at $0.63. Bulls have their eyes on $1, but they must bring down the resistance at $0.75.

Ripple seeks regulatory clarity

Ripple Lab's Inc., the United States blockchain startup, has recently filed a response to the Securities and Exchange Commission (SEC) lawsuit. In the filing, Ripple denied all the accusations against it and its top executives. The SEC claims Ripple failed to register with it at the beginning of its operations and has been evading the regulator for seven years.

Ripple came up with yet another twist for the SEC to provide information proving that Bitcoin (BTC) and Ethereum (ETH) are not securities. The battle for regulatory clarity seems to have started for Ripple, and the road could be bumpy. On the other hand, XRP is making weekly highs despite the uncertainty.

Ripple extends the bullish leg toward $1

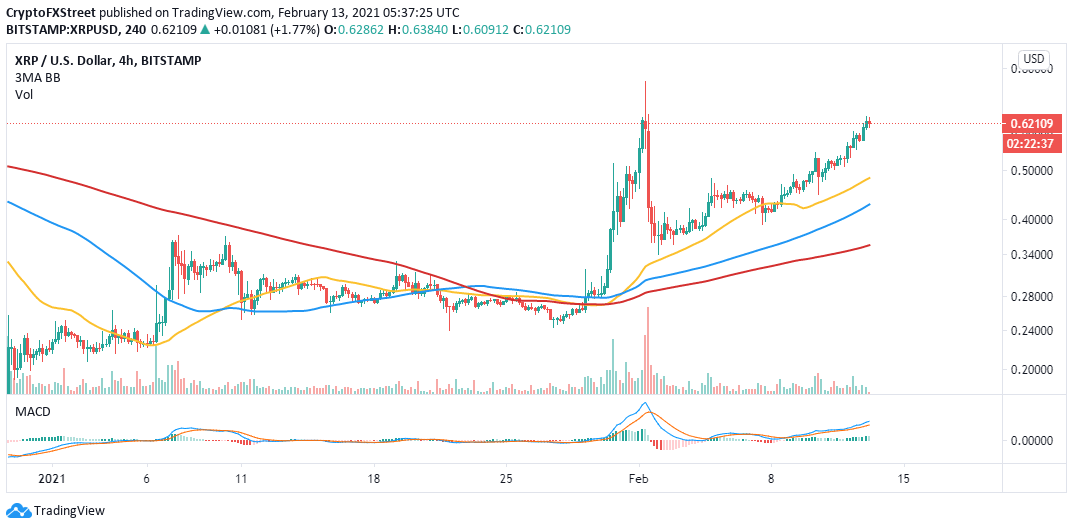

XRP is gearing up for an ultimate upswing to $1 after closing the day above $0.6. Recovery from the recent dip has been persistent and steady. All eyes are glued on the short-term resistance at $0.75, which will function as a springboard to $1.

The bullish outlook has been cemented by the Moving Average Convergence Divergence (MACD). The MACD line (blue) cross above the signal line is a bullish signal, which means the uptrend is likely to progress to higher price levels. This technical indicator tracks the trend of the asset and measures its momentum. It can also be used to identify possible entries and exists in the market.

XRP/USD 4-hour chart

XRP holders are currently on a buying spree according to the holder distribution metric by Sentiment. Following the pump a couple of weeks ago, whales offloaded their bags in large volumes. However, the token appears to be attracting them back. For instance, addresses containing between 1 million and 10 million XRP have risen from 1,117 on February 1 to 1,151 at the time of writing, a 3% increase. If this buying pressure continues to grow, we can expect XRP to shoot to $1 quickly.

Ripple holder distribution

Looking at the other side of the fence

It is essential to realize that XRP may start to correct from the upswing it fails to rise above $0.75. Moreover, bulls must defend the support at $0.6 as if their lives depend on it. Otherwise, Ripple could see selling pressure intensify, especially with the cloud of uncertainty hovering over it.

The most critical support is $0.5 at the 50 Simple Moving Average, but the primary support at $0.35 will come in handy if the declines soar.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(95)-637487929907797502.png&w=1536&q=95)