Ripple CEO calls out SEC and Chair Gary Gensler, saying, “Everything the SEC cares about, they lost”

- Ripple CEO calls out SEC and Chair Gary Gensler, saying, "Everything the SEC cares about, they lost"

- Ripple founder Brad Garlinghouse spoke against SEC chair Gary Gensler during the Messari Mainnet event.

- Garlinghouse stated that Gensler was simply pursuing power and politics and not sound policy.

XRP price has been holding strong for the past few days despite the token being removed from NYDFS' approved tokens list.

Ripple has seen considerable support from the community since it partially won the lawsuit filed by the Securities and Exchange Commission (SEC). Interestingly, since the win, the overall criticism against the regulatory body has grown, with people speaking up against the agency and its Chair, Gary Gensler.

Read more - XRP price at risk as NYDFS removes Ripple from approved-tokens list

Ripple CEO fires at SEC chair

The founder and Chief Operating Executive (CEO) of Ripple, Brad Garlinghouse, has always been vocal against SEC and Gensler. This confidence grew tenfold following the partial win by the payment processing network.

So much so that Garlinghouse recently publicly named Gensler a bully. According to lawyer and crypto enthusiast Jess Roberts, during the recent Messari Mainnet event, the Ripple CEO said,

"You have to stand up to a bully … he's pursuing power, he's pursuing politics. Not sound policy.

The official X (formerly Twitter) account of the event host Messari also tweeted Garlinghouse's words from the event, quoting him saying,

"Everything the SEC cares about, they lost... A freight train was driven through Gensler's arguments that these are all securities.

However, it is to be noted that the quotes have not been independently verified by FXStreet owing to the panel being a strictly offline event.

Regulation has been a crucial aspect of the discourse regarding the future of cryptocurrencies, and the United States is falling severely behind. The closest the country has come to actually adopting regulations is in its agreement with the 20 biggest economies in the world. During the G20 summit held this month, these countries, including the US, UK, India and more, decided upon advancing a global crypto regulation framework entitled “Crypto Asset Reporting Framework” (CARF).

But, the regulation would only likely come into effect by 2027, leaving the regulatory gap in the hands of Gensler and his SEC.

Read more - Bitcoin adds 265k new users in 24 hours as G20 closes in on crypto regulation standardization

XRP price stands strong

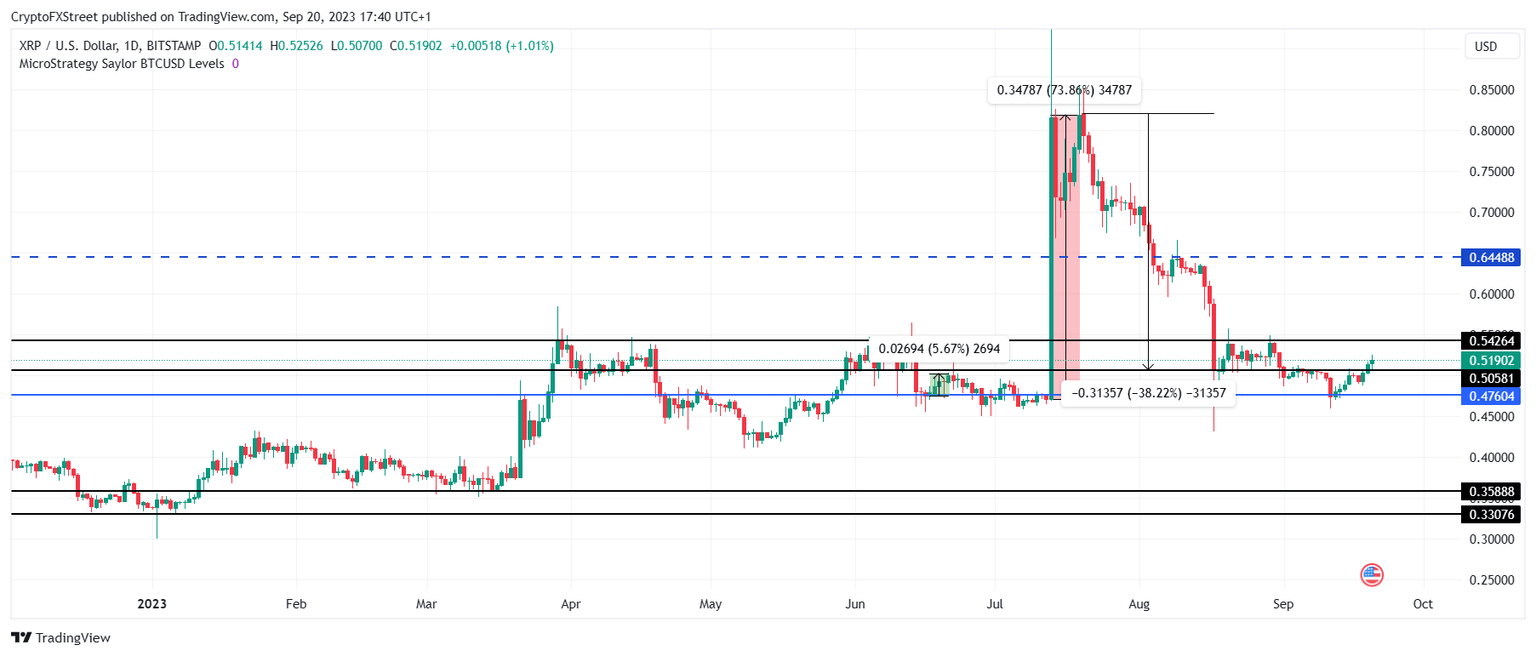

XRP price, trading at $0.519, has maintained a bullish outlook for the past few days, breaching the resistance level at $0.505 and aiming at the barrier marked at $0.542. This rise comes despite the recent removal of Ripple's native token, XRP, from the New York Department of Financial Services' (NYDFS) "greenlist" of approved tokens.

XRP/USD 1-day chart

The crypto market is relatively calm at the moment, leaving room for the altcoin to keep continuing its uptrend. However, in the event that it falls back below $0.505, XRP could slip to $0.476, losing which would invalidate the bullish thesis.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.