- XRP price observed some increase in the past day but not enough to initiate a recovery rally.

- Until XRP holders begin accumulating again, the chance of a rally akin to the end of October is unlikely.

- The Head of Payments Product at Ripple stated that the company intends to be a large part of the potentially $300 trillion cross-border payment industry.

XRP price is close to taking a break from the active downtrend, but the altcoin still does not have enough bullish momentum to initiate a recovery rally. For the most part, the focus of the parent company Ripple is now on the macro-financial aspect, as evidenced by an executive who stated that the payment processor is eyeing the global cross-border payment industry.

Ripple has its next target

Ripple, which has been a key entity in connecting banks and other financial institutions for conducting instantaneous cross-border payments, is now looking to double down on the same. According to the Head of Payments Product at Ripple, Pegah Soltani, the company intends to revolutionize the cross-border payment sector, potentially using a powered solution.

According to Soltani, the industry has the capability of becoming a $300 trillion sector by 2030, and if Ripple manages to become a crucial part of it, it would unlock immense profits for not just the company but for XRP holders as well.

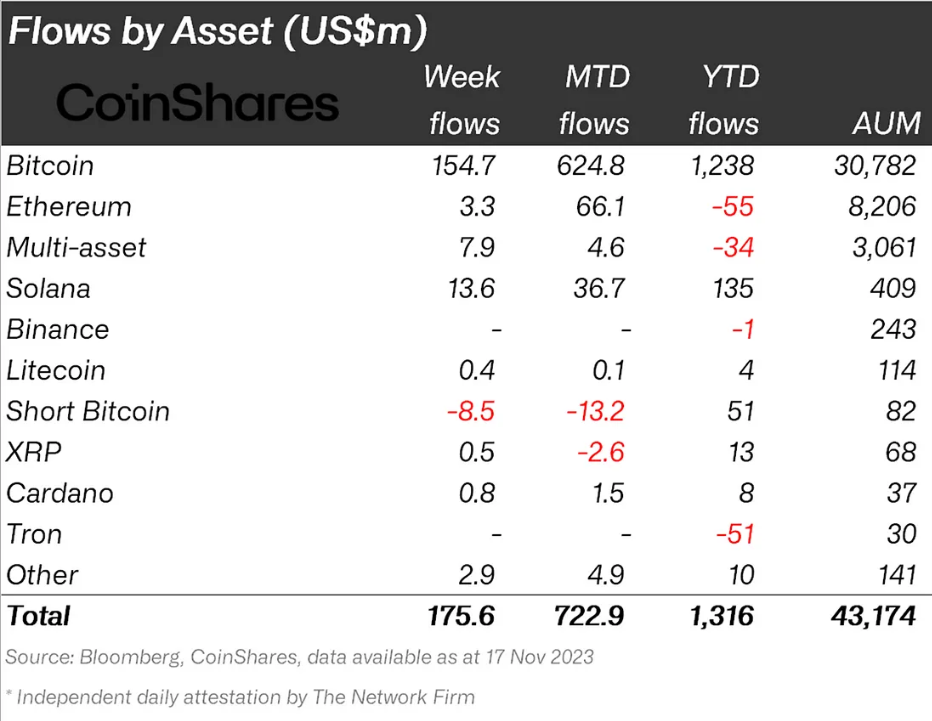

As is, XRP is an important part of institutional investors' holdings. As observed in the Coinshares’ report, for the week ending November 17, XRP bought in over half a million dollars in investment, bringing its month-to-date inflows to $17 million. Consequently, since the beginning of the year, the cryptocurrency has managed to bring in $68 million, which is much higher than the other assets on the list, such as Cardano (ADA), Tron (TRX), etc.

Ripple institutional inflows

This is expected to act as a bullish catalyst for XRP price as well.

XRP price continues to struggle

XRP price is likely set to begin a sideways movement, trading at $0.620 at the time of writing. Over the past two weeks, the altcoin has declined by close to 19% but gained slightly in the past 48 hours.

Nevertheless, the larger picture ascertains that until XRP manages to reclaim $0.644 as a support floor, a recovery rally is unlikely. The Moving Average Convergence Divergence (MACD) indicator has also yet to confirm a bullish crossover, as the bars on the histogram are still red, suggesting that the bearishness is waning.

Thus, a retest of $0.644 would prove to be the bullish boost needed for Ripple to initiate a recovery rally and send the XRP price to $0.700.

XRP/USD 1-day chart

However, if the sideways movement continues and XRP fails to produce enough bullishness, it could slip back down to test $0.600 as support. Falling through this line would invalidate the bullish thesis and push the altcoin to $0.551.

Investors need to make a move

By the looks of it, the XRP price is bound to witness sideways movement for a while since the investors are not making a definite move at the moment. Neither are XRP holders willing to sell their assets to book profits or offset losses nor are they trying to accumulate more tokens to instill a sense of bullishness in the market.

This is evident by looking at the Market Value to Realized Value (MVRV) ratio. This indicator is used to assess the average profit/loss of investors who purchase an asset. The 30-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past month.

For Ripple, when the 30-day MVRV hits 12% to 23%, XRP has undergone major corrections. At this time, investors are likely to sell their holdings to realize profits, which could trigger a sell-off. Hence, this area is termed a danger zone.

Likewise, when the MVRV value hit anywhere between -17% and -32%, it was often followed by rallies. Hence, this area is termed an “opportunity zone” and an ideal place for accumulation.

Ripple MVRV ratio

But since XRP has missed hitting either zone during the recent rally and correction, investors are likely going to refrain from making a move until they witness clearer signs. Thus, Ripple will most likely have to wait for either accumulation or selling and consequently continue moving sideways for a while.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[22.43.58,%2024%20Nov,%202023]-638364666121489590.png)