Render price skyrockets by 25% as Binance announces RNDR listing on its Japanese exchange

- Render price has shot up by 25% in a single day, bringing the price to a 19-month high.

- Binance Japan will be launching the RNDR token on the exchange on November 27, along with a host of other tokens.

- The 24-hour trading volume increased by 203% today, suggesting that the price rise may likely stick.

Render price is seeing one of the largest single-day growth this month as the AI token hits a 19-month high. Generally, such large rallies are either run by speculation or major network development, and fortunately, in the case of RNDR, it is the latter.

Binance Japan onboards Render

On November 15, Binance announced that it would be listing 13 new crypto assets on its Japanese arm, Binance Japan. The assets set to be listed are mostly the top-rated altcoins, including the likes of RNDR, Near, Optimism, Arbitrum, and more.

Set to start trading by November 27, these tokens will likely find significant demand in the Japanese market, pushing their value and market capitalization. The impact of this anticipation can already be witnessed in the case of the Render token.

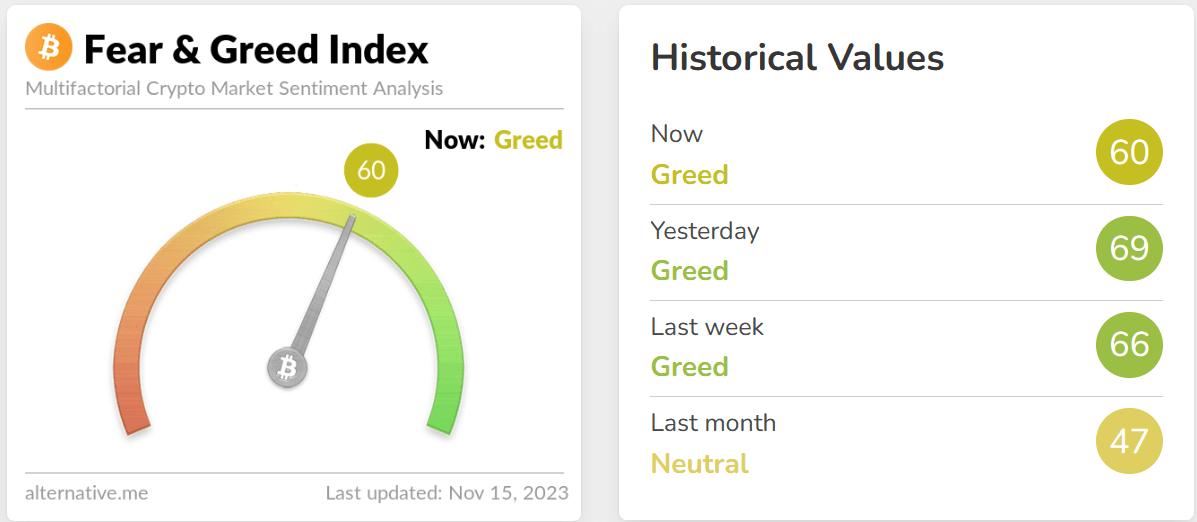

Generally, token listings tend not to be a major development, but given the current market conditions, potentially making a bullish move is on the cards since investors are Greedy at the moment, according to the Crypto Greed and Fear index.

Crypto Fear and Greed Index

Render price hits new highs

Render price reached a 19-month high following the announcement of the listing, most likely resulting in a 25.6% hike. The rise was anticipated, given that the RNDR token had mostly been moving sideways for the past two weeks. The recent rise has resulted in the altcoin establishing new 2023 highs, trading at $2.83 at the time of writing.

The rally also reversed the bearish crossover noted at the beginning of the month on Moving Average Convergence Divergence (MACD). Nevertheless, a bullish momentum is yet to be formed and will only be confirmed once the green bars on the histogram begin rising by the end of the week.

This would set up the Render price for a further rally, and increased bullishness could result in the altcoin breaching the $3 mark and closing above it. Bouncing off the critical support line marked at $2.26, RNDR climbed all the way up to breach the $2.74 barrier.

RNDR/USD 1-day chart

A successful retest of this level would cement the rise, which is necessary for the Render price since it has only noted the growth in a single day.

But if this support is invalidated and RNDR price falls through it, Render could decline to wait for a recovery. This would bring the altcoin down to test the support lines at $2.55 and $2.26. Falling through these support lines would generate a black hole of bearish momentum, likely erasing all the gains, invalidating the bullish thesis and sending the altcoin to trade at $2.08.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.