RNDR Price Prediction: A 10% rise in sight for Render

-

Render token is up 30% since September and 20% up so far in the month with little signs of slowing.

-

RNDR could extend the gains by 10% to the three-day supply zone at $1.938 with the bulls still in the driver’s seat.

-

Invalidation of the bullish thesis will occur when the altcoin records a three-day candlestick close below $1.384.

Render (RNDR) token has sustained a bullish streak since early last month, with the price action recording higher highs and higher lows. The upside potential remains plausible for RNDR but it depends on how bulls play their hand from here on out.

Also Read: Tether's 40% surge on exchanges to $10 billion hints at bullish momentum

Render token eyes 10% gains

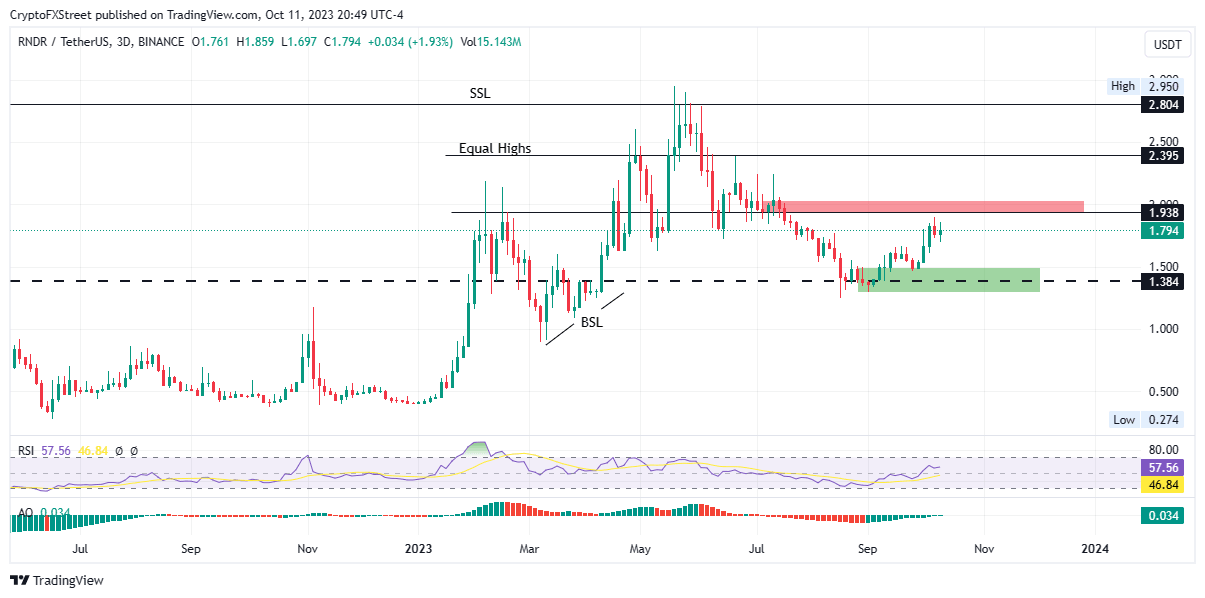

Render token (RNDR) price is up 30% since September and 20% up so far in the month with no signs of stopping. With bulls still taking the lead, RNDR is confronting a supply barrier between $1.938 and $2.035, the supply zone, where aggressive selling is expected. A test of this order block would constitute a 10% surge above current levels.

With profit-taking appetites kept at bay, the altcoin could break past this zone, flipping it into a bullish breaker and possibly extending to clear the equal highs at $2.395. In a highly bullish case, the gains could extrapolate to the range high of $2.804.

The position of the Relative Strength Index (RSI) supports this outlook, climbing to show momentum is still rising. In the same way, the Awesome Oscillator (AO) indicators are in the positive zone after a steady series of green histogram bars, also bolstering the case to the upside.

RNDR/USDT 3-day chart

Conversely, if the supply zone holds as a resistance level, Render token price could face a rejection. The ensuing selling pressure could plunge RNDR into the demand zone between $1.496 and $1.296. A solid move below the midline at $1.384 could invalidate the bullish thesis, sending RNDR to collect buy side liquidity residing underneath.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.