- Reddit users found a way to cash out their testnet token MOON.

- The token is now available on the cryptocurrency exchange Honeymoon at $0.072.

Reddit's crypto community has worked out a way to sell its native token MOON for cash. The coin that was initially hosted on an Ethereum testnet and intended for internal use only is now converted to a mainnet currency and traded on DeFi-protocols.

What is MOON

$MOON is a native token or Reddit's cryptocurrency community launched in May 2020 together with the Vault feature. Vault is a cryptocurrency wallet integrated into Reddit users' accounts, where they can store subreddit-based community tokens.

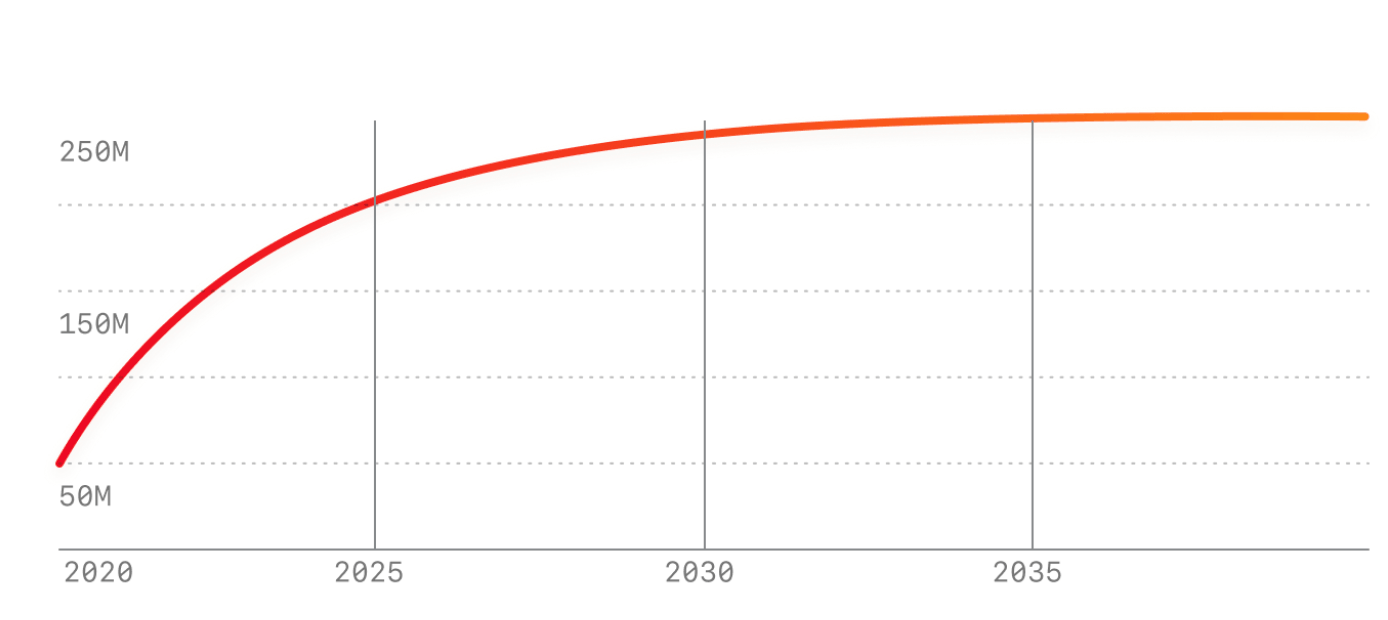

r/Cryptocurrency was the first to get its coin, known as MOON. The first 50 million MOONs were airdropped to users' wallets based on their karma points. Now the system distributes the tokens every four weeks, each time reducing the amount of the airdrop by 2.5%. All in all, there will be 250 million coins in circulation that will be fully distributed by 2040.

Distribution schedule

The token was supposed to incentivize the members of r/CryptoCurrency to contribute high-quality content. The better content you post, the more Moons you have. The new coin could only be spent on Reddit for purchasing badges and other trinkets.

Moons are a new way for people to be rewarded for their contributions to r/CryptoCurrency. Claim your Moons in the new Vault section of the Reddit iOS or Android app! They represent ownership in the subreddit, they are tokens on the Ethereum blockchain controlled entirely by you, and they can be freely transferred, tipped, and spent in r/CryptoCurrency.

Not for sale

The tokens are ERC-20 tokens based on the Ethereum blockchain, but they are not intended for monetization. Thus, naturally, holders cannot change them for ETH or any other coin as they are hosted on a testnet called Rinkeby.

However, Ethereum developer Austin Griffith discovered a leeway on how to turn Moons into cash. He created a way to move the tokens from Rinkeby to an Ethereum sidechain, xDai, and the rest is history. Tech-savvy Redditors quickly figured out how to covert their Moons into Cash using Ethereum wallet MetaMask and the decentralized finance (DeFi) token, Dai.

The process is complicated and requires many steps and some resources to pay fees, but the fact is: the token that has never been intended for sale has its own markets on DeFi protocols. Users on Twitter and Reddit share the tips and tricks on bypassing the limitations and cash out on their reputation.

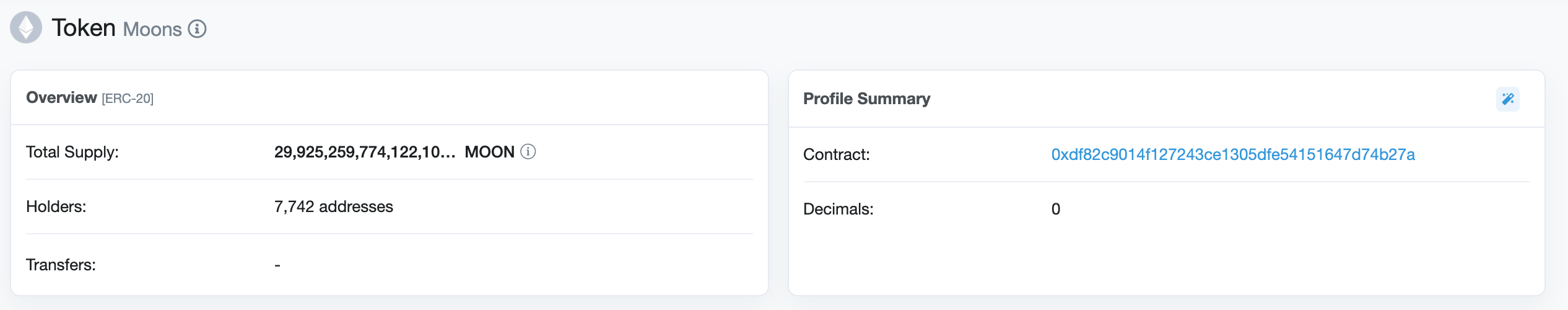

According to the crypto twitter analyst Jason Fernandes (@TokenJay), currently, there are only 7,721 MOON holders, and the top-100 possess over 69% of the total amount of coins in the circulation.

Fun Facts: The Top 100 Moon holders collectively own 68.55% of the total supply. Surprisingly only 7,721 holders total. https://t.co/yY6TtKNSwG #CryptoCurrency (from Reddit) pic.twitter.com/5Pzw8EgRvE

— Jason Fernandes (@TokenJay) September 29, 2020

The same is confirmed by Etherscan data, also showing that the top two addresses contain over 36% of all coins:

Moon tokens statistics

How much for the Moon

At the time of writing, $MOON is changing hands at $0.072 on the cryptocurrency exchange Honeyswap. According to the trading platform statistics, the price peaked at $0.35 on September 26 and has decreasing quickly ever since. An average daily trading volume reduced $232,738 from over $400,00 on Monday, September 28, meaning that the buying interest in the coin is fading away.

$MOON price chart

Meanwhile, Reddit users seem to be eager to cash out their tokens. One of them said that selling Moons was like winning a lottery. However, it is still not clear, who's buying them.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.