Ripple counters SEC’s argument on ‘Fair Notice’ defense, this is how they set the record straight

- Ripple has responded to the SEC’s arguments about rejecting its fair notice defense.

- They insist the case cited by the SEC did not provide any grounds to dismiss the fair notice defense.

- Ripple price (XRP) has reacted to the promising rebuttal with a positive leap above critical resistance level.

Ripple has come forward to respond to the arguments by the Securities and Exchange Commission (SEC) concerning the rejection of its Fair Notice defense in a recent filing. In its address, the blockchain company has provided another compelling counterargument.

Also Read: Ripple’s main argument weakened by SEC’s recent court win, impact on XRP price

Another twist in the Ripple v SEC lawsuit

The development brings another twist to the ongoing legal tussle between Ripple and the SEC lawsuit. In the document filed on April 13, Ripple claimed that the case cited by the regulator failed to provide any grounds for dismissing its fair notice defense. To substantiate its claims, the trading firm argued that the SEC did not give sufficient notice of its disclosure obligations.

In a supplementary authority letter filed on April 11, the SEC supported its motion for summary judgment citing a District of Massachusetts court opinion concerning a case against Commonwealth Equity Services LLC.

In the case, the regulator won after the judge ruled that “the defendant violated the Investment Advisers Act of 1940 about disclosure failures and rejected a fair notice defense.”

A 50-year-old Supreme Court precedent for disclosure requirements was enough to provide fair notice in the case.

According to the SEC, the Howey Test and its offspring provided adequate, fair notice to beat Ripple’s defense. Further, the financial regulator highlighted that the judge on the Commonwealth case rejected the fair notice defense despite it being obvious that the SEC knew about Commonwealth Equity Services LLC’s practices for a long time before adopting regulations around that particular product.

The SEC also noted that the Commonwealth case added to the long chain of district court decisions to reject fair notice defenses on summary judgment in the agency’s enforcement actions.

How Ripple set the record straight

In its counterargument, Ripple challenged that the defendant in the Commonwealth case failed to provide adequate evidence on the fair notice defense because they only cited SEC guidance and presented a compromised (paid) expert witness.

As regards its case, Ripple argues that there was much evidence to conclude that the offer and sale of XRP tokens were not investment contracts. According to the blockchain company, this evidence includes the SEC’s files and the agency’s communications with third parties.

Accordingly, Ripple has described the regulator’s boast of an unbroken chain of district court decisions to reject fair notice defenses as irrelevant. This is because none of the previous cases on the alleged chain concerned XRP or the facts presented in the Ripple v SEC case.

Ripple price reacts to the promising counterargument

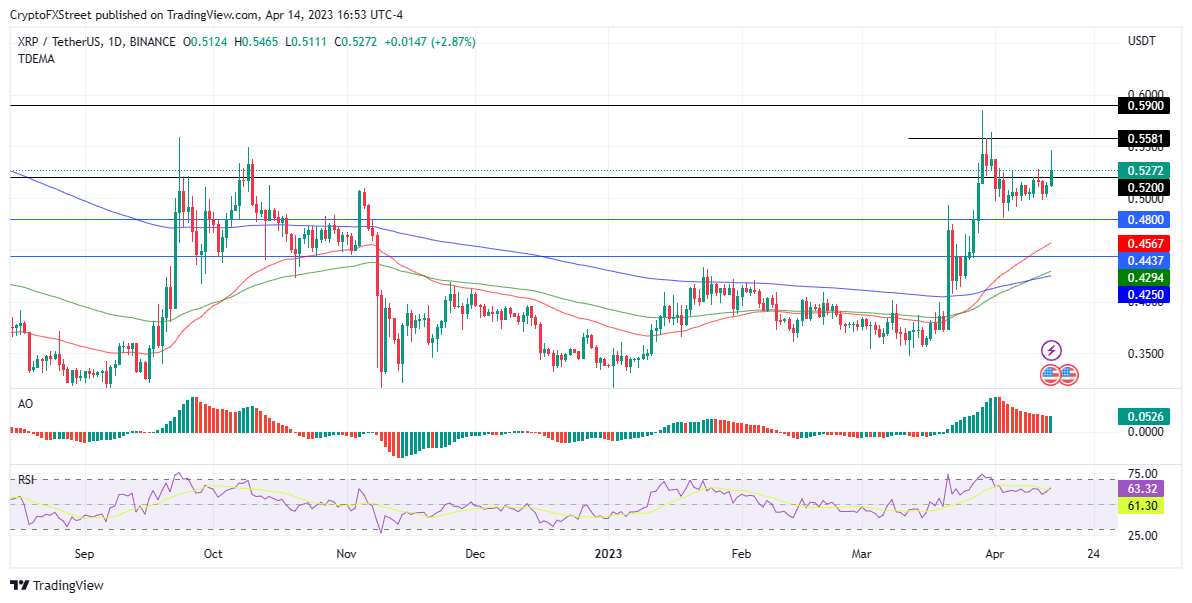

Ripple price (XRP) seems to have reacted to the promising counterargument by the blockchain company. At the time of writing, XRP is auctioning for $0.527 after gaining 2.1% in the last 24 hours.

XRP/USDT 1-day chart

Ripple price has managed to breach a two-week-long barrier at $0.520 as bulls lead the XRP market. If buyer momentum increases, the remittance token could leap higher to confront the next barricade at $0.558 or, in highly bullish cases, tag the $0.590 resistance level to regain the early May range before the collapse of the Terra ecosystem triggered a long-enduring bear market.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.