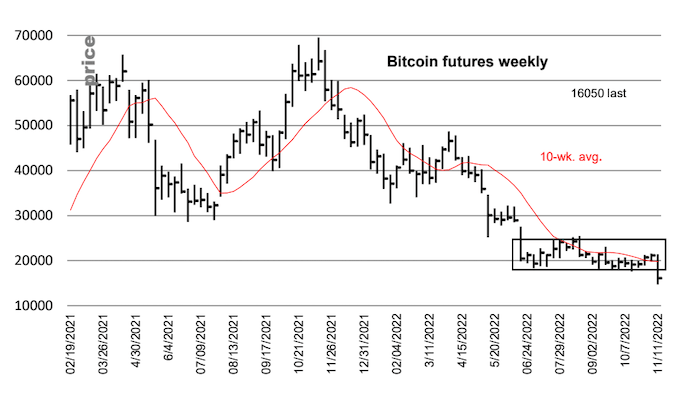

Renewed Bitcoin market swoon has put price support at $13k in crosshairs: Technical analysis

The Bitcoin market has recently awakened from a prolonged slumber, putting bears in the driver's seat. That's the message from experts studying chart patterns, who now see a high chance of bitcoin sliding to $14,000 or below.

The top cryptocurrency fell 22% last week, hitting a two-year low of $15,600 as FTX's collapse dented investor confidence. The decline marked a downside break of months of horizontal or sideways trading above $18,000, opening doors for a notable sell-off.

"From a technical perspective, bitcoin has now broken below $18,000, which was an area of support in recent weeks. The next levels to watch are $13,500, the 2019 high, and $12,500 (the 3Q20 high)," strategists at Morgan Stanley wrote in a note to clients on Friday.

Range breakdowns or breakouts usually bring a notable decline or rally. According to technical analysis theory, an asset builds potential energy during consolidation and this energy is unleashed in the direction in which the range is eventually breached. The longer the consolidation, the bigger the energy store and post-breakout/breakdown move. Seasoned traders, therefore, avoid trading against the range breakdown or breakout.

"Firstly, think of the consolidation range like a spring, coiled up over time and full of potential energy. Each successful bounce off of support and rejection from resistance adds more potential energy," analysts at Delphi Digital said in a note sent to subscribers on Friday. "When prices do eventually break from the range, the impulse move can be extremely strong, much like the initial unwind of a coiled spring."

Technical patterns can and often do fail. However, bitcoin's latest range breakdown is likely to bring more pain, as adverse macroeconomic conditions and FTX's collapse are likely to keep investor risk appetite under pressure.

"This breakdown has been accompanied by one of the worst crypto catalysts to date, weighing on investor sentiment and asset prices. Combine the native crypto catalyst in the FTX-Alameda blowup with a continued bleak macroeconomic backdrop that has not materially changed, and continuation to the downside is the path of least resistance at this point as opposed to a reversal," Delphi's team noted, citing support between $14,000 and $16,000.

Bitcoin has dived out of a prolonged consolidation. (Momentum Structural Analysis, LLC)

Michael Oliver, the founder of Momentum Structural Analysis, said bitcoin's flush out through the range lows may have kicked off the bottoming process, though the market may not find a bottom anytime soon.

"That presumed basing action [above $18,000] might be a precursor to a bottom, but a flush-out through the range lows was likely to be next in any bottoming process. It has begun," Oliver said in the weekly note.

"Based on various metrics, we suspect lower will be seen and quite possibly, this market might not find an effective low until we get into December. But for now, let it rip," Oliver added.

Bitcoin changed hands at $16,800 at press time.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.