XRP trades close to $0.60, firm is a clear winner against SEC says company executive

- Ripple’s Chief Legal Officer, Stuart Alderoty, says that public verdict in SEC lawsuit is in and the firm is a clear winner.

- SEC spokesperson claimed victory in the final lawsuit ruling and said that the fine totaled more than 12 times the amount suggested by Ripple.

- XRP hovers close to $0.60, up 4.9% in the last seven days.

Ripple (XRP) traders continue to digest the Securities & Exchange Commission’s (SEC) recent lawsuit ruling. But Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, said in a recent tweet that the firm is a clear winner in the lawsuit.

XRP hovers close to key support at $0.60 on Thursday.

Daily digest market movers: Ripple executive confident of the firm’s win

- Ripple executive Alderoty commented on the final ruling in the SEC vs. Ripple lawsuit and stated that the firm was a clear winner.

Had a great conversation with @nikhileshde at @CoinDesk about SEC v Ripple. The public verdict is in: "Ripple is the clear winner."

— Stuart Alderoty (@s_alderoty) August 16, 2024

https://t.co/8mCOU3Y1Pa

- While there is a likelihood that the regulator appeals the ruling, Alderoty is confident that the SEC is less likely to do so and said that only 10% of appeals result in reversals.

- Alderoty’s comments have assuaged the concern among XRP traders who celebrated the legal clarity of the altcoin.

- XRP is not a security in secondary market transactions, per Judge Analisa Torres’ July 2023 ruling. This was upheld in the final outcome of the SEC vs. Ripple lawsuit.

- Ripple executives’ confidence combined with the recent positive developments in the firm and the XRP Ledger ecosystem support a positive sentiment among traders.

- Ripple announced its yearly flagship event Swell 2024, and it is slated to occur on October 15 and 16.

Introducing the (incredible!) speaker lineup for Ripple Swell 2024 -- we're bringing together some of the most influential voices in blockchain, fintech and payments including:

— Ripple (@Ripple) August 21, 2024

Brad Garlinghouse, CEO, @Ripple

Superintendent Adrienne Harris, @NYDFS

Sheila Bair, Former… pic.twitter.com/wuhHKbziGp

Technical analysis: XRP hovers close to key level at $0.60

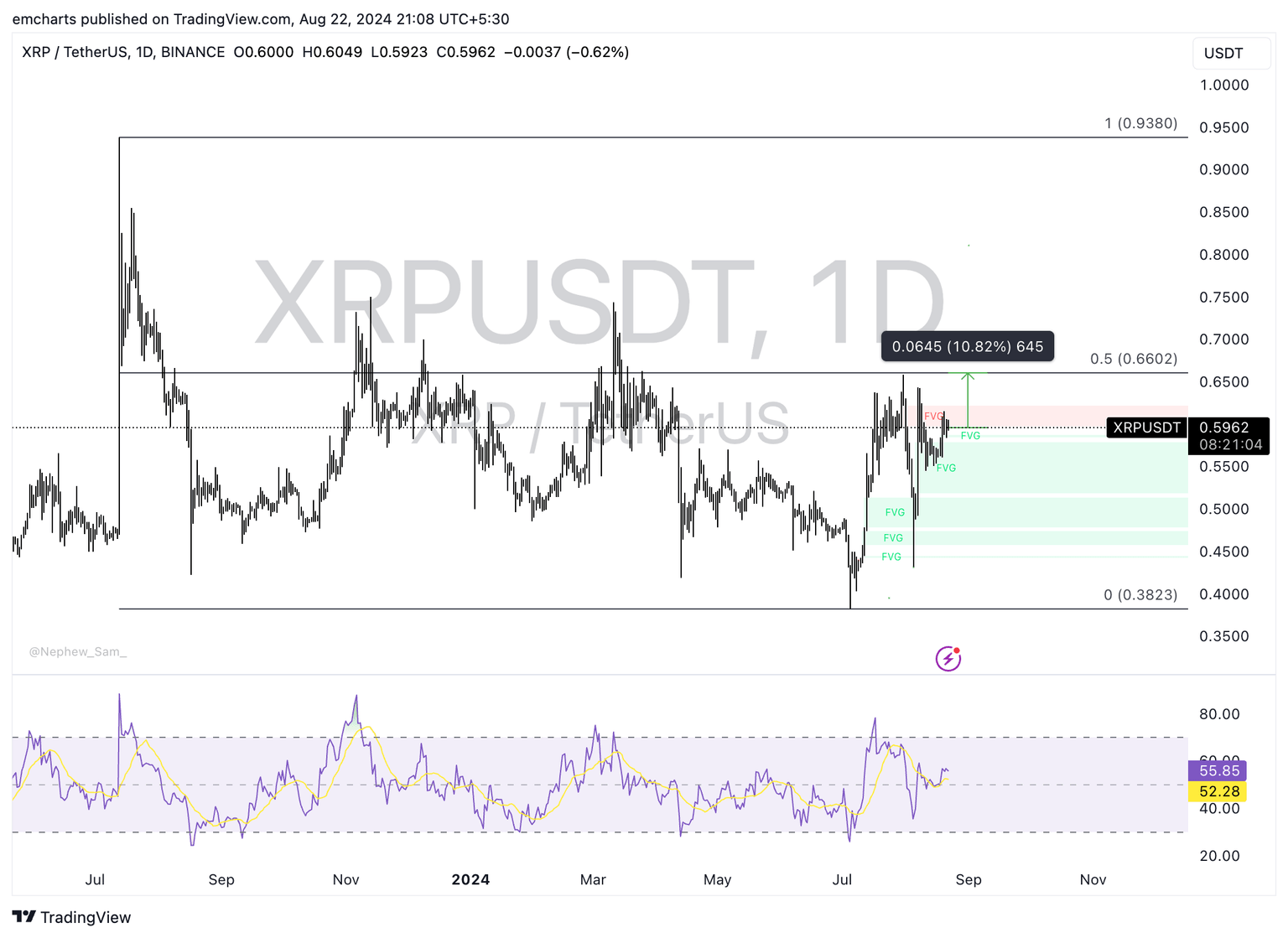

Ripple trades at $0.59, and XRP rallied 4.9% in the last seven days. The altcoin is trading close to $0.60, a key psychological level for the altcoin. XRP is likely to extend gains by 10.8% to $0.6602, the 50% Fibonacci retracement of the decline from the July 13 top of $0.9380 to the July 5 low of $0.3823.

The Relative Strength Index (RSI) reads 55.74, above the neutral level, which is more ammo for bulls.

XRP/USDT daily chart

XRP could find support in the Fair Value Gap (FVG) between $0.5845 and $0.5875.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.