Ripple Price Analysis: XRP bulls battle with 10-day SMA, bumpy road ahead

- XRP/USD extends weekend recovery moves, consolidates December losses.

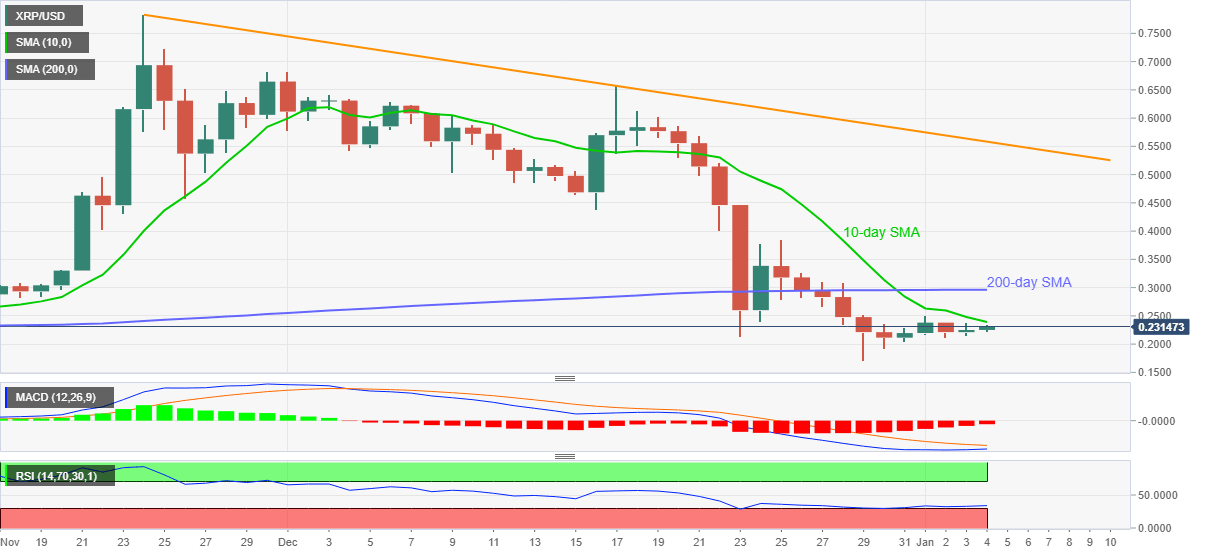

- Bearish MACD doubts further corrective pullback, 200-day SMA adds to the upside filters.

XRP/USD picks up bids near 0.2300, currently up 2.73% near 0.2310, during early Monday. In doing so, the ripple buyers attack 10-day SMA while stretching corrective pullback from December lows, also the lowest since June 2020.

Not only the 10-day SMA level of 0.2393 but the 0.2400 round-figure and bearish MACD also challenge XRP/USD bulls.

Even if the quote manages to cross the 0.2400 threshold, it needs to surpass the 200-day SMA level of 0.2964 and the 0.3000 psychological magnet to renew short-term buying interest.

Alternatively, a downside break of the 0.2000 round-figure should recall XRP/USD sellers targeting June 2020 low near 0.1690.

While RSI conditions may trigger the XRP/USD pullback from 0.1690, failing to do so might not refrain from challenging the 2020 bottom around 0.1130.

Overall, the bulls are trying to retake controls but the upside momentum needs to tackle key hurdles.

XRP/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.