Render price could crash 30% as investors book $7.5 million in profits following AI crypto coin hype

- Render price could crash as investors cash in on the NVDIA earnings and OpenAI mania that drove rallies in AI crypto coins.

- As the hype dissipates, RNDR could crash 30% to find support at $2.266.

- However, amid lack of parity between NPL spike with whale transaction count, the steep correction could be delayed.

- Invalidation of the bearish thesis will occur after the altcoin’s price decisively breaks and closes above $3.451.

Render (RNDR) price recorded a massive run beginning mid-November, fueled by the NVIDIA earnings report and extended by the hype around AI crypto coins because of the recent euphoria in the OpenAI ecosystem. The pump was also driven by the listing of the cryptocurrency on Binance’s Japanese exchange.

Also Read: Render price skyrockets by 25% as Binance announces RNDR listing on its Japanese exchange

Render price responds to NVIDIA earnings and waning OpenAI mania

Render (RNDR) price is coiling up for a crash as investors cash in on the nearly 70% profit made since November 15. It comes after the NVIDIA earnings report recorded tumbling shares following the Q3 report. AI crypto coins had rallied ahead of the report, fueled by the ‘buy the rumor sell the news’ sentiment as the company fully monetizes AI. Revelations on the reports show that NVIDIA absolutely knocked earnings out of the park.

NVIDIA Q3 EARNINGS SUMMARY

— GURGAVIN (@gurgavin) November 22, 2023

REVENUE UP 206% YoY FROM $5.9 BILLION TO $18.1 BILLION

GROSS MARGIN UP 19% YoY FROM 56% TO 75%

NET PROFIT UP 588% YoY FROM $1.4 BILLION TO $10 BILLION

EPS UP 593% YoY FROM $0.58 TO $4.02$NVDA

Also, the discord in the OpenAI camp seems to be quelling after the reinstating of Sam Altman back to the top office as CEO alongside a new initial board. Altman committed to building on a strong partnership with Microsoft Corp despite his presence at OpenAI.

We have reached an agreement in principle for Sam Altman to return to OpenAI as CEO with a new initial board of Bret Taylor (Chair), Larry Summers, and Adam D'Angelo.

— OpenAI (@OpenAI) November 22, 2023

We are collaborating to figure out the details. Thank you so much for your patience through this.

The reinstatement of Altman follows intense pressure from OpenAI’s investors and stakeholders, including employees who threatened to quit without Altman’s restoration. Citing an excerpt from Bloomberg, “OpenAI will bring back Sam Altman and overhaul its board to bring on new directors, a stunning reversal in a drama that’s transfixed Silicon Valley and the global AI industry.”

As hype around these two waves dies down, Render as well as other AI crypto coins could crash after recording up to $7.5 million in profits.

Render price coils up for a 30% crash

Render price could be coiling up for a crash, with both technical and on-chain metrics supporting the thesis. For one, RNDR is already overbought, evidenced by the position of the Relative Strength Index (RSI) above 70.

The token faces a rejection from the $3.451 resistance level, the mean threshold of a supply zone extending from $3.158 to $3.725. A supply zone is an area characterized by aggressive selling. With this order block likely to hold as a resistance, Render price could drop to test the immediate support at $2.825.

If the aforementioned base fails to hold, the slump could extend for Render price to test confluence support between the horizontal line and the 25-day Exponential Moving Average (EMA) at the $2.266 support level, or in the dire case, extend lower, slipping below the 200-day EMA at $1.720.

RNDR/USDT 1-day chart

Render on-chain metrics to support bearish case

Several on-chain metrics support the bearish case for Render price, starting with the RNDR Network Realized Profit/Loss (NPL) and whale transaction count (WTC) of $100k or higher. These have shown a consistent rise, with their parity often preceding a correction in the market. With NPL and WTC showing considerable spikes, investors could consider taking short positions on the altcoin.

RNDR Network Realized Profit/Loss (NPL) and Whale Transaction Count (WTC)

Also, the Market Value To Realized Value Ratio (MVRV), which shows holder profitability, hints at a potential pullback or correction in Render price.

RNDR 30-day MVRV

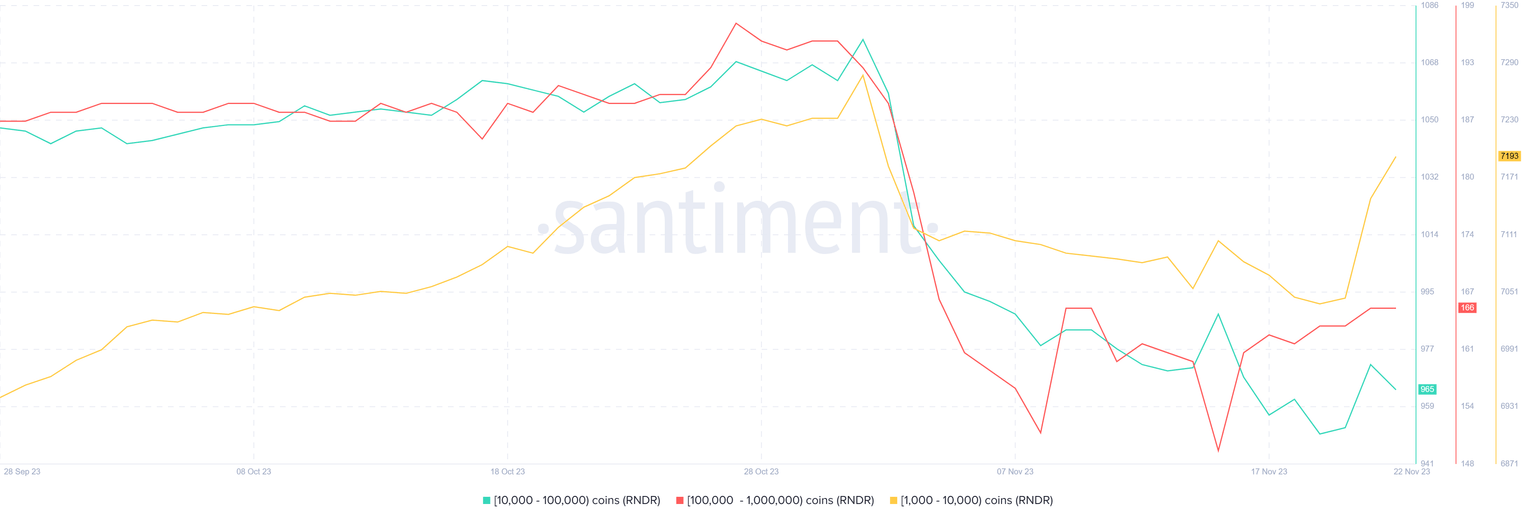

The supply distribution for address with between 1000 and 1,000,000 coins also points to increased seller momentum.

RNDR supply distribution

This is corroborated by the spike in the supply on exchanges, often interpreted as an intention to sell.

RNDR supply on exchanges

On the other hand, increased buying pressure above current levels could send Render price north, with a decisive move above the $3.451 invalidating the bearish thesis. This could set the tone for RNDR value to hit $4.000, or in a highly bullish case, extend a neck high to $4.409 resistance level. Such a move would constitute a 30% climb above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.