Ripple unveils plans for crypto custody while XRP price trades sideways

- XRP price declined slightly on Wednesday, trading sideways below $0.53.

- Ripple CEO Brad Garlinghouse unveiled the payment firm’s plan to expand product offerings to crypto custody.

- Ripple is seeking US regulatory approval to purchase Standard Custody and Trust Co. to acquire a New York trust charter.

XRP price is trading sideways below the $0.53 level. The altcoin is struggling to tackle resistance on its path to its $0.56 target.

The payment remittance firm’s CEO, Brad Garlinghouse, announced Ripple’s plan to foray into crypto custody with its recent acquisition of a New York trust charter firm.

Also read: XRP price could rally towards $0.56 target amidst possibility of settlement in SEC v. Ripple lawsuit

Daily Digest Market Movers: Ripple plans to foray into crypto custody with latest acquisition

- While Ripple is embroiled in a legal battle with the US Securities and Exchange Commission (SEC), the firm has secured nearly 40 US money transmitter licenses, a Monetary Payments Institution license from the Monetary Authority of Singapore (MAS), and a Virtual Asset Service Provider registration with the Central Bank of Ireland.

- Brad Garlinghouse, the CEO of Ripple, shared the news in an official tweet on X.

With @StandardCustody, we’ll be able to improve existing product offerings for our customers, as well as explore new products and use cases, all in a fully compliant way.

— Brad Garlinghouse (@bgarlinghouse) February 13, 2024

To date, @Ripple has secured: ✅ nearly 40 U.S. money transmitter licenses, ✅ MPI license from MAS, and ✅… https://t.co/0BrAWjBmhM

- While the ongoing lawsuit has likely negatively influenced the asset’s price, the developments that are likely to boost XRP adoption, like its growing utility and use cases, could catalyze gains in the altcoin.

- The SEC lawsuit pushed Ripple to look outward and shift its focus overseas and the company is working on boosting its payments infrastructure for firms in the US with the likes of a limited purpose trust charter held by Standard Custody and Trust Co.

- Ripple President Monica Long was quoted as saying: "We want to offer more and more of these infrastructure pieces to these financial institutions. We see this as giving us a lot of flexibility."

Technical Analysis: XRP price struggles below resistance at $0.53

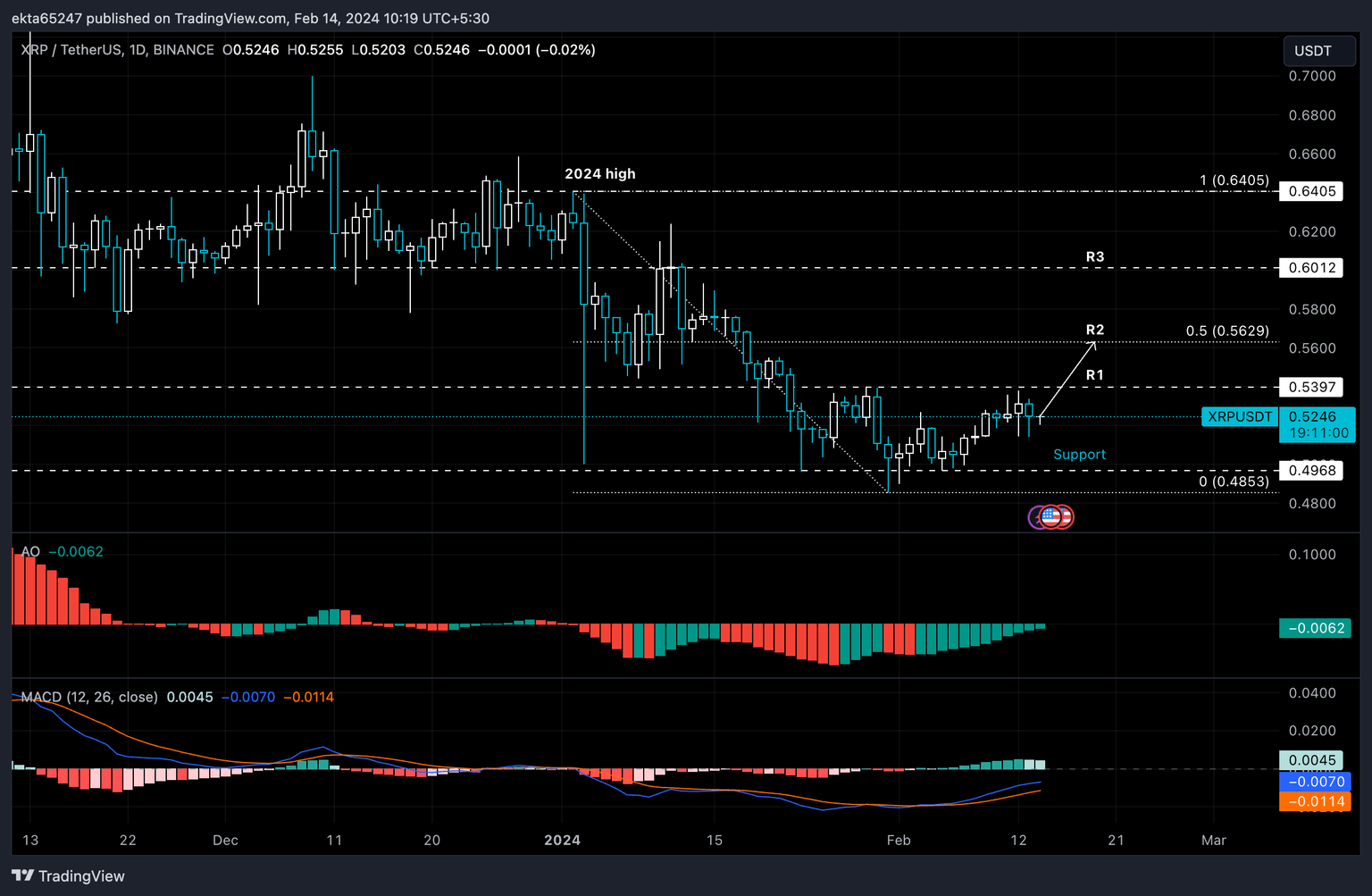

XRP price is trading sideways since its January 31 low of $0.4853. The altcoin is trading between resistance at $0.5397 and support at $0.4968. XRP price declined slightly on Wednesday to $0.5246 on Binance.

The altcoin faces immediate resistance at R1, $0.5397. The next two resistances in XRP’s path to its 2024 high are at the 50% Fibonacci retracement of the altcoin’s decline from its January peak, at $0.5629; and $0.6012, a level that acted as resistance for XRP throughout January.

Two technical indicators, Awesome Oscillator (AO) and Moving Average Convergence/Divergence (MACD) are flashing green bars, implying that the uptrend is intact. However, XRP price continues to struggle at the immediate resistance.

XRP/USDT 1-day chart

A daily candlestick close below support at $0.4968 could invalidate the bullish thesis for XRP price and open the possibility of a sweep of January 31 low of $0.4853, before the altcoin sees meaningful recovery.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.