Ripple Price Analysis: XRP bulls stay hopeful inside weekly rising channel

- XRP/USD steps back from day's high while keeping the upside momentum.

- Normal RSI conditions, bullish chart pattern favor buyers.

- 100-bar SMA adds to the upside filter, bears will eye June 2020 on breaking channel to the downside.

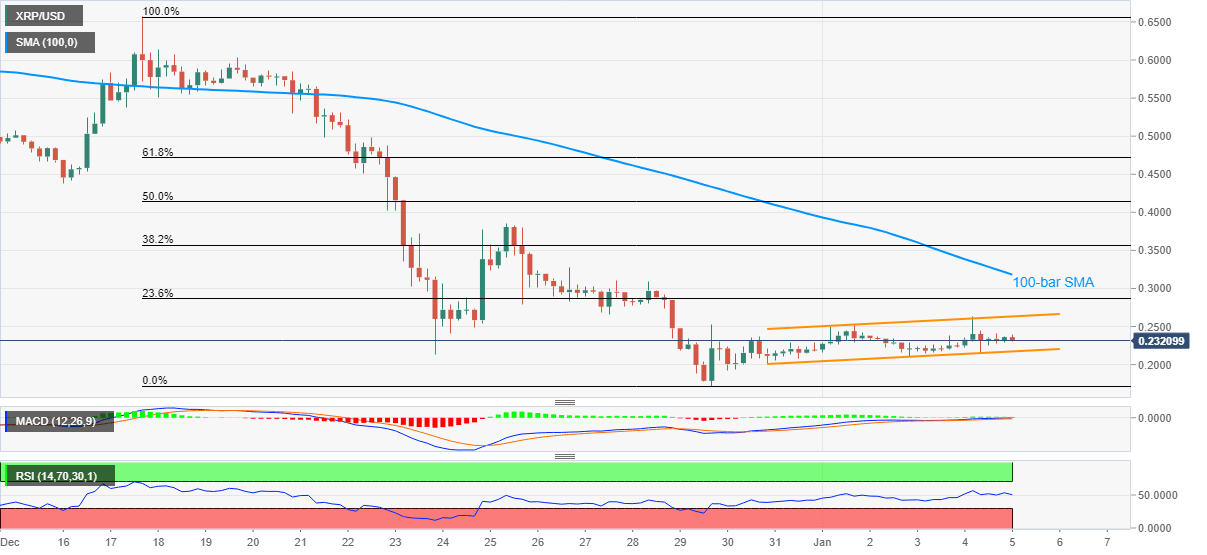

XRP/USD recedes from an intraday high of 0.2400 to 0.2306 during early Tuesday. Even so, the ripple pair remains inside an ascending trend channel formation established since December 30.

Not only the bullish chart pattern but normal RSI conditions and an absence of bearish MACD also favor the XRP/USD buyers unless breaking the stated channel’s support, at 0.2170 now.

In a case where the sellers sneak in around 0.2170, the 0.2000 psychological magnet and December low near 0.1720 will add filters to the quote’s south-run targeting June 2020 bottom of 0.1691.

Alternatively, the upper line of the stated channel near 0.2630 will probe the recovery moves ahead of 100-bar SMA, currently around 0.3180.

During the XRP/USD run-up past-0.3180, the December 25 top of 0.3848 will be the key as it holds the gate for further north-run towards the 0.5000 threshold.

Overall, XRP/USD consolidates the recent losses and is up for further rise provided fundamentals don’t deteriorate further.

XRP/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.