- US Congressman Brad Sherman believes Ripple doesn't stand a chance against the regulator in the ongoing legal battle.

- Rep. Sherman believes XRP is a security for the reasons set forth in SEC's case against payment giant Ripple.

- As investors remain cautious of the court ruling and Fed policy, analysts predict a fall in XRP price to support at $0.36.

US Congressman Brad Sherman commented on the SEC v. Ripple case. Rep. Sherman believes Ripple will likely lose its legal battle as the native cryptocurrency XRP is a security.

Also read: Ripple battles the SEC with massive cross-border payment growth

SEC v. Ripple update

In an interview, Congressman Brad Sherman, told FOX Enterprise that he believes the US Securities and Exchange (SEC) will prevail in its authorized struggle against Ripple, in a case which centers around whether XRP should be treated as a security or not. Sherman believes XRP is a security; and that therefore, the payment giant doesn't stand a chance against the regulator.

In its lawsuit against Ripple, the SEC alleges that XRP is an unregistered security. The SEC accuses the corporation and two Ripple executives, Brad Garlinghouse and Chris Larsen, of raising $1.3 billion through the sale of XRP.

Sherman is popular on crypto Twitter as the Congressional representative who pushed for a complete ban on cryptocurrencies. Eleanor Terrett, Journalist and Producer at FOX Business, tweeted:

When I asked Rep. Sherman why he thinks $XRP is a security, he told me "for the reasons set forth in the SEC's position" and went on to explain that XRP investors relied on Ripple's efforts to bump up the price. He then said the proof that he's right stems from the crypto exchanges.

When I asked Rep. Sherman why he thinks $XRP is a security he told me "for the reasons set forth in the SEC's position" and went on to explain that XRP investors relied on @Ripple efforts to bump up the price. He then said the proof that he's right stems from the crypto exchanges https://t.co/D1fuwsIlZZ

— Eleanor Terrett (@EleanorTerrett) July 20, 2022

Investors remain cautious ahead of court ruling

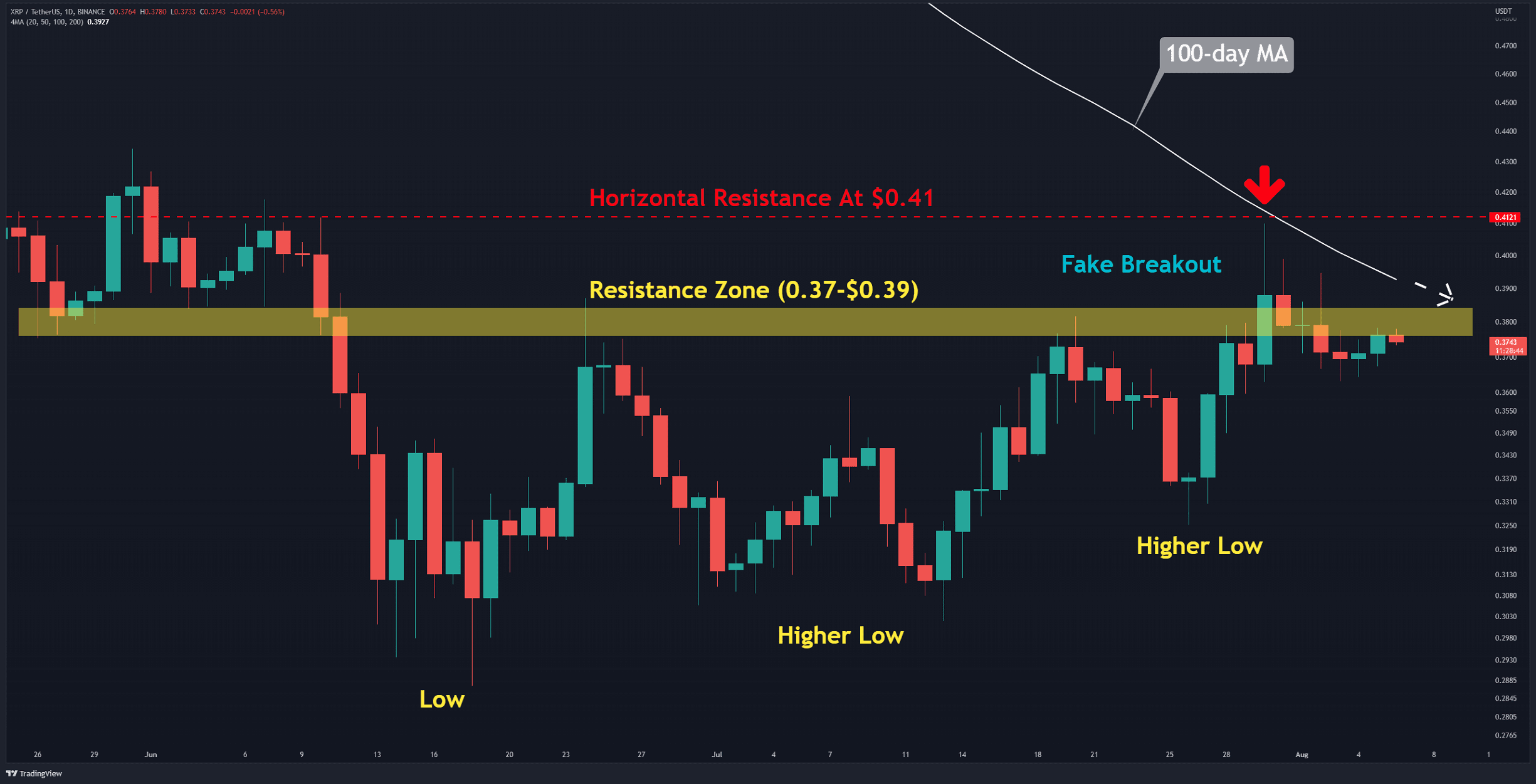

Analysts have a bearish outlook on XRP price and investors are cautious of the court ruling and Fed policy. Grizzly, a leading crypto analyst, noted that bears are defending the move to $0.39. The XRP/USDT pair is currently beneath a resistance zone, with the bias as a consequence lower.

XRP-USDT price chart

Analysts at FXStreet believe XRP price will likely undo its gains as the market structure weakens. For key levels and targets in XRP price, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.