- XRP/USD looks to extend recovery from two-week lows.

- 200-DMA is the level to beat for the XRP bulls.

- Daily RSI edges higher but holds below the midline.

Ripple (XRP/USD) is attempting to build on Friday’s impressive bounce from two-week lows of $0.2400 amid the upbeat sentiment witnessed across the crypto board so far this Saturday.

The no. 5 coin currently trades near $0.2800, adding over 2% on a daily basis. However, it remains on the track to end the week almost unchanged.

The altcoin rose as high as $0.3295 earlier this week following the news of the nomination of Michael Barr, a former US Treasury official and a former key member of Ripple's advisory board, as head of the Office of the Comptroller of the Currency (OCC).

XRP/USD: Battling 21-DMA on the road to recovery

XRP/USD: Daily chart

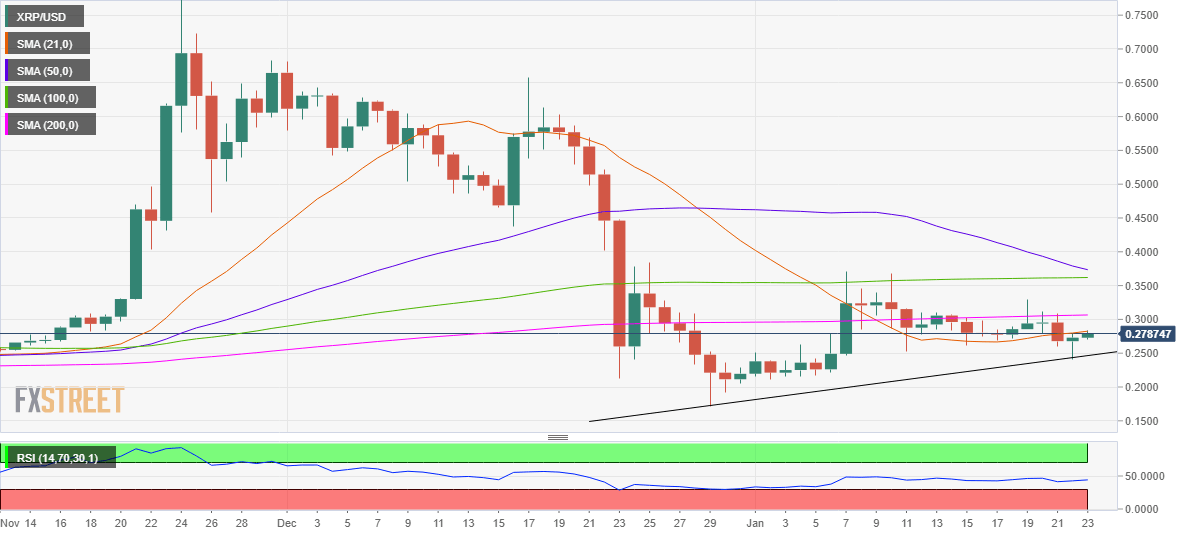

Ripple’s daily chart shows that the bulls are trying hard to recapture the 21-daily moving average (DMA) at $0.2826, in order to revive the recovery momentum.

However, with the 14-day Relative Strength Index (RSI) still trading within the bearish territory, the XRP bulls lack the conviction for the upside extension.

Acceptance above the 21-DMA could open doors for a test of the critical horizontal 200-DMA at $0.3066, Note that the coin has failed to sustain above the latter since January 10.

A daily close above the 200-DMA barrier is needed to negate the bearish bias.

Alternatively, a rejection at the abovementioned 21-DMA hurdle could expose the three-week-long falling trendline support at $0.2465, below which the two-week troughs will be put to test.

The next best support awaits around $0.2150 while the December 29 low of $0.1719 would be the last line of defense for the bulls.

XRP/USD: Additional levels to consider

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.