- XRP/USD gains over 2% of its value in a matter of minutes.

- The further upside is limited at this stage.

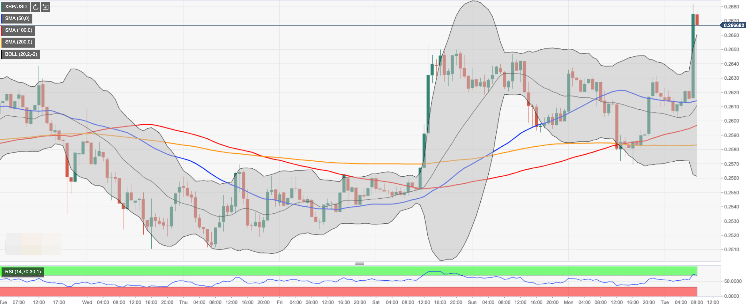

Ripple’s XRP has jumped from $0.2600 to $0.2680 in a matter of minutes. By the time of writing, XRP/USD has retreated to $0.2670, though the upside momentum remains strong. The third largest digital asset has gained over 2% since the beginning of the day and 1.4% on a day-on-day basis.

The fundamental triggers of the move remain unknown so far.

Technical picture

Looking technically, the price has returned to the area below the upper line of four-hour Bollinger Band currently at $0.2676. Considering that the Relative Strength Index (RSI) is reversing to the downside on the intraday timeframes, XRP/USD is vulnerable to the technical correction after a strong movement. The first area of support is located on the approach to $0.2660 ( the upper line of one-hour Bollinger Band). Once below, the sell-off may be extended towards $0.2610-$0.2600 area strengthened by SMA200 (Simple Moving Average) four-hour.

On the upside, a new attempt at $0.2680 looks unlikely thus far; however, if it is cleared, the upside trend wil gain traction with the next focus on $0.2775 (SMA50 daily).

XRP/USD, one-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

Shiba Inu rallies as trading volume rises 228% amid increase in bullish bets

Shiba Inu price extends its gains by 8% and trades at $0.000015 at the time of writing on Wednesday, rallying over 15% so far this week. On-chain data shows that SHIB’s trading volume rose 228% in the last 30 days, bolstering the platform’s bullish outlook.

BTC, ETH, and XRP could face volatility as Trump’s “Liberation Day” nears

Bitcoin (BTC) price hovers around $87,000 on Wednesday after recovering 4% in the last three days. Ethereum (ETH) and Ripple (XRP) find support around their key level, suggesting a recovery on the cards.

BlackRock’s BUIDL fund launch on Solana platform while Fidelity files for spot Solana ETF

Solana price hovers around $142 on Wednesday after recovering by 7% so far this week. BlackRock’s BUIDL fund launches on the Solana platform. Fidelity files for a spot Solana ETF with Cboe.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.