- Ripple co-founder and executive chairman Chris Larsen extends support to Vice President Kamala Harris in the US Presidential election.

- Former Ripple board member Gene Sperling left the White House in August to join Kamala Harris’ 2024 presidential campaign.

- XRP dipped to a one-month low of $0.5323 on Friday.

Ripple (XRP) co-founder Chris Larsen joined 88 other business leaders in supporting Vice President Kamala Harris in the upcoming US Presidential election, per a CNBC report. The payment-remittance firm recently received the Securities & Exchange Commission’s (SEC) consent on a stay on the monetary portion of the final ruling in the SEC vs. Ripple lawsuit.

XRP slipped to $0.5323, a one-month low for the altcoin’s price.

Daily digest market movers: Ripple co-founder and former board member backs Kamala Harris

- SEC vs. Ripple lawsuit updates, actions of co-founder, and former board member and on-chain metrics are the key market movers for XRP on Friday.

- Ripple co-founder Chris Larsen joined key business leaders and expressed support for Kamala Harris’ Presidential campaign, signing a letter to endorse Harris for president.

- A former Ripple board member, Gene Sperling, left the White House to join Vice President Harris’ 2024 Presidential campaign in August.

- As the November elections draw close, leaders in the crypto community are backing pro-crypto candidates.

- Several crypto community members backed former US President Trump for his promise to put an end to Gary Gensler’s crusade against crypto. In this regard, Ripple CEO Brad Garlinghouse said on Tuesday in Seoul that he will make a “gentleman’s bet” that the SEC Chair’s tenure is up irrespective of who wins the US Presidential election, according to The Korea Herald.

Technical analysis: XRP corrects to one-month low at $0.5323

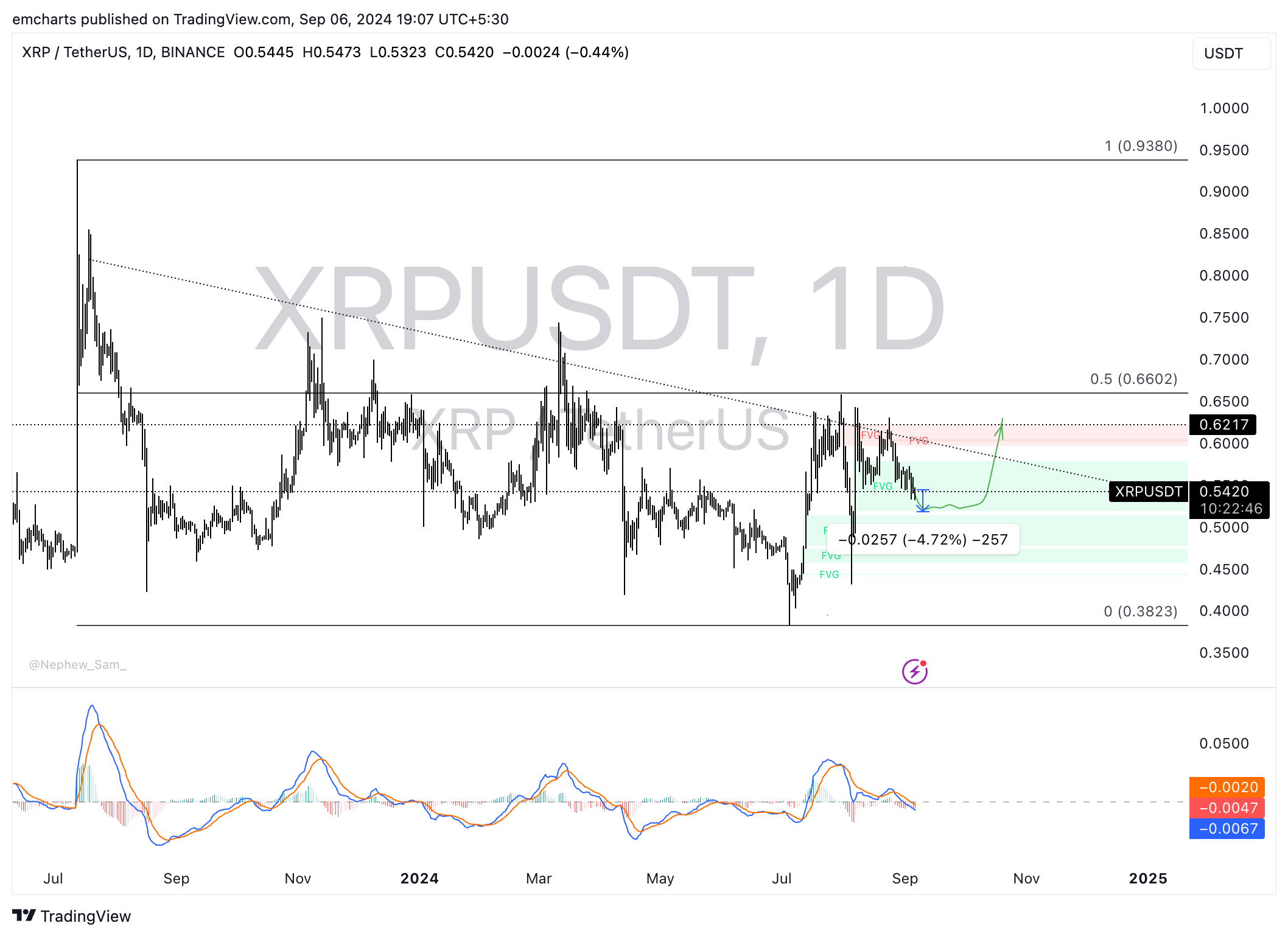

XRP is in a multi-month downtrend. The altcoin dipped to $0.5323 early on Friday, a one-month low, and recovered slightly afterwards. Still, XRP looks set to post losses for a second consecutive week, losing around 2% this week so far.

If the downtrend persists, XRP could extend losses by another 4.72% and sweep liquidity at $0.5188, the lower boundary of the imbalance zone in the XRP/USDT daily chart. Once there, buyers could take control to let the altcoin attempt a recovery towards a key resistance at $0.6217. This marks a key level that XRP has tested as resistance several times since July.

The Moving Average Convergence Divergence (MACD) momentum indicator shows red histogram bars under the neutral line, suggesting the bearish momentum prevails.

XRP/USDT daily chart

Still, a daily candlestick close above the upper boundary of the Fair Value Gap (FVG) at $0.5785 could invalidate the bearish thesis. In this scenario, XRP could rally towards the mentioned $0.6217 resistance level.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.