The conclusion of the SEC vs. Ripple lawsuit, with Ripple ordered to pay $125 million in fines, has had a significant impact on XRP prices, causing a notable correction. Despite the court maintaining XRP’s status as a non-security, the ongoing concerns about a potential SEC appeal have weighed heavily on market sentiment. Judge Analisa Torres’s statement that Ripple may have violated federal securities laws has introduced uncertainty, making traders wary of further legal developments. As a result, XRP has dipped below the key psychological support level of $0.60, reflecting the market's apprehension about the potential implications of an appeal on the token’s future.

Moreover, the possibility of an SEC appeal looms large, with some analysts and journalists suggesting that the SEC may still challenge XRP’s non-security status, which could further erode market confidence. This uncertainty is crucial, as it may delay or complicate the anticipated applications for an Exchange Traded Fund (ETF) based on XRP. This development had been expected to boost the token's value. As traders grapple with the mixed signals from the legal outcome, XRP’s recent losses present the volatility that could remain until the legal situation is resolved. This situation highlights the delicate balance between regulatory clarity and market performance, with the potential for ongoing legal battles to continue influencing XRP’s price trajectory in the near term.

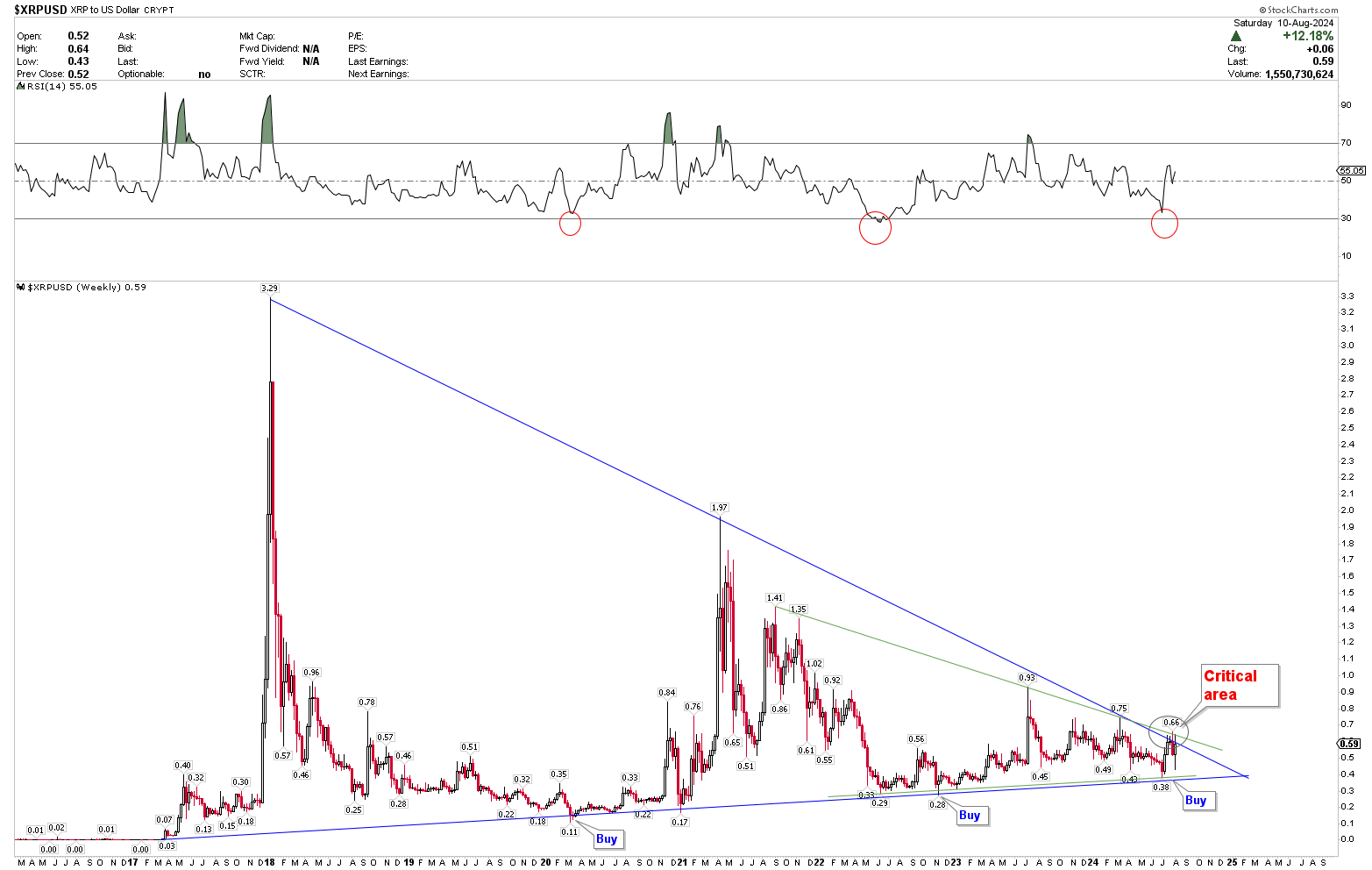

From a technical perspective, XRP has been trading within a triangle pattern for the past seven years and is now poised to break out from the apex of this formation. The wide consolidation within the triangle indicates price volatility, and the narrowing price range at the apex suggests price compression, signalling the potential for a strong move. Strong buy signals emerged in 2020, 2022, and 2024, indicating that prices are likely to move higher. Currently, the weekly chart shows that XRP is reversing from the midline of the RSI, suggesting a potential for a decisive breakout.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

Arbitrum, Aptos, Starkware, SAND lead $220 million token unlocks next week

Token unlocks data on Friday reveals that the crypto market will see $220 million worth of tokens entering circulation next week amid signs of recovery from the recent market crash.

$560 million Ethereum options expire amid weakening bearish momentum

Ethereum (ETH) is up 0.4% on Friday as ETH ETFs record another day of mild inflows. The recent market crash could also alter earlier predictions of the ETFs, boosting ETH to a new all-time around $5,000.

Key Bitcoin metrics to watch out for ahead of next week following market sell-off

Bitcoin could be set for an interesting week as it struggles to recover from its largest drawdown in the current cycle. This drawdown was sparked by fears of recession, geopolitical tension in the Middle East, and the Japanese yen carry trade.

Ripple set to begin testing stablecoin launch after ending case with SEC

Ripple revealed on Friday that it has begun beta testing for its RLUSD stablecoin, pending regulatory approval for its usage. Meanwhile, XRP has declined over 6% in the past 24 hours but could see a rally after the announcement.

Bitcoin: Can BTC bounce back from recent market crash?

Bitcoin (BTC) trades above $60,000 on Friday after a 7.2% decline and a dip below the $50,000 level earlier in the week, following a test of its daily support level at around $49,900 on Monday.