- Ripple CLO announced the company would drop its cross-appeal against the SEC.

- The SEC will keep $50 million of the original $125 million fine and ask Judge Analisa Torres to remove the injunction she placed on Ripple.

- XRP could fall to $1.96 if it declines below $2.34.

Ripple confirmed on Tuesday that it will no longer pursue its cross-appeal against the United States (US) Securities and Exchange Commission (SEC). XRP's price remained fairly muted despite the positive development.

Ripple to drop cross-appeal against SEC

Ripple has agreed to drop its cross-appeal against the SEC, bringing its case with the agency to a conclusion.

According to Ripple's chief legal officer Stuart Alderoty, the SEC will keep $50 million of the original $125 million fine from Judge Analisa Torres and return the balance to Ripple. He also highlighted that the agency will ask Judge Torres to lift the injunction she placed on Ripple last August.

The final crossing of t’s and dotting of i’s – and what should be my last update on SEC v Ripple ever…

— Stuart Alderoty (@s_alderoty) March 25, 2025

Last week, the SEC agreed to drop its appeal without conditions. @Ripple has now agreed to drop its cross-appeal. The SEC will keep $50M of the $125M fine (already in an…

Immediately after the Commission votes on it and the court processes are finalized, the more than four-year battle between Ripple and SEC will be officially over.

The new development follows Ripple CEO Brad Garlinghouse's earlier announcement last week that the SEC will drop its appeal against the company. The agency has reversed most of its actions against crypto companies since former Chair Gary Gensler resigned in January.

Judge Torres ruled at the district appellate court in July 2023 that XRP sales to retail investors do not fall under securities laws except sales to institutional investors. In August 2024, she placed a $125 million fine on Ripple — below the SEC's request of $1.9 billion — and imposed an injunction that prevented the company from selling XRP to institutions without registering the transaction as securities.

"The Ripple case was a high-stakes test of the SEC's ability to regulate crypto through enforcement, and its retreat may indicate growing recognition that clear legislation, rather than lawsuits, is the way forward," Bitget's COO Vuga Zade told FXStreet.

Despite the positive developments surrounding the case, XRP's price has remained flat on average in the past few days.

"The market reaction to Ripple's win has been muted. The case has been ongoing since 2020, and its resolution was largely priced in," said Agne Linge, Head of Growth at WeFi.

XRP risks decline to $1.96 if 50-day SMA resistance holds firm

XRP saw $4.43 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $3.44 million and $0.9 million, respectively.

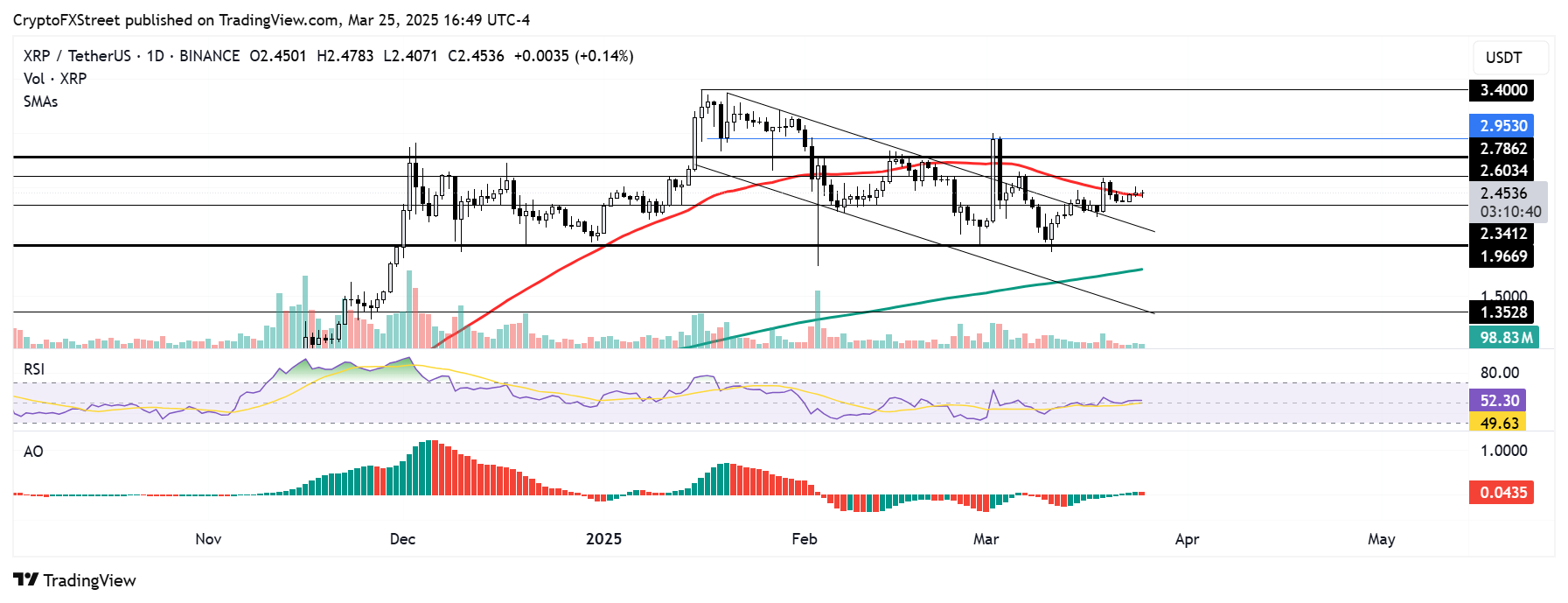

XRP has been consolidating since bouncing off the upper boundary of a descending channel last Wednesday. The remittance-based token rallied briefly upon the announcement of the SEC dropping its appeal against Ripple before seeing a rejection at $2.60. It found support at $2.34 but has struggled just below the 50-day Simple Moving Average (SMA).

XRP/USDT daily chart

XRP could fall to $1.96 if it declines below the $2.34 support and the descending channel's upper boundary. However, a firm move above the 50-day SMA and $2.78 level could see XRP tackle its seven-year high resistance of $3.40.

The Relative Strength Index (RSI) is testing its neutral level, while the Awesome Oscillator (AO) has posted a red bar above its midline, indicating weakening bullish sentiment.

A daily candlestick close below $1.96 will invalidate the thesis and potentially send XRP toward $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.