XRP could reach $17 by 2025 per analyst, SEC vs. Ripple lawsuit ruling awaited

- Ripple could see the end of its lawsuit with the Securities and Exchange Commission soon, per recent reports.

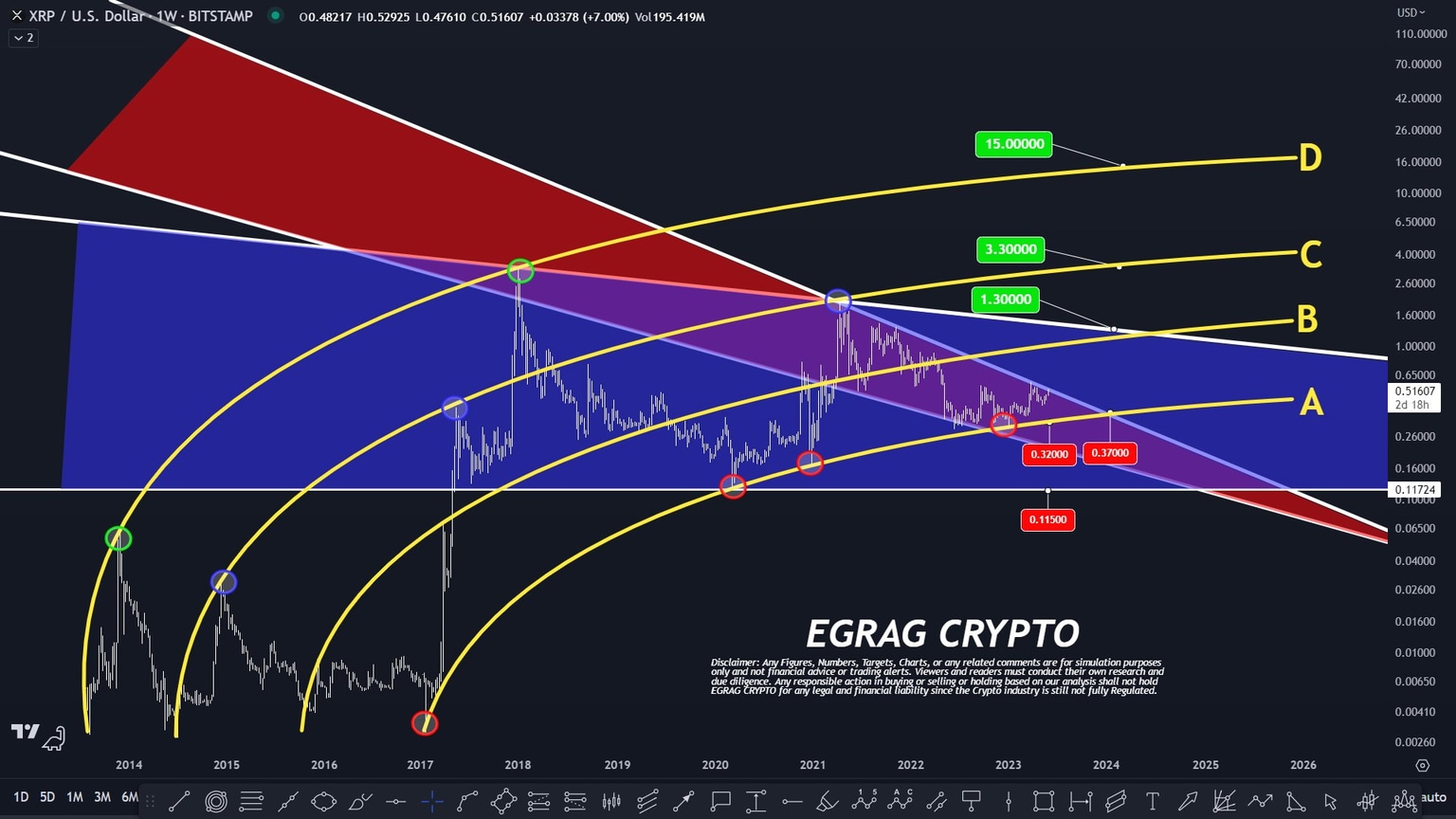

- An analyst predicts XRP rally to $17 through the Bent Fork chart, a bullish thesis for the altcoin.

- XRP traders at $0.44 on Wednesday, adding nearly 2% value on the day.

Ripple (XRP) traders are awaiting the final ruling in the US Securities and Exchange Commission (SEC) lawsuit against the payment remittance firm. A pro-crypto attorney, Fred Rispoli, informed market participants that a ruling is likely by July 31 2024, through a tweet on X.

XRP traders are awaiting the ruling, a key market mover for the altcoin, in July 2024.

Additionally, a crypto analyst behind the X handle @egragcrypto has analyzed XRP price trend and set a $17 target for 2025. While XRP trades at $0.44 on Wednesday, July 10, the analyst presents a Bent Fork chart as a thesis backing his prediction for the altcoin.

Daily digest market movers: Ripple traders await ruling in lawsuit, RLUSD launch

- The SEC alleges that Ripple sold unregistered securities (XRP tokens) to institutional investors and asked the court for over $2 billion in penalties. In a development in May 2024, the SEC quoted $102.6 million.

- Ripple filed a letter of supplemental authority, citing the Binance lawsuit, where Judge Analisa Torres’ ruling was considered as precedent. The ruling of Judge Amy Berman Jackson cemented the status of XRP as not a security in secondary market sales, meaning sales on exchange platforms.

- SEC filed its response to the supplemental authority letter. With both filings in, Ripple traders are awaiting a ruling in the lawsuit.

- Pro-crypto attorney Fred Rispoli says the ruling is expected as early as Saturday, July 13, or by July 31, 2024.

- The lawsuit has been a key market mover for the altcoin since the legal battle commenced.

- Alongside lawsuit developments, on-chain metrics have influenced XRP traders’ sentiment and the asset’s price in the past.

- Santiment data shows a large spike in active addresses in XRP on July 10; over 27,000 addresses were active on the XRP Ledger. This supports a bullish thesis for the altcoin, signaling rising demand and relevance among market participants.

XRP Active addresses and price

- After consistently realizing losses on their XRP holdings since May 30, traders realized $4.42 million in gains on July 10. The long period of negative spikes on the Network Realized Profit/Loss metric is consistent with capitulation among investors.

XRP Network realized profit/loss

Technical analysis: XRP analyst predicts rally to $17 by 2025, altcoin extends gains

Analyst behind the X handle @egragcrypto has predicted a $17 target for XRP by 2025 based on his Bent Fork chart. This is a long-term target for the altcoin that currently trades at $0.44 on Binance.

The analyst introduced the chart with key resistances at $1, a psychological hurdle, and $3.5, the asset’s all-time high. The analyst introduced the target for the first time in 2023 with four tracks,

A) Major Historical Support

B) Ranging Zone

C) Mid-Cycle Top

D) Cycle Top

The analyst considers the track D is the one that the altcoin is most likely to reach, with a slight variation. The target has been increased from $15 in 2023 to $17 in the latest update.

XRP/USD chart

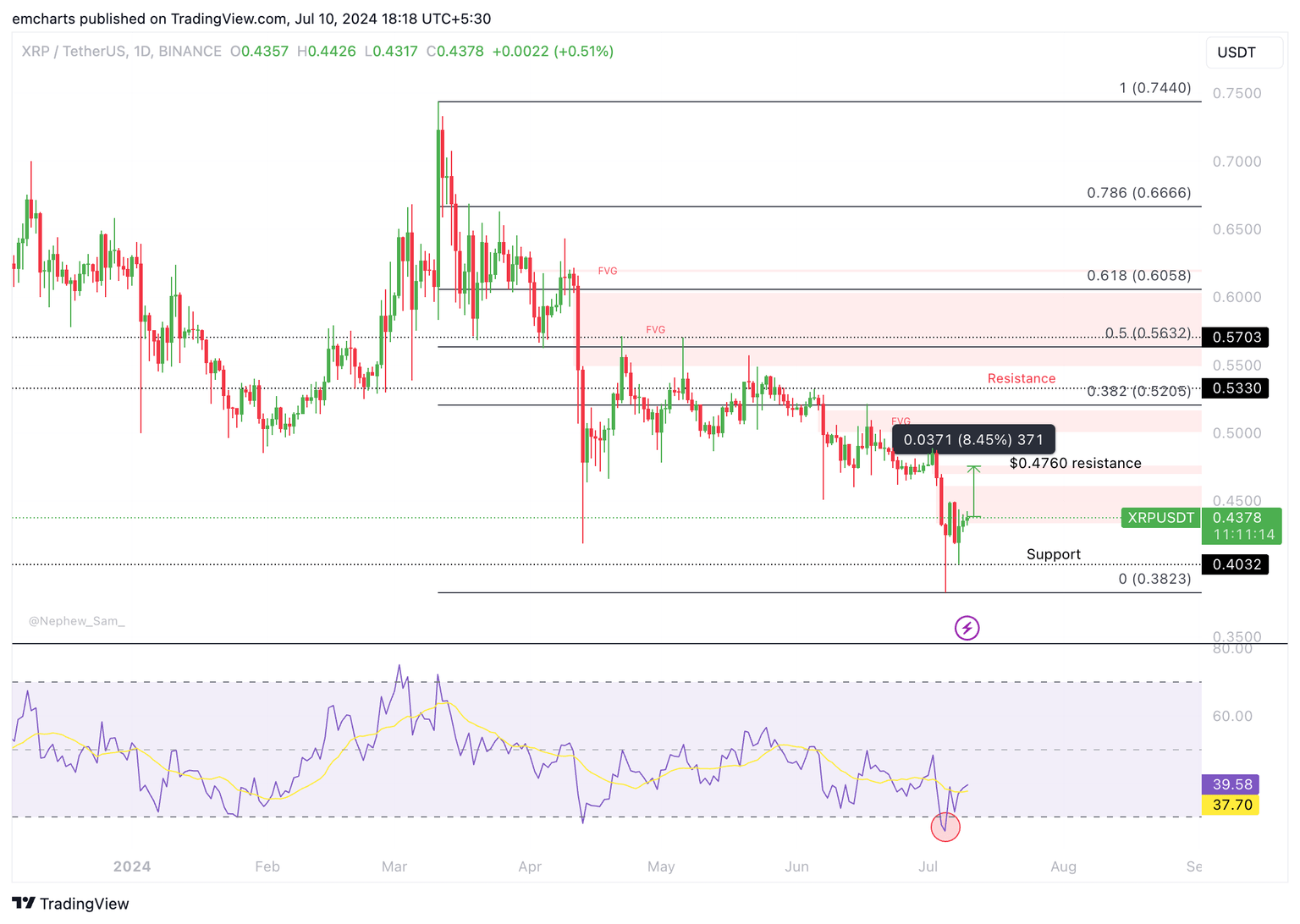

On the XRP/USDT daily chart, it is clear that XRP is recovering from its recent downward correction. If Ripple extends its gains, the altcoin could add 8.45% to its value and hit resistance at $0.4760, the July 2 low and the upper boundary of the Fair Value Gap (FVG), as seen in the chart below.

The Relative Strength Index (RSI) reads 39.58, showing Ripple’s price trend has underlying positive momentum.

XRP/USDT daily chart

Ripple could find support at $0.4032, the July 8 low. In the event of further correction, XRP could sweep liquidity at the July 5 low of $0.3823.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B18.06.04%2C%252010%2520Jul%2C%25202024%5D-638562148743802210.png&w=1536&q=95)

%2520%5B18.07.38%2C%252010%2520Jul%2C%25202024%5D-638562149070142047.png&w=1536&q=95)