- Flare Network will distribute 100 billion Spark tokens to XRP users.

- XRP price is skyrocketing as traders buy tokens to qualify for the airdrop.

Ripple's XRP is changing hands at $0.64, having gained over 6% on a day-to-day basis and over 110% on a weekly basis. The coin hit the multi-year high at $0.7824 on November 24 but failed to hold the ground as speculative traders started cashing out their profits. Despite the retreat, XRP is one of the best-performing altcoins out of the top-10.

XRP is currently the third-largest digital asset with a current market value of $29.3 billion and an average daily trading volume of $32 billion.

Flare Network's airdrop fuels XRP's growth

As FXStreet previously reported, the token of the San-Fransisco-based blockchain startup has enjoyed a steady flow of positive news that created a bullish environment and sent the price to the highest level since September 2018.

However, there may be another massive catalyst behind the impressive rally. The smart contract platform Flare Network announced the airdrop of 45 billion of its brand-new "spark" tokens to XRP holders. The distribution will be based on the XRP addresses snapshot made on December 12.

According to Jehan Chu, a managing partner at Hong Kong-based blockchain investment firm Kenetic Capital, the forthcoming airdrop fuels the XRP bull market and drive Ripple's community into a frenzy.

Flare is a blockchain network based on the Flare Consensus Protocol that integrates with Ethereum's Virtual Machine and allows running Ethereum decentralized applications (dapps) within the XRP ecosystem.

The team also announced that Ripple-related accounts and the accounts of the cryptocurrency exchanges that do no support the airdrop would be excluded from the snapshot.

The team further explained in the blog post:

Other than Ripple inc and the non-participating exchanges, there are a few groups that are entirely excluded from the distribution. These are Jed McCaleb and accounts that are known to have received XRP as a result of fraud, theft, and scams.

The list of the exchanges supporting the airdrop is already available on the website of the project. It includes Bithumb, Bitstamp, Coinfiedl, Coinone, Upbit, Crypto.com, Youholder, and many others.

Flare's native token is an XRP utility fork with the price based on supply and demand. However, according to the preliminary estimates, it will cost about $0.01 at the start. The total issuance is 100 billion tokens.

Traders are buying XRP to qualify for the airdrop

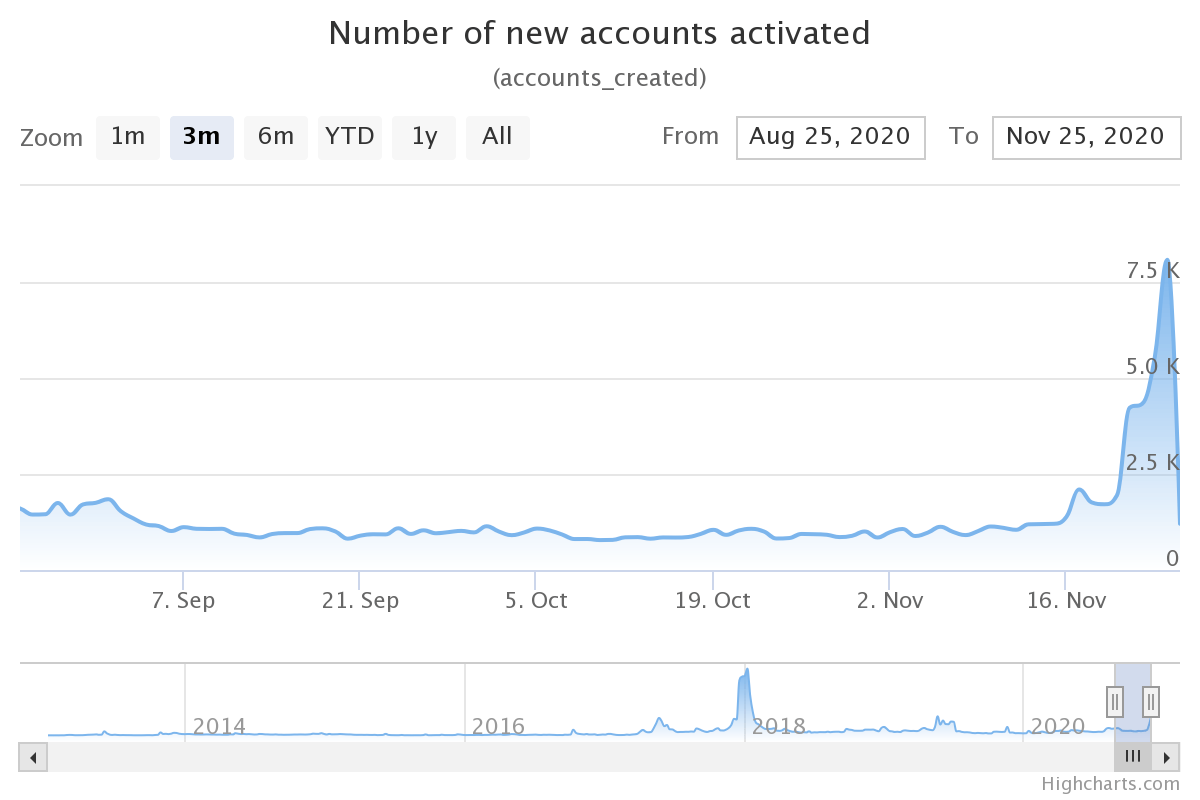

The number of new accounts created on XRP Ledger spiked from 1,300 to over 8,000 in less than two days, according to data source XRPScan.

Number of new XRP accounts

Other on-chain metrics are also skyrocketing as cryptocurrency traders are buying XRP tokens ahead of the airdrop to receive free tokens distributed by Flare. The market often goes crazy pumping the coin before the event; however, the dump is also imminent once the airdrop is over.

According to Phillip Gradwell, the chief economist at Chainanalysis, exchange inflows of XRP has been growing along with the token's price. XRP holders transferred nearly 2.3 billion tokens on the exchange accounts since Saturday. Typically, it is an ominous sign for the asset, as it means that investors want to cash out on their assets.

XRP/USD, 4-hour chart

XRP is currently grossly overbought. Once the market starts unwinding the overstretched longs, XRP may go down like a stone with the first support at $0.5. Once it is broken, the decline may be extended to $0.38 and $0.31. A sustainable move below this area will reverse the recent rally and invalidate the immediate bullish scenario.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.