Ripple opposes SEC 'extraordinary demand' for additional Slack communications

- As part of the latest developments in the SEC v. Ripple case, the blockchain firm has opposed the agency’s request for extra Slack communications.

- The cross-border remittances firm stated that the process would be costly and could take months to complete.

- The two parties continue to disagree on what should be sealed in the case.

Ripple has opposed a demand from the United States Securities & Exchange Commission (SEC) to turn in additional internal communications. The cross-border remittances firm stated that the request from the regulator would take months to complete.

SEC and Ripple fail to see eye to eye

The legal battle between the US SEC and Ripple Labs continues. The SEC has previously asked for additional Slack communications, and the blockchain firm has filed its opposition to the agency’s request.

The cross-border remittances firm also filed a motion to seal exhibits attached to the regulator’s motion on the communications and exhibits attached to the company’s opposition.

According to James K. Filan, an attorney familiar with the case, the two parties currently do not agree on what should be sealed.

The SEC’s request included more than a million Slack messages to be produced, and Ripple stated that this demand was “extraordinary” and would be “burdensome and highly disproportionate."

The regulator’s Motion to Compel would require Ripple to turn in additional Slack data from 22 custodians. The blockchain firm argued that the time frame and expenses required would be unreasonable for the process.

Ripple stated that the SEC has already received substantial discovery from Ripple, as well as additional Slack messages from nine custodians.

XRP price suffers minor pullback after extraordinary rally

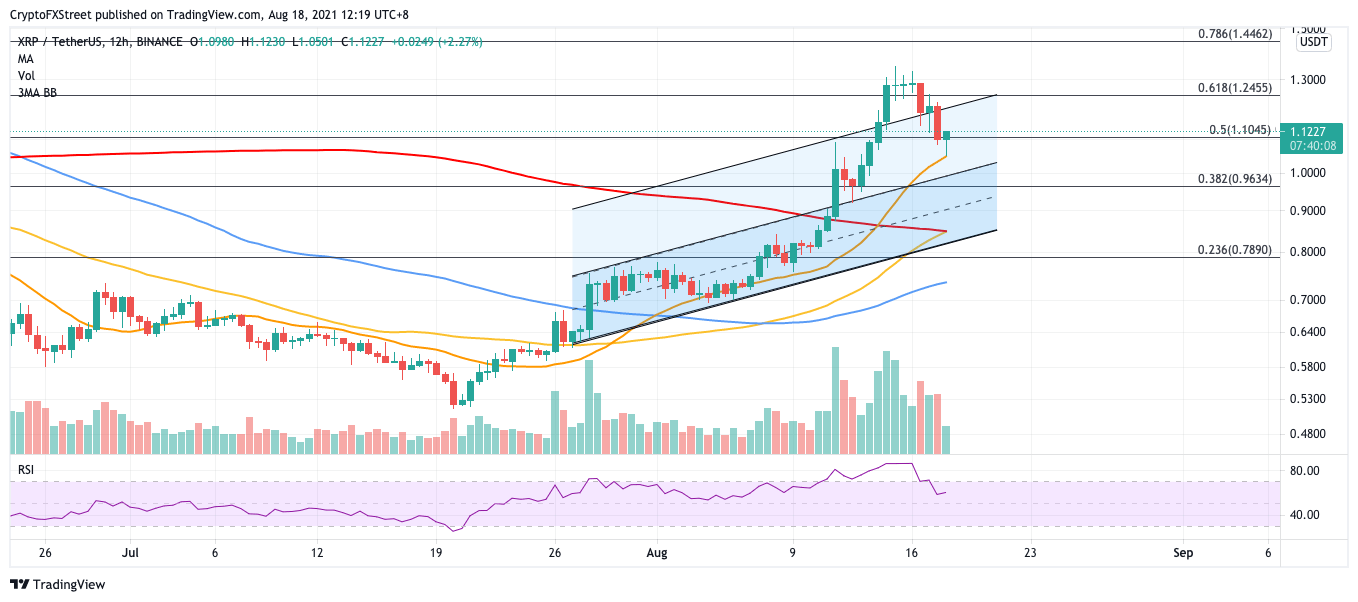

XRP price was able to reach and exceed its bullish target given by the ascending parallel channel pattern. Now, Ripple is retracing following its rally as interest from the bulls has subsided.

XRP price is able to find immediate support at the 50% Fibonacci extension level at $1.10. The following line of defense is at the 20 twelve-hour Simple Moving Average (SMA) at $1.05.

The upper boundary of the prevailing chart pattern at $0.99 also acts as meaningful support should selling pressure witness a spike.

XRP/USDT 12-hour chart

Although a sell-off is taking place, investors should also pay attention to the golden cross, where the 50 twelve-hour SMA slices above the 200 twelve-hour SMA. This could incentivize the bulls to push prices higher.

Currently, the topside trend line of the upper parallel channel, coinciding with the 61.8% Fibonacci extension level at $1.24, acts as resistance for Ripple. Only a close above this level could open up the possibility of XRP price targeting bigger aspirations.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.