Ripple Elliott Wave technical analysis [Video]

![Ripple Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Coins/Ripple/ripple_XtraLarge.jpg)

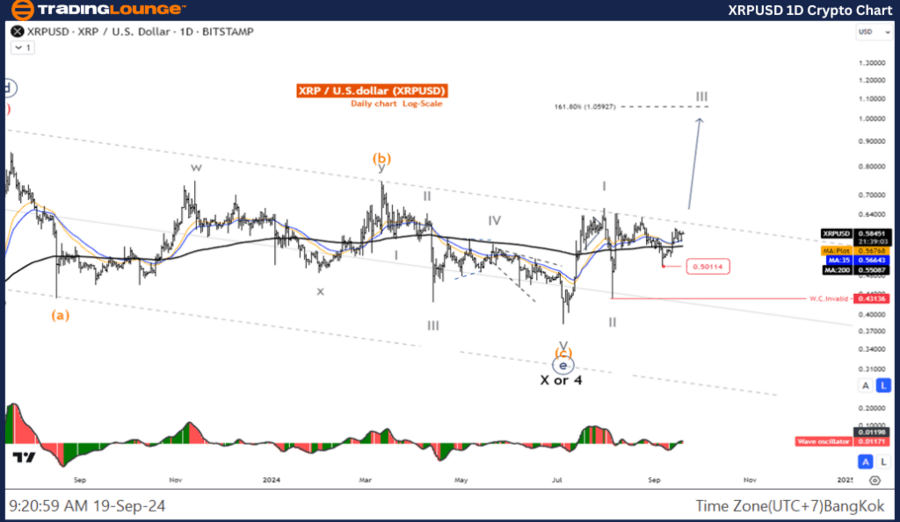

Elliott Wave Analysis TradingLounge Daily Chart.

XRP/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave III.

Direction Next higher Degrees: Wave I of Impulse.

Details: The five-wave Increase of wave III.

Ripple / U.S. dollar (XRPUSD) Trading Strategy: It looks like the wave (2) correction is complete and the price is still likely to move up. Look for an opportunity to join the wave (3) uptrend.

Ripple / U.S. dollar (XRPUSD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bearish Momentum.

Elliott Wave Analysis TradingLounge four-hour chart.

XRP/USD Elliott Wave technical analysis

Function: Follow Trend.

Mode: Motive.

Structure: Impulse.

Position: Wave III.

Direction Next higher Degrees: Wave I of Impulse.

Details: The five-wave Increase of wave III.

Ripple/US dollar(XRPUSD) Trading Strategy: It looks like the wave (2) correction is complete and the price is still likely to move up. Look for an opportunity to join the wave (3) uptrend.

Ripple/ US dollar(XRPUSD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bearish Momentum.

Ripple Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.