Pro-XRP attorney slams former SEC Chair, XRP price plummets in market wide crash

- Ripple’s programmatic sales of XRP are making headlines again with pro-XRP attorney John Deaton’s criticism of former SEC Chair’s comments.

- Galaxy CEO Michael Novogratz acknowledged in an interview that the XRP Army is real and its role in the lawsuit.

- XRP price nosedived nearly 6% in the past day, alongside other altcoins in a marketwide correction.

The SEC v. Ripple lawsuit is making headlines again as pro-XRP attorney John Deaton criticizes former SEC Chair Jay Clayton for his comments on the court ruling. Clayton believes that the initial issuance of XRP tokens was a securities transaction in the capital raising phase. This is where Attorney Deaton disagrees with Clayton.

XRP price declined in the past 24 hours as cryptocurrencies suffered a market wide correction in response to Bitcoin’s price drop.

Also read: Altcoin bull cycle 2023 picks by analyst: Ethereum, ChainLink, Arbitrum, Optimism

Daily Digest Market Movers: SEC v. Ripple lawsuit update, Galaxy CEO comments on XRP Army

The SEC v. Ripple lawsuit raised questions about the programmatic sales of XRP tokens by Ripple’s executives. While XRP holders and legal expert John Deaton believe that the token sale by Ripple executives did not constitute securities transactions, former SEC Chair Clayton argues otherwise.

Legal expert John Deaton responded to Clayton’s comments and said he would like to be on a panel with the former SEC Chair. Deaton argues that there are no similar cases like SEC v. Ripple.

Oh how I would love to be on a panel discussion with Clayton. First of all, he’s misrepresenting the truth - as usual. There are no other cases with similar facts that found otherwise at summary judgment. Period. The judge in LBRY said his decision didn’t apply to secondary… https://t.co/TtBJ7j9WvQ

— John E Deaton (@JohnEDeaton1) December 9, 2023

Michael Novogratz, CEO of Galaxy Digital told Real Vision’s Raoul Pal that he acknowledges the XRP Army and believes they are real. Attorney Deaton supported Novogratz’s comments and acknowledged the role of the XRP Army in Ripple’s partial victory.

No one could argue @novogratz is wrong about the #XRPArmy being real. There were TWO THOUSAND EXHIBITS entered as evidence in the @Ripple case. In her decision, Judge Torres cited only a couple dozen of those exhibits. #XRPHolder Affidavits made the cut.

— John E Deaton (@JohnEDeaton1) December 10, 2023

It all began with the… https://t.co/ctpmG7w0rI

The XRP Army’s affidavits submitted by XRP holders played an instrumental role in Judge Torres’ decision, a partial victory for the cross-border remittance firm.

Technical Analysis: XRP price crashes alongside altcoins

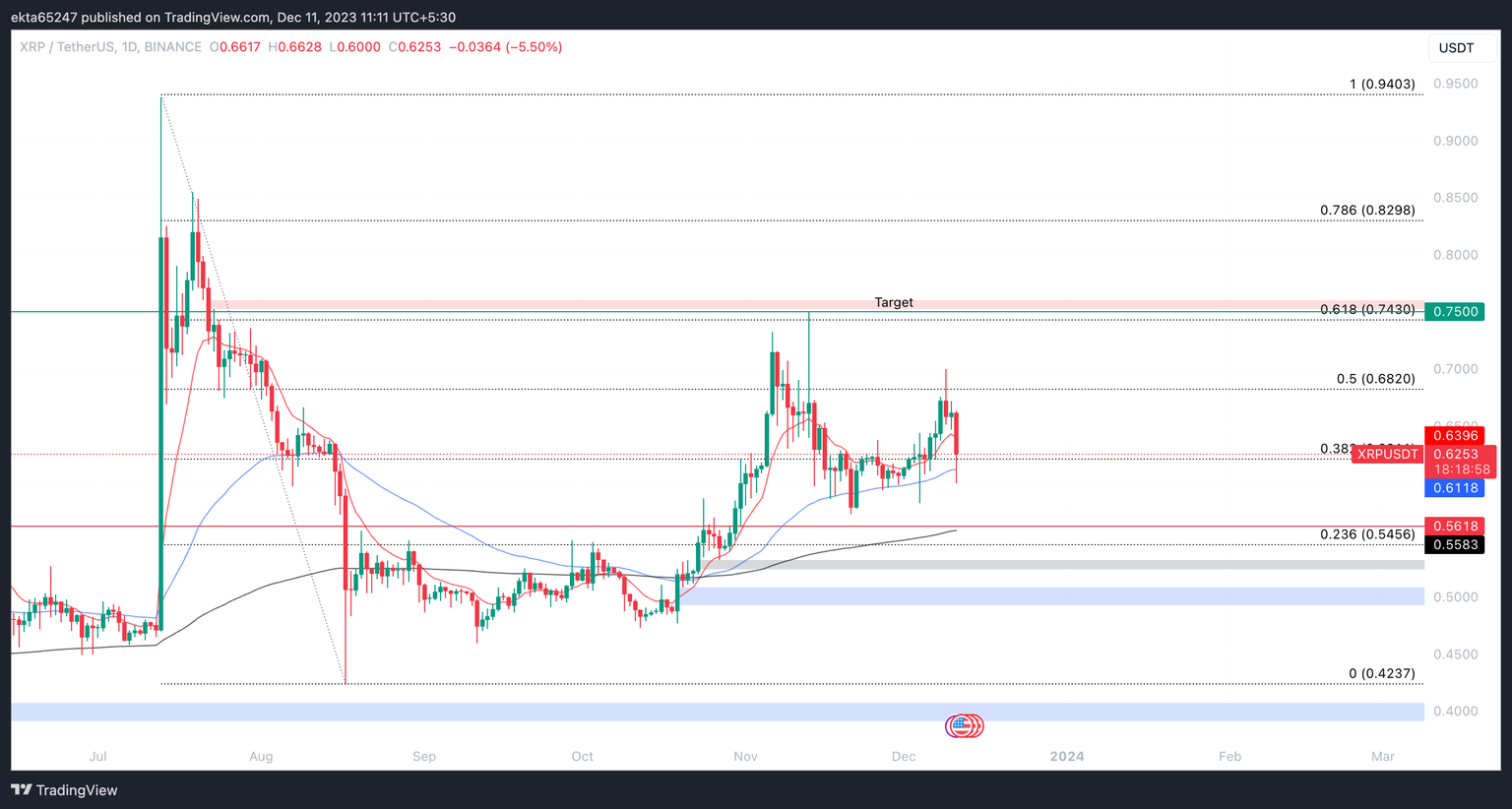

XRP price declined from $0.6990 on December 9 to $0.6010, early on Monday as Bitcoin crashed and altcoins suffered a market wide correction. XRP price recently hit a local top of $0.7500 on November 13, since then the altcoin suffered a 20% drop.

XRP price is likely to attempt a recovery to $0.6820, the 50% Fibonacci level of the decline from the July 13 top of $0.9413 to the August 17 low of $0.4237.

The altcoin is currently trading above its 200-day Exponential Moving Average (EMA) at $0.5583. XRP price is likely to attempt a recovery in response to bullish developments in the SEC v. Ripple lawsuit.

XRP/USDT 1-day chart

At the time of writing, XRP price is $0.6248 on Binance. The altcoin’s price dropped nearly 6% in the past 24 hours.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.